VCs and day traders alike know the challenge of deciding whether to invest in a software company. Many of these are exploring, even creating new markets and most are nowhere near any meaningful profitability.

So, when an investor is deciding whether to invest in a SaaS company, they are essentially making a bet on the future.

Are they placing their chips on the next Uber or the next Quibi?

For many investors, it is also a time-based bet — most VC funds, for example, have a lifetime of about 10 years.

Essentially, they are betting on the growth rate of the company.

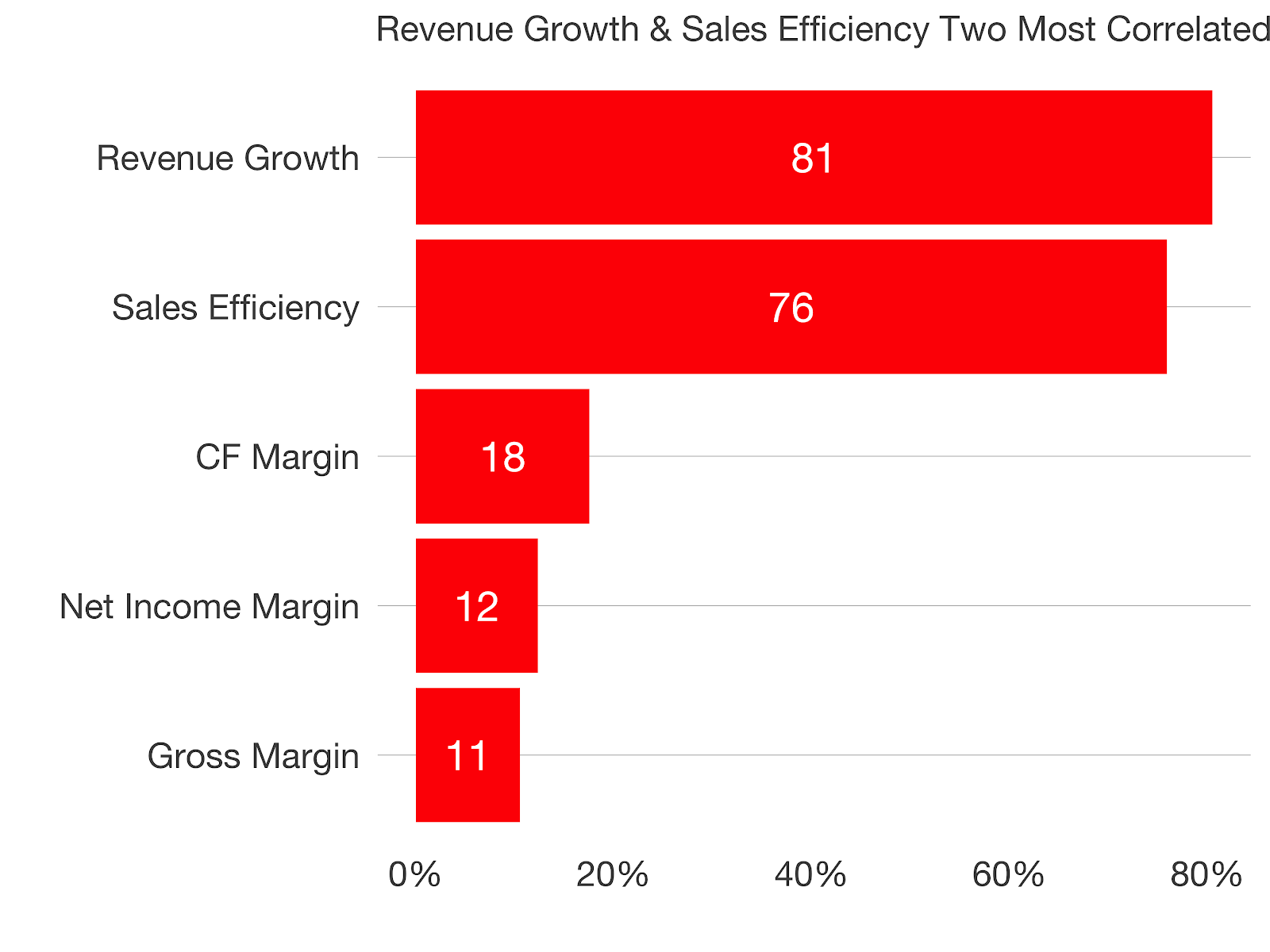

It’s not a coincidence then that the growth rate is the biggest predictor of a startup’s valuation:

