Revenue recognition is changing. A new accounting standard is slowly, slowly, being implemented across all kinds of businesses — big and small, goods and services, on earth and in the cloud.

Despite a flurry of discussion about it in the accounting world, most companies haven’t paid the change much mind yet. The deadline is 2018 — and sure, technically you still have a year and a half to adopt it. But don’t underestimate the impact of what seem like mere accounting details. As PwC warns,

“The impacts of the new standard extend far beyond technical accounting. Change to the way revenue is recognized will have broader impacts on other areas of the business, including go-to-market strategies, income taxes, compensation arrangements and debt covenants, among others.”

Arm yourself with information now and the inevitable transition may not be so tricky. No time like the present, right?

What is the new standard?

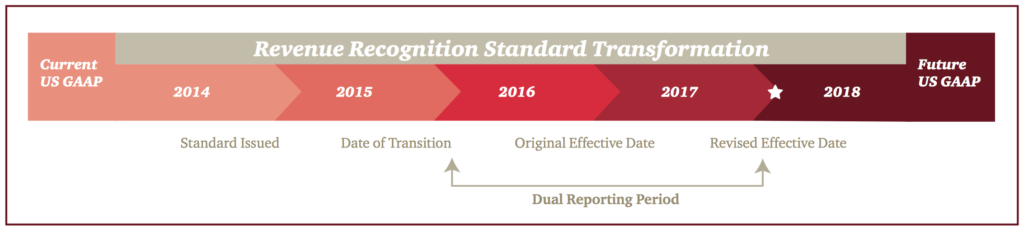

The new standard is called Revenue From Contracts With Customers, or less affectionately, ASC 606. A joint endeavor by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB), its aim is to smooth over how contracted revenue is recognized across industries and around the world. Uniform and simplify. It was originally set to go into effect in December 2016, but the adoption deadline has been revised to January 1, 2018.

Why is it happening?

Thus far, revenue guidance has been either (a) generally lacking, or (b) highly sector-specific or even transaction-specific. For example there were all sorts of technicalities around whether, and when, your product would be considered “software” or a “service.” This unnecessarily acute specificity led to different accounting methods for transactions that were actually economically similar. It led to varying revenue recognition patterns that didn’t accurately reflect business performance. Such discrepancies were a bit of a nightmare for the other side: auditors, investors, and anyone interested in acquiring a company.

