As a Senior AE with ChartMogul, my role is to take businesses through their revenue metrics within ChartMogul to help them gain an understanding of our product offering and to ideally also teach them something about their business using their metrics.

Sometimes I like to call myself a revenue metrics mechanic. I pop the hood of SaaS businesses and figure out why the car is “smoking”. It’s the highlight of my job because I learn so much from my prospects.

However, because we work with thousands of high performing SaaS businesses globally, we can also share insights and ideas from like-minded businesses. In a given sales conversation, I aim to share relevant commercial insight and focus on the real SaaS metrics at hand… instead of focusing on our product offering.

Demos are much more productive for all involved parties if a prospect is willing to import their Stripe, Recurly, or Chargebee revenue data to a trial account, and we can review the charts together.

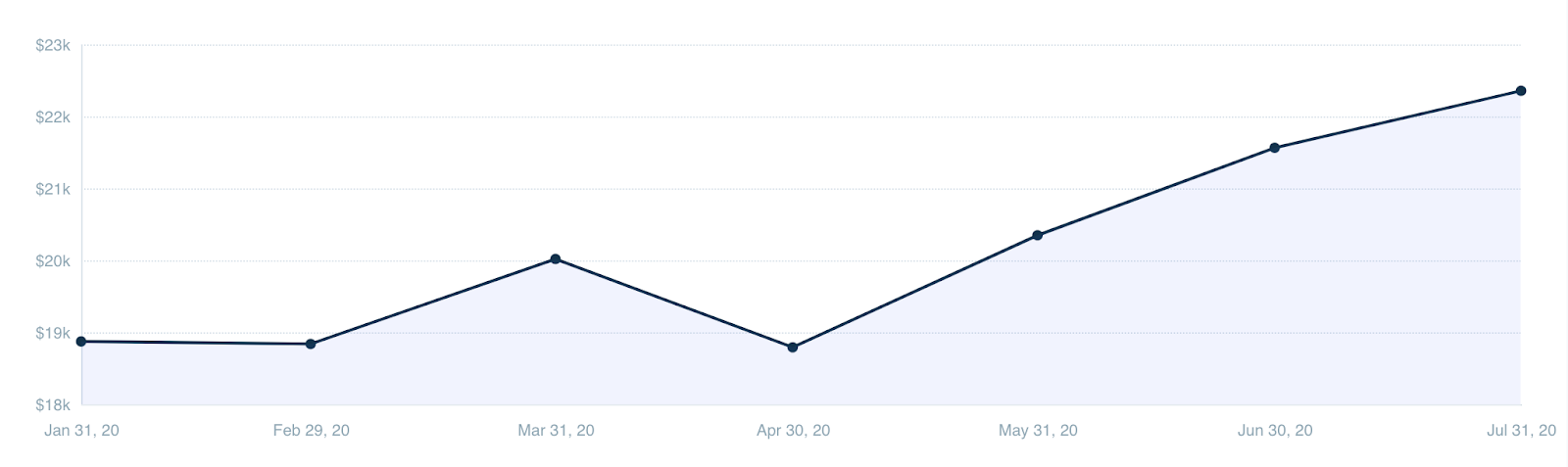

The first chart that I have prospects navigate to is the MRR chart. There was a pretty constant theme in Q2 and Q3 of 2020 as prospects imported their data and navigated to their MRR chart:

A sigh heard around the world.

Many prospects are often quick to point out the dip in MRR in April/May 2020 followed by a sigh and someone on the call quickly backing up the sigh by saying, “Ah, COVID”.

COVID… 2020 in a nutshell.

Earlier this year, SaaS businesses around the globe reacted quickly to the global pandemic. These were “unprecedented times”, after all.

A few very obvious things happened in the world of SaaS — we saw negative effects on businesses as they let people go in an attempt to become cashflow efficient in unpredictable times.

Subscriptions businesses jumped at the opportunity to provide tools for the world to go more digital while also ensuring they were aware of budget cuts and financial uncertainty.

Dropbox gave nonprofits and NGOs 6 months of free access.

Mailchimp gave governments, schools, healthcare companies, and non-profits more features in their free accounts and upgraded them to their standard tier at no extra charge.

Adobe offered free home access to its Creative Cloud for teachers and students.

Dialpad gave customers in Japan and North America two months of access to Dialpad Pro for free and Zoom removed its 40 minute limit on free calls for students and teachers.

(Check out this list of SaaS companies with COVID-19 discounts.)

Companies of all sizes were trying to navigate the chaos and uncertainty оf the pandemic while providing some kind of support to their customers. But very often trying to offer that kind of support would create even more confusion. Considering offering a discount due to the pandemic is easy, but getting the details right is a lot harder.

How do you figure out who deserves a discount? And, above all, what kind of discount do you offer?

In my calls with SaaS founders, I’ve noticed several key billing and revenue trends when it comes to COVID-related discounting:

- Paused subscriptions

- Free months

- Discounted plans

- Freemium models

Without a doubt, there’s a trend of decreased MRR for 2020 and early 2021, but there is some gold nestled in the midst of that data — it’s about understanding the impact of your business’ reaction plan and understanding where to look for the opportunity.

Understanding the impact of a COVID discount

Whatever method you choose to offer a COVID-related respite to your customers, there will be some effect on the performance of your business. Usually, this will be manifested in one (or more) of your core metrics.

Typically, you’ll see it in one of the following:

Monthly recurring revenue

Regardless of the strategy your subscription business took, any of the four strategies will present an overarching drop in MRR.

It’s important to note that MRR is much more of a complex metric than we give it credit for — the drop in monthly recurring revenue could have been caused by any of the three factors: lower net new sales, spikes in contraction revenue, or higher overarching churn.

As we round the curve and head into 2021, it will be equally as important to look at reactivation MRR to understand if you’re starting to win customers back.

Net MRR retention rate

Looking at retention from a cohort perspective helps you look at your current customer base in a critical way.

MRR Retention Rate = MRR of renewed subscriptions / Total MRR of subscriptions up for renewal.

Tweet this quote

It’s highly probable that MRR retention dropped in the midst of COVID, considering that renewals could have been negatively impacted by the economic circumstances of your paying customers.

As you reflect on your strategies for retention in the midst of COVID, it’s important to understand how much revenue you managed to keep in the door, especially if you put practices in place to keep your customers from churning.

Churn rate and Segmented churn rate

Churn is not unique to COVID — SaaS executives have long used churn as a barometer for health. At the highest level, understanding your company churn rate through the pandemic was and is paramount. This is straightforward: was there an uptick in your churn percentage?

The idea of segmentation is something that we highlight to all prospective users of ChartMogul. It became essential during COVID.

Understanding the who’s, how’s and what’s of churn matter — if your business took to one of the strategies I mentioned above, it’s paramount to be able to compare between COVID-related churn and other more average reasons for churn.

In April of 2020 our team took to our customer list and determined, based on a small set of criteria, if we suspected the customer could be negatively (or positively) impacted by COVID — in other words, which accounts were potentially at risk. In doing this, we were able to then analyze churn month-over-month throughout Q2 and Q3 to determine if our predictions were accurate. We were also able to measure the success of our practices to prevent churn.

Subscriber count

The subscriber count is something that you can look at from a couple of angles. Simply put, did your business see the number of net new subscribers decrease in the early months of 2020… or did it increase?

As I mentioned before, many businesses shifted their subscription offering to incorporate a free tier for a period of time. Technically speaking, these would be active subscribers. In this case, there may have been a massive positive impact on the number of subscribers.

This can be a confusing and misleading metric to follow — an increase in subscribers but a decrease in MRR?

The key piece here comes back to understanding the subscriber count and being able to break it down into its parts: paying subscribers and non-paying subscribers.

It’s critical to think about these two segments separately. Paid subscribers need to be nurtured for retention. And what about free subscribers? If the hope is to one day move them to a paid plan, the next step will be nurturing them for conversion.

Understanding the opportunity a discount will create

I have to give credit to businesses that reacted quickly to the needs of their customers in the global pandemic. But there’s a bigger issue to consider.

