In this episode of SaaS Open Mic, I’m speaking with Jess Bartos, an investor with Salesforce Ventures. We discuss the SaaS metrics that investors like Jess use to evaluate the potential of a company, no matter the market conditions. Plus, we share benchmarks from our research.

Listen to the podcast or read the article below.

- Why SaaS businesses are attractive to investors

- Why SaaS metrics matter to investors

- Five key SaaS Metrics that matter to investors

- Advice for using your SaaS metrics to gain investment

- SaaS metrics matter to investors

Why SaaS businesses are attractive to investors

Generally, SaaS businesses can be attractive to investors due to its recurring revenue model. SaaS offers predictability around income streams, high scalability potential, and low costs.

As Bartos describes it, “It’s an asset-light business model. You don’t need a lot of expensive equipment to deliver it; you just need code, delivered over an internet connection.”

In general. Software is a super high-growth space…It’s a highly predictable model because it’s a subscription-based model. Not every business out there has a subscription customer base. [The subscription customer base] gives a tonne of predictability and creates built-in growth.

Why SaaS metrics matter to investors

The beauty of a SaaS product is that it’s a whole lot more predictable than non-subscription-based companies. But while predictability is high, proving success, growth, or even future opportunities to potential investors can only be done through metrics.

It’s the quantitative information from reliable, accurate metrics that drive the valuation for your business.

Simple calculations in Excel won’t cut it anymore. If you don’t have a reliable system to track your key revenue metrics and share them with investors, your business won’t be even considered for potential funding. Insights into your MRR growth, NRR, gross margin, etc are table takes these days, and without them, investors won’t be able to gather sufficient data to trust and understand the potential growth trajectory of your business.

Besides, gaining that much-needed investment can be hard to come by so ensuring you have the data to stand out to investors is key.

Some metrics matter to investors in any market condition. According to Jess, if you’re looking to secure VC funding, you should understand your growth trajectory, net dollar retention, gross margin, rule of 40, and burn multiples.

I wanted to pick out the top five [metrics] that really drive the core evaluation in getting the strongest evaluation for your business. The reason I say that they matter in any market condition is because when any kind of market investor, whether it’s a public shareholder evaluating a stock, or a private investor evaluating a business they want to buy, they’re always looking at the stream of cashflows that will ultimately come out of owning that business and that stream of cashflows is driven by two things: how much the business is growing in the longer term and how much cash can the business generate.

Five key SaaS Metrics that matter to investors

Growth

Growth has long been known as that North Star metric that everyone should strive to improve and for good reason. Not only is it the main focus from the eyes of investors, but high growth results in the other metrics usually looking valuable too.

Having a disruptive product that brings value to your target audience is shown best when the company is growing at high rates, which allows for scalability. It proves the market is real, the product works, and it’s being received well.

Remember about VC investors, we need to generate super outsized returns, 100x returns; we need mega growth in order to get to that mega return.

High growth solves other metrics problems

High growth in a SaaS business can help other metric challenges. Increases in ARR also signal strong market demand and customer satisfaction.

High growth sort of solves other metrics problems. If you’re adding lots of ARR at a fast clip, other metrics will look good.

Growth needs to endure at high rates

It’s no secret that VCs need to generate outsized returns. They need rapid growth in order to get to that magical place — return on investment. To be a good prospective investment opportunity, SaaS businesses need to be scaling quickly, and that growth needs to endure at a high rate for a long time.

[As investors,] we usually like to see getting from zero to one. From the time you launch your product to reaching a million of ARR in around 12 months or less. And then triple triple, double, double, double — where you triple for two more years and then double every year from that.

This is the growth trajectory of a best-in-class SaaS business on the path to a $100 million ARR that companies like Twilio and Hashi Corp have followed.

Growth duration

Naturally, growth will slow down as a company scales. However, investors will look at the ratio between this year’s growth and last year’s growth. Make sure that the slow-down is not too abrupt.

If last year you were growing at a hundred percent and this year you’re growing at 80%, then your growth duration is 0.8. And what you want to do is not deteriorate that. Don’t slow down too quickly.