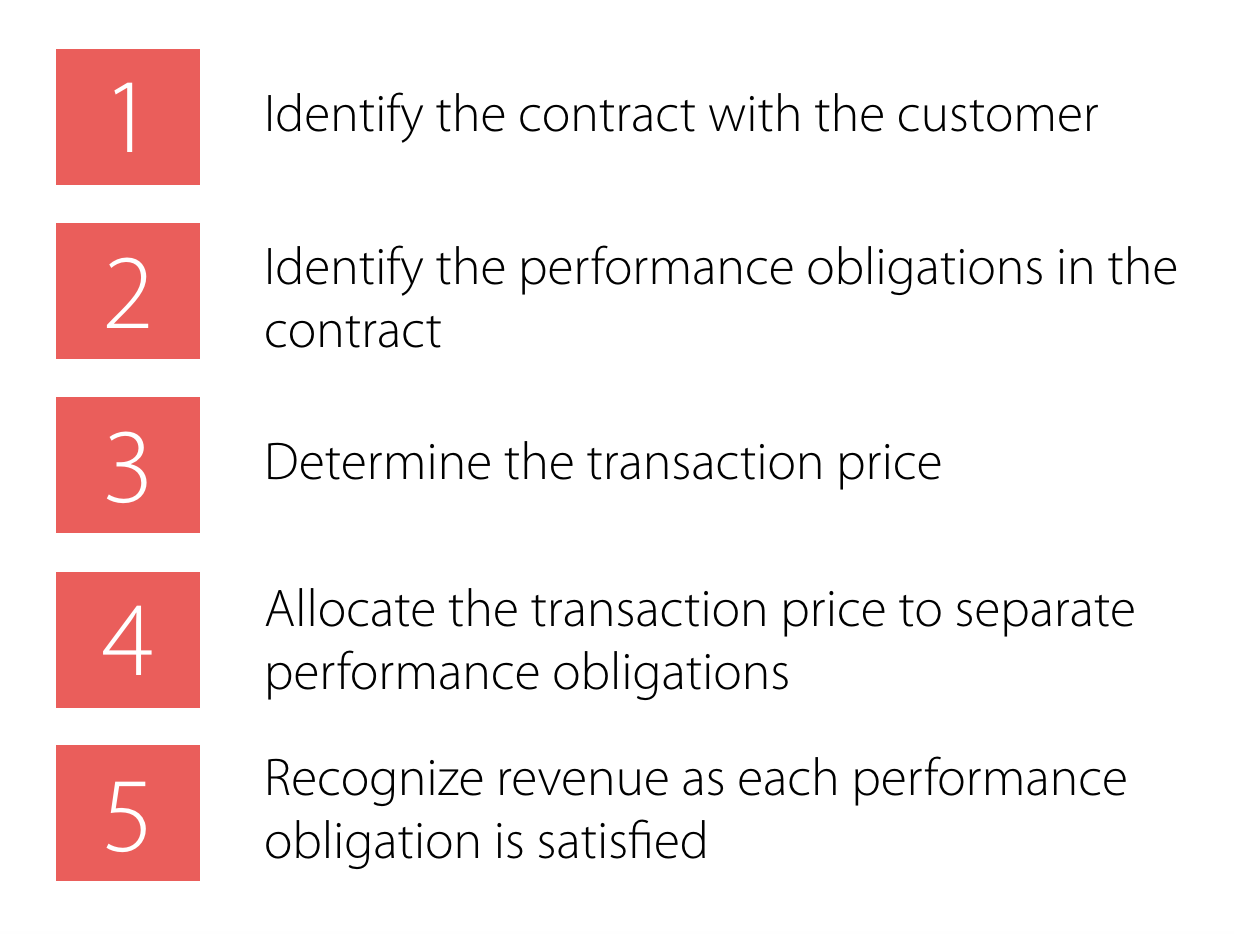

The new reporting framework applies to any situation where there is a contract for goods and services. It’s principles-based, which means it’s comprehensive yet leaves a lot of room for judgment on the actual execution. The model is also neatly sorted into five steps.

The model

As you can see, each point gives the company a lot of agency. You identify, you determine, you allocate.

The new standard leaves a lot more judgment to management. As a result, the new standard also requires a lot more explanation from management. I.e.- disclosures, justifying your judgment and disclosing how it impacts your financial line items. Considering this it’s imperative you understand your realm of influence when it comes to revenue — and how your decisions affect your financial reporting.

What does each step mean for SaaS?

Though the new model may be simple, implementation can be anything but. Here’s a brief overview of the basics, laying out how you would apply the model to each contract. However there are many more intricacies involved in full implementation which are better discussed with an accounting professional!

Step 1: Identify the contract with a customer

Whether or not you use the word “contract” in your SaaS business, here it simply means “an agreement between two or more parties that creates enforceable rights and obligations” — the service agreement with your customer.

Step 2: Identify the separate performance obligations in the contract

A “performance obligation” is a distinct service included in the contract. A service is distinct if the customer can benefit from that specific element on its own, without corresponding service or software use. The subscription itself is a performance obligation, but there could be other items bundled, too. It’s up to you to determine if whether items are separate performance obligations or not.

Example

There’s a SaaS contract that’s a multiple-element arrangement of “subscription + consultation.” If the consultation service provides measurable value to the customer apart from their use of the subscription software, then the consulting element would be a distinct service with a distinct cost (see Step 4) and require a separate line in revenue accounting. However if the consultation was just teaching the customer how to use the software better, then it is not a distinct service and not a separate performance obligation.

Step 3: Determine the transaction price

Pretty straightforward. This is the actual cost you expect to be paid for delivering a service.

Step 4: Allocate the transaction price to the separate performance obligations in the contract

Each performance obligation (remember: distinct service) needs its own transaction price. This could get hazy if your company doesn’t already and clearly allocate value/cost within a subscription, diced out for each element in the contract. Most don’t. So it’s largely an estimate. Allocating the transaction price is another place where your judgment comes in. Also, you must consider any discounts offered to the customer!

Step 5: Recognize revenue as the entity satisfies a performance obligation

With a subscription, you satisfy your performance obligation over time. So you recognize the revenue from the customer over time, usually month by month. Different revenue recognition schedules exist for other types of performance obligations.

How to adopt it?

There are two options for transition to the new revenue recognition standard. Regardless of which method you choose, you will have to maintain two sets of accounting records and supporting processes for some period of time.

Full retrospective transition

Wait until the deadline. The new standard is applied retrospectively to each prior reporting period presented with the cumulative effect of the change recorded in retained earnings as of January 1, 2016. Two years of dual GAAP reporting.

Modified retrospective transition

Start now. The new standard is applied to all existing contracts as of the effective date and to all future contracts. While this allows companies to avoid restating prior periods, there is a still some extra work. The qualitative and quantitative impact of applying the new standard on all affected financial statement line items must be disclosed in the year of adoption. One year of dual GAAP reporting.

Final Word

Stay engaged with your revenue recognition schedule and financial reporting. After all, revenue performance determines the valuation of your company, and your revenue recognition methods will be heavily scrutinized. You want to make sure your company is compliant with the new standards, and that your methods are aligned with those who are evaluating your business. Seeking help from a professional accountant is wise. Best of luck in the transition!

Name: ASC 606, Revenue From Contracts With Customers

Deadline: U.S. GAAP public companies is January 1, 2018, U.S. GAAP non-public companies is January 1, 2019

Resources:

Exhaustive accounting and financial reporting guide on ASC 606 from PwC

Overview of ASC 606 from Deloitte

Share and follow!

NEW on @ChartMogul: Ready or not, changes to #revenue recognition are coming https://t.co/XMYeCAvXtd #SaaS #Startup pic.twitter.com/PKPTgbobUb

— ChartMogul (@ChartMogul) April 12, 2016