I ask founders daily if they understand what the opportunity, both present and future, their COVID plan of action creates. More times than not I get a single eyebrow raise… confusion, intrigue, and maybe a little excitement.

When considering a COVID discount, it is also important to understand the long-term impact your actions will have on your brand.

Paused subscriptions + Months free

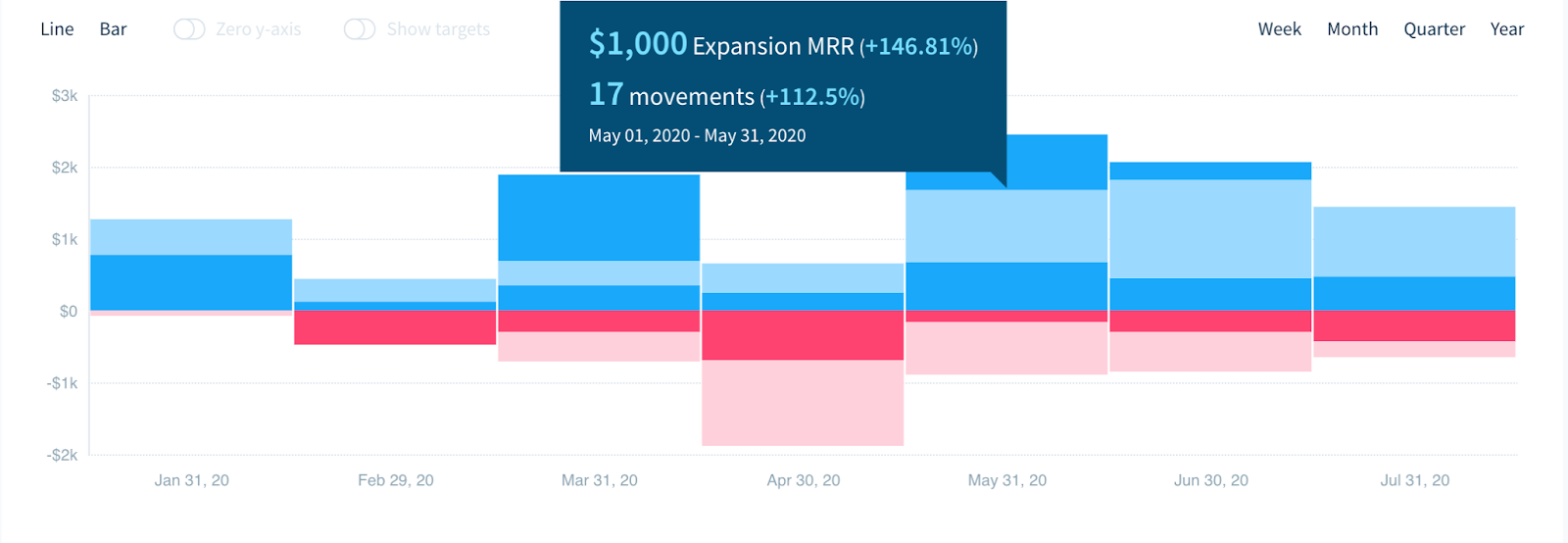

Assuming your business paused subscriptions for a specific period of time, have you factored in a way to examine your expected expansion revenue for when subscriptions become unpaused or return to their paid plans?

This will result in an uptick in MRR but could also result in an uptick in churn.

What’s your strategy for monitoring the effectiveness of a paused subscription? Do you have a quick and easy way to see what % of customers came back from their pause or didn’t cancel before their plan kicked back in?

By using custom attributes or tags you’re able to look at these accounts after the fact and determine how these accounts acted — did they return to normal after their free months or did you lose them entirely?