What our research tells us about growth

According to our research, which looks at SaaS growth, the best-in-class businesses reach the $10 million ARR mark in two years and nine months. It takes the median startup a little more than five years.

While the journey to this milestone isn’t always linear, using benchmarks to find answers for how long it takes companies to hit other goals can be incredibly useful for comparing your performance.

ChartMogul Benchmarks provide on-demand and up-to-date insights into what good growth looks like for SaaS companies, with a view of the whole industry.

Net Dollar Retention

If you have poor retention, nothing else matters. Retention is the definitive proof that you’re delivering on the promise, going beyond just acquiring customers -, You’re actually able to keep them.

This ability to retain is one of the key SaaS metrics for investors as it’s a substantial growth driver and shows fuel for your business to succeed for a long time to come.

Net Dollar Retention means you’re delivering on your promise

Net dollar retention (NDR) is essentially looking at your customer base a year ago, that same cohort of customers, how much you have churned, how much you have upsold or cross sold, and then what’s that percentage today.

If last year you were growing at a hundred percent and this year you’re growing at 80%, then your growth duration is 0.8. And what you want to do is not deteriorate that. Don’t slow down too quickly.

For example, if you had $100 ARR at the beginning of the period, you churned $5, and you upsold $25, then your NDR is 120%.

We really like this metric because it encapsulates both the business’s ability to retain — so minimizing churn — but also their ability to upsell. That’s super important, not just winning new logos in B2B software, but adding additional products, expanding your platform, cross-selling, and increasing usage.

If your NDR is under 100%, you have a leaky bucket problem. On the other hand, NDR over 100%, indicates that the value of your product and your pricing are aligned with the success of your customers. It proves that you’re delivering on the promise.

What our research tells us about Net Dollar Retention

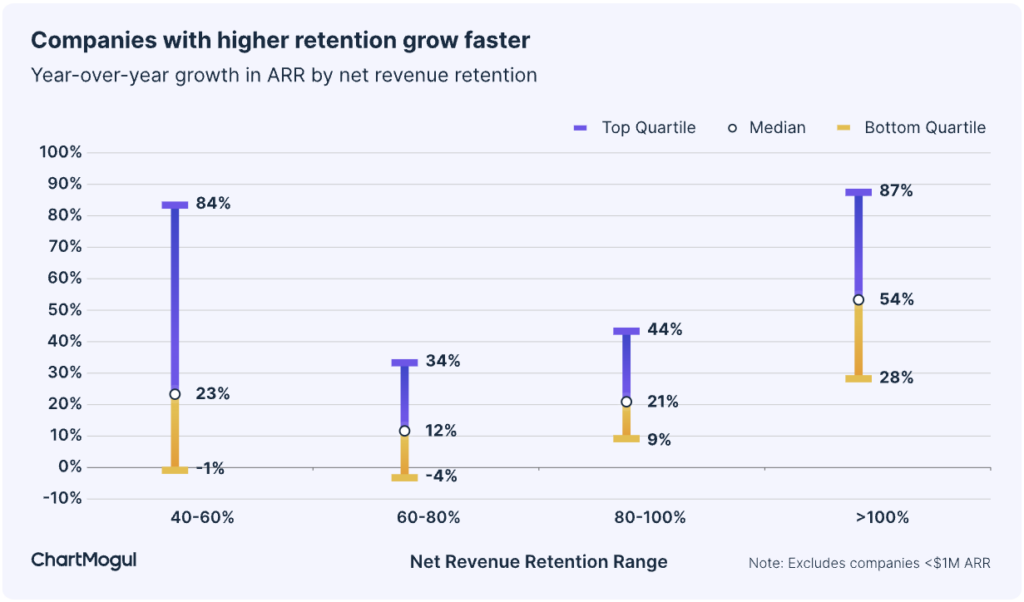

When looking at data from our SaaS Growth Report, companies with best-in-class retention grow faster than their peers.

