Calculating Customer LTV is always tricky, even if you don’t have negative churn. I’ll begin by explaining the problems with the original formula, and then move on to answer how you should calculate it when you have negative churn.

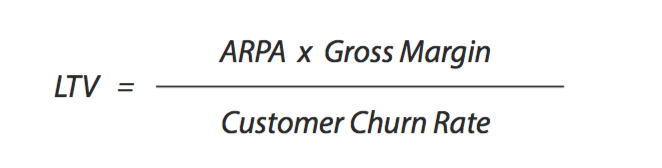

Basic Customer LTV formula

The original formula is problematic because it makes assumptions about churn rate — and totally overlooks other things. As a result, this LTV prediction is overly optimistic.

The standard limitations of the basic LTV formula

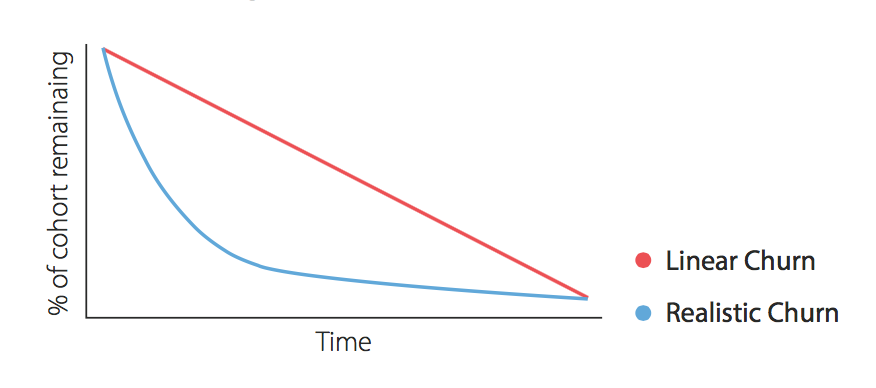

- Assumes linear churn rate over time.

This is never really the case in real life. SaaS businesses see most churn within the first 90 days of a subscription, and then churn tapers off in later months. Like so:

- Doesn’t account for risk or reduced value of money over time.

– Risk: Particularly as a startup, there is unlimited risk in the form of changes to the market, technology becoming obsolete, and fierce competition.

– Reduced value of money over time: When viewing money as a future resource, the common practice is to model it at a reduced value. Since LTV is a predictive metric, it’s more accurate to reduce the value of future revenue. - Doesn’t account for customer growth.

And this is the gap that particularly concerns you. When a SaaS company has strong MRR growth over a customer lifetime — or expansion business — that can result in negative churn.

The limitation when it comes to negative churn, specifically

The basic LTV formula doesn’t work well with negative churn. Why? Because this formula is about CUSTOMER churn rate. “Negative churn” has to do with MRR churn rate. These are measuring two completely different factors of your business: number of accounts versus recurring revenue.

So how do you try to solve for the three limitations plus the blocker that negative churn has no place in the formula? Well, David Skok expertly, and true to form, exploded the basic LTV metric by analyzing these three limitations and researching a better LTV formula.

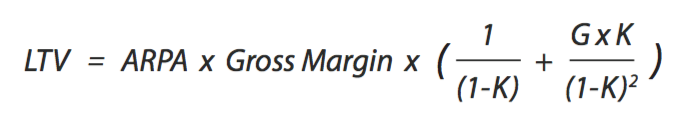

Spoiler alert: this new formula is definitely more complicated. And it will show you a lower Customer LTV than you see with the other formula. But this one is actually far more accurate.

David Skok’s revised LTV formula

The two concepts added to this new formula are:

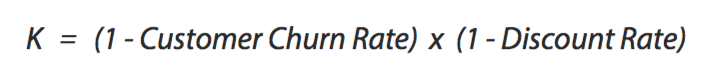

“K”

Which takes care of value reduction on all fronts. This includes the usual customer churn rate, but also “Discount Rate”. Discount rate accounts for both risk and reduced value of money over time, mentioned above. It’s a pre-defined annual rate of your choosing. Skok suggests a Discount Rate of 20-25% for pre-scale businesses.

“G”

Annual Growth rate for customers who haven’t churned. Aka: the business expansion rate of your existing customers. Which turns your negative MRR churn into a positive figure in the formula.

Final Word

Try out this revised LTV formula and see how it works for your business. For a much more in-depth explanation and detailed advice, do check out David Skok’s impressive breakdown of this new definition of LTV.

Another resource, more of a quick-and-easy read, is this SaaS LTV Cheat Sheet. It’s a free PDF that could be handy around the office.

I leave you with Skok’s LTV wisdom.

“Don’t obsess over getting to the last level of accuracy here. We are using a formula to predict the future, and the future, by its very definition is not predictable.”

Good luck!

This answer was originally published on Quora. View the original thread here: How do I calculate customer lifetime value (LTV) when my SaaS business has negative churn?

NEW SaaS Q&A: How do I calculate #LTV when I have negative churn? https://t.co/h1mXVu9V1g #SaaS #churn pic.twitter.com/6Iv2rIIxCE

— ChartMogul (@ChartMogul) June 29, 2016