OK, we all know that growth is important, but measuring it and communicating it to stakeholders is a lot less clear. There are the obvious ways to measure it, but are they as useful in an environment where growth is coming from different directions — marketing, sales, product-led growth, scalable pricing?

Since there’s no longer a one-size-fits-all way to build and grow a SaaS company, there’s no one-size-fits-all way to measure your growth rate.

Tweet this quote

In the following section, I will discuss the most common ways to calculate your growth rate.

Calculating your SaaS growth rate?

On the surface, this question looks easy — you just calculate the (percentage) growth of your revenue, right?

But what do you take — monthly, average trailing, or annual revenue? And what do you compare it to?

Suddenly, even the simple way to calculate your growth rate doesn’t look so simple. And as you add other layers of complexity, you will start to realize that you need even more advanced ways to understand your growth.

Here are some of the most common approaches that SaaS companies today use to measure their growth rate.

Revenue growth

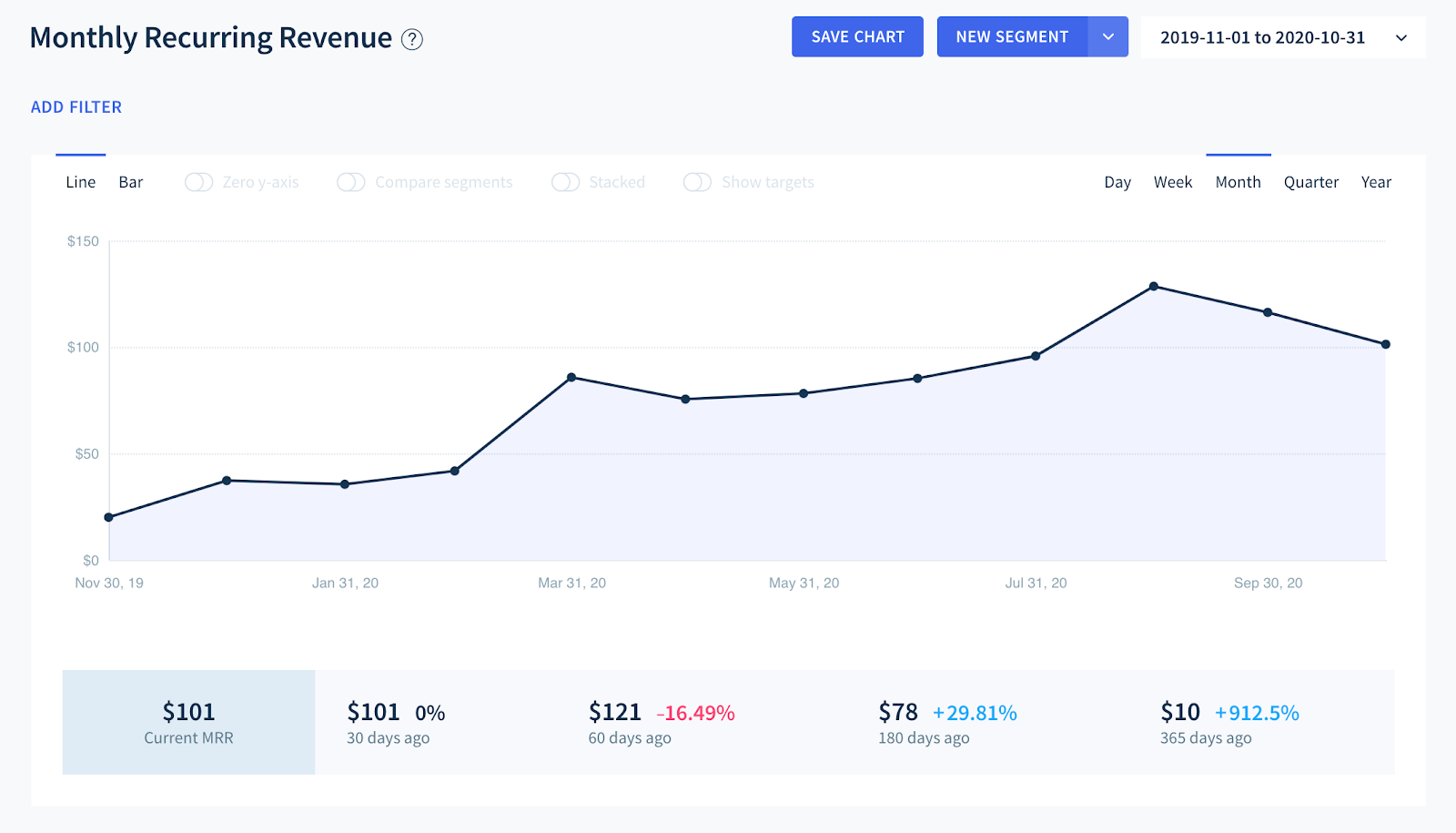

MRR is a good starting point when you want to calculate your growth rate.

It allows you to observe your progress on a month-by-month basis, but also to compare how you’ve progressed over the last quarter or year by comparing your MRR in, say, November 2020 to the one in the same month of 2019.

Our subscription data platform calculates this for you, but in case you need to do it yourself the formula is fairly simple:

MRR Growth rate = (End value of MRR – Start value of MRR) / Start value of MRR x 100

This calculation is useful as a top-level view or your growth or to check if things are going according to plan. For example, if you need to double revenue in a given year, you can use a CAGR calculator to find that you need to grow 5.95% each month to hit that goal.

By looking at your monthly growth rate you will know if you’re ahead or behind schedule.

Net Dollar Retention

Net Dollar Retention has emerged as one of the leading indicators of how well a SaaS company satisfies the needs of its existing user base.

The formula for it looks like this:

NDR = (Start value of MRR + Expansion & Upgrades – Contraction & Churn) / Start value of MRR) x 100

An NDR above 100% means you’re generating more revenue from your existing customer base — faster than you’re losing revenue from customers.

High NDR is indicative of a sticky product and is usually tied to a value metric. Companies like Slack and Zoom are famed for their high NDR which has fueled their exponential growth.

Natural Rate of Growth

In the last few years, Product-led growth (PLG) has emerged as one of the leading trends in growing startups.

A lot has been said about designing products for adoption and stickiness, using the freemium model and scalable pricing, to generate growth. However, OpenView, one of the leading voices on the topic, has made the case that we need a new way to measure growth in a PLG universe.

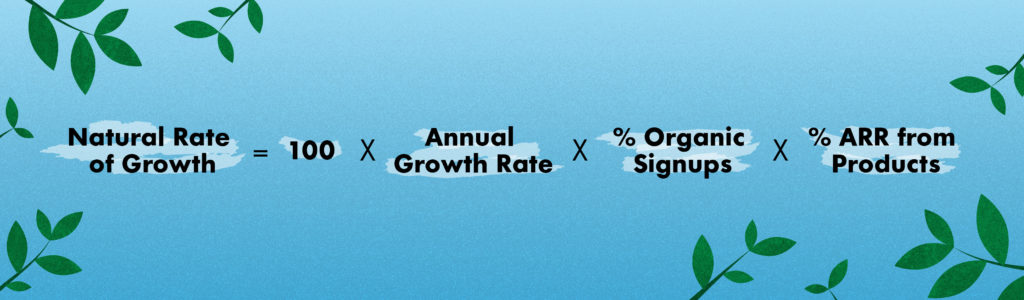

Sam Richard of OpenView argues this comes in the form of a new metric that they call Natural Rate of Growth (NRG).