Discounted plans

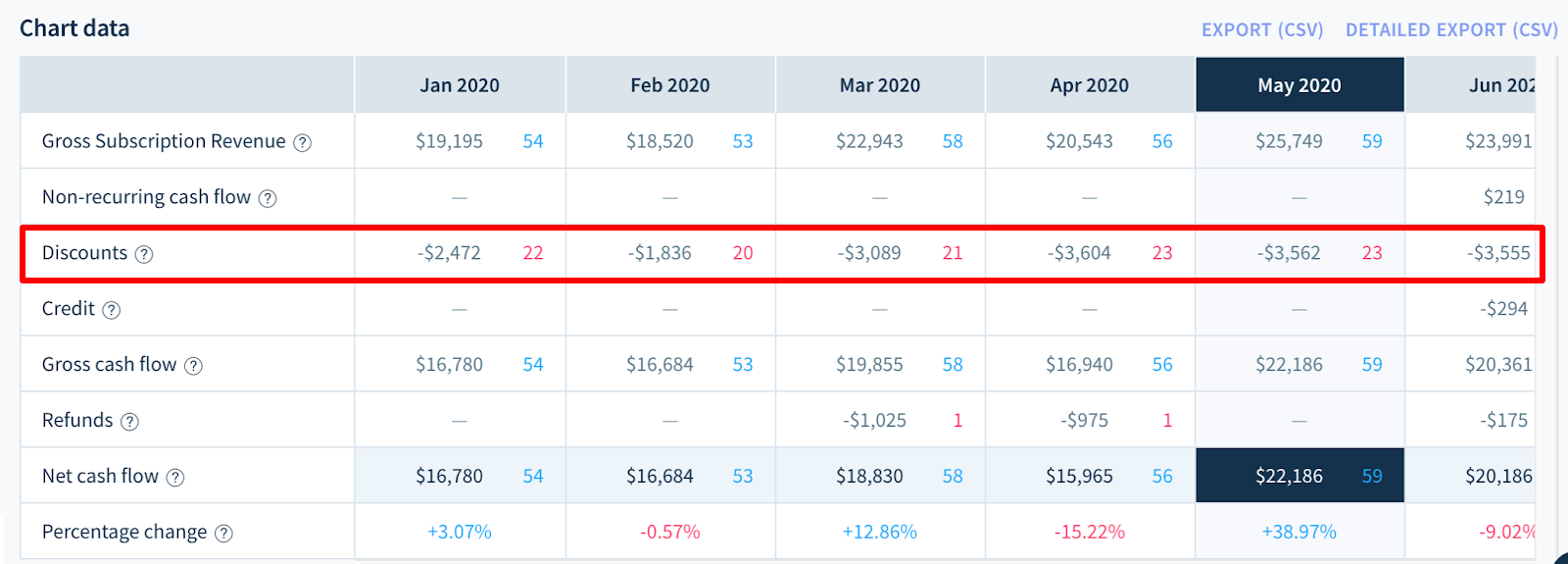

Understanding the impact of discounting is something I educate buyers on daily. Many businesses use discounting as a closing strategy.

Discounting impacts MRR but the aggregate result of a discounting approach is often overlooked because it is more of an accounting-focussed metric.

If you’re aware of the $$$ you did not bring in during COVID, you’re more aware of what you might need to make up if you hope to stay on target.

Do you have a plan to make up the revenue that was lost through COVID discounting?

In some (lucky) cases, discounting might be a way to take full advantage of the opportunity the pandemic is generating.

On a recent webinar, we heard how SignEasy experienced strong lead generation during the outbreak of the pandemic. They used discounting as a way to maximize this opportunity — rather than let some customers go to a competitor.

Freemium models

Some businesses count free accounts as subscribers, others do not. This has been noted a few times now.

Businesses that acted quickly and provided a free solution are eager to see the conversion of these customers to paid accounts — if something isn’t free forever, do customers keep using your product? It’s important to know how long a customer takes before upgrading and generating MRR for your business.

Every crisis creates opportunities as well as threats

Looking at your metrics with a critical eye will help you plan for the 2021 year ahead. There are opportunities nestled in the midst of your strategies: areas to understand churn, opportunities to earn business back, plans to convert free customers.

COVID strategies, though reactionary and necessary, were experiments that still need to be measured and accounted for.

If you’d like to look at any of these points together, book a call with me. I’d be happy to take you through it!