On average, SaaS businesses with a net retention rate of over 100% grew 54% in the last 12 months. In comparison, businesses with net retention in the 60 – 80% range grew by just 12%.

Gross Margin

The third metric, highlighted by Jess Bartos, is gross margin. This percentage allows investors to quickly see if the company is profitable and how much pricing power it holds. It speaks directly to the success of the asset.

Essentially, a high gross margin allows for quicker growth opportunities in the future as there will be more money to re-invest into the business.

If your gross margin is high, your other SaaS margins will look even better.

Turn your gross margin into growth

Gross margin is your revenue, less the cost of goods sold. In SaaS, these costs are low, so healthy gross margins for a SaaS business can be around 70% to 80%.

I also like to look at gross margin because I think it’s the kind of telltale sign of any fake SaaS. So, technology businesses that are actually more of a service business as opposed to a software business, and you can really see that come across in gross margins.

Jess explains that having a high gross margin means that you’ll be able to invest more to grow faster. If you have 80% of your revenue left, you can spend it improving your product, and investing in sales and marketing.

Rule of 40

Blending the relationship between a company’s growth and its profitability, the rule of 40 metric focuses on sustainability.

While a high growth rate is sought out by all, the other elements must match up as losses could still be occurring. The rule of 40 gives a snapshot into the efficiency of the strategy, along with the other SaaS metrics for investors.

Rule of 40 is the balance between growth and profitability

Rule of 40 is the sum of your EBITDA margin and your growth rate. If your EBITDA margin is 20% and your growth rate is 100%, your rule of 40 number is 120%. The rule of 40 measures the relationship, or balance, between a company’s growth and profitability.

Historically, valuation multiples for software companies have been correlated with how fast you’re growing. But actually, during the most recent market correction, these multiples started to be more correlated with how software businesses were doing on the rule of 40. (…) Both public markets and private investors are looking a lot more carefully at how efficiently you’re growing, and how much profitability or burn does it take to continue to grow at such a fast rate.

Burn Multiples

Another metric that speaks to the efficiency of growth is burn multiples. This is an incredibly useful tool for understanding how a start-up is using cash and managing the balance between spending and growth.

For investors, it’s especially important to understand if a company risks running out of money or if they’re falling behind the competition through a lack of investment in the future.

Burn multiples measure growth efficiency

Burn multiple is your cash burned, divided by your net ARR added in that same period.

Adding ARR is what you wanna be doing, and the burn is how you do it. This multiple shows the relationship between them.

This can be measured cumulatively over the life of your startup or it can be measured in a period. Jess recommends looking at this metric on a monthly or quarterly basis, in this cash-constrained environment. These numbers will give you confidence in how efficiently you’re growing.

If you are an early-stage company, over 3 is normal. But burn multiples should be coming down as you grow. Under 1 is fantastic because it means it takes less than a dollar for you to get another dollar of ARR, which is fantastic.

Advice for using your SaaS metrics to gain investment

The fundamentals of SaaS businesses haven’t changed

Behind all successful SaaS businesses are the same fundamentals. These include determining a strong product-market fit, high growth goals, and a focus on customer retention and churn. The tried and true process for growing this style of business hasn’t changed.

High growing cash flows is something all investors are looking for.

Use your SaaS metrics to tell a great story to your investors

As a last piece of advice, Jess reminds founders that it’s not just about numbers, but also about stories.

In the noise of all these numbers, use your numbers to tell a great story.

All these SaaS metrics, calculations, and figures, are at the core of telling a compelling story about your business, where it’s going, how you’re going to disrupt the market, and what is so exciting about it. Make sure to make investors part of that excitement.

SaaS metrics matter to investors

While SaaS businesses have high growth potential in a fast-growing market, investors need the metrics to see the possibilities and glean an understanding of how the company will perform going forward.

Ultimately, being able to share intimate financial details through metrics is the only way to prove the hard work put into the business has come to fruition. In the case of most people seeking investment in the early stages, metrics highlight the vision, as well as any bottlenecks that need to be addressed before it’s too late.