NRG = Annual growth rate x % Organic signups x % ARR from PLG x 100

This one is a bit more complex, so I’ll try to unpack it here:

- Annual growth rate: This is just your MRR growth on an annual basis (i.e. your MRR this month, compared to the same month one year ago).

- Organic signups: OpenView has a good definition for this one: “Any signup you didn’t have to pay for”. Of course, in essence, you pay for every signup, but in this case, it means excluding customers who were acquired from paid ads, events, SDRs, and the like.

- ARR from product: For this, we’re looking at the incremental revenue that came from customers using the product. That excludes leads who went the sales-assisted path, requested a demo, etc.

NRG gives you a new way to measure and understand your growth, especially if you’re pursuing a PLG strategy.

In my experience, very few companies are entirely reliant on a PLG strategy, but I see an increasing number of teams get hooked on a hybrid strategy where there combine PLG with another motion.

In such cases, it is a lot more common to use several approaches towards measuring growth.

What is a good growth rate for a SaaS company?

Naturally, the answer to this question depends a lot on the stage and vertical your company is in.

Benchmarking, i.e. comparing yourself to peers, is the best way to approach this question.

One way to do this is to have a peer group of competitors that you track. However, that’s not always a viable option, especially if you’re competing against a low-cost or a do-nothing alternative (in our case that would be using a spreadsheet to track your metrics).

Resources like the SaaS Product Benchmarks Report are useful when you’re looking for this kind of insight.

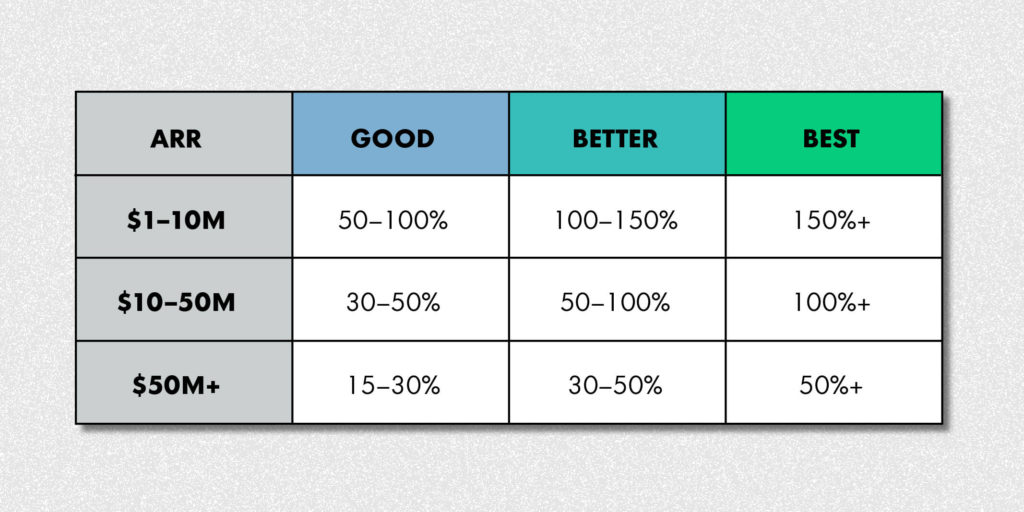

Here’s an example using OpenView’s NRG metric I discussed above:

It tells you how much you should be aiming to grow on a natural basis (i.e. when you take out your sales and marketing spend) at different levels of ARR.

Growing starts with knowing

Growing a startup is challenging and it doesn’t happen on its own.

You need a process that allows you to add new users sustainably and add new tactics when the established ones begin to wane.

Measuring your growth rate reliably is central to that process. Using the 3 methods described above is a good starting point, but over time you’ll probably find even better and more accurate ways of tracking your growth.