The 1:3 ratio rule

One of the most widely-accepted uses of LTV as a metric, is to balance acquisition cost (CAC) against it, thus growing sustainably.

The rule that most people follow is a CAC:LTV ratio of 1:3, i.e. as long as your LTV is at least 3x the amount you’re spending on acquiring a single customer, you’re probably safe. Right?

To elaborate, if my LTV is estimated to be $1000, then spending $300 to acquire a single customer should be okay, because on average I’d expect to see back $1000 in lifetime revenue from each customer.

Even better, if I find a way to scale my paid acquisition at that cost then I basically have a money-printing machine! Right?

The huge problem with this method

There’s a giant hole in this method of “balancing” CAC against LTV, leading you to pour money into user acquisition that you may never see back.

You’re basing this calculation on a global LTV estimate. That is, the LTV across all of your customers, including those who’ve signed up through word of mouth, content, outbound sales — everything.

But the customers you’re spending money to acquire obviously represent a specific acquisition channel. What’s the LTV of this channel? It may be that paid customers have a much lower LTV than those acquired through word of mouth, for example.

In fact, I’d be willing to bet that paid customers DO have a generally lower LTV than other channels.

Furthermore, as you scale your paid acquisition efforts, this problem may in effect compound as you expand to wider and lower-quality audiences to reach the volume you need. These audiences may have an even lower LTV. Before you know it, you might be confidently spending $300 per customer, for a channel whose CAC:LTV is nowhere near the suggested ratio of 1:3. Your money-printing machine has just turned into a money-shredding machine.

Segmenting metrics is essential

There is a way to avoid this problem:

Stop looking at your global LTV.

If you segment LTV by acquisition channel, you’ll have a far more detailed picture of the value of your customers, in turn allowing you to invest in paid acquisition channels with a greater level of confidence than ever before.

In summary: If you’re trying to balance your paid acquisition spend, make sure you look at the LTV of that acquisition channel — or at the very least, the LTV of customers you’ve paid to acquire.

ChartMogul segments your metrics

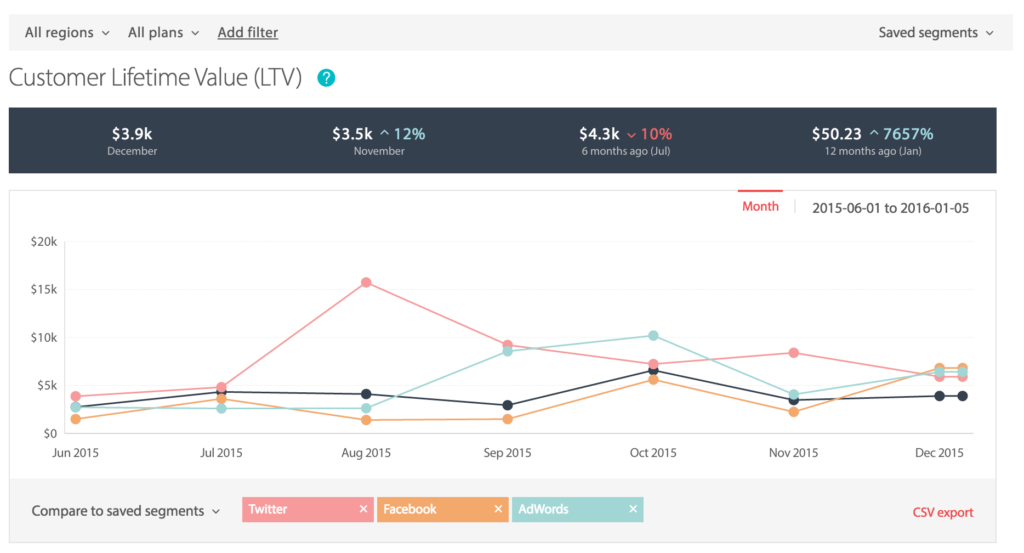

You can do all of the above with ChartMogul. With Segmentation you can pipe in acquisition channel data from another platform (or manually), and use this to create custom segments to apply right across the platform, like so: