What is CMRR in SaaS?

CMRR stands for Committed Monthly Recurring Revenue. This metric helps SaaS businesses predict their monthly recurring revenue (MRR). It is calculated considering booked monthly contract revenue, as well as scheduled contract changes: like cancellations or upsells.

CMRR can help SaaS fight churn, realign priorities and better manage their budgets. CMRR can also help teams know if they’re going to hit their end-of-year growth goals and proactively strategize if things aren’t currently going to plan.

MRR vs CMRR

CMRR as a metric is often misunderstood. It doesn’t help that to begin with, it’s often found under two different names:

- Committed Monthly Recurring Revenue

- Contracted Monthly Recurring Revenue

So what’s the deal here? Are these two different variations on the same metric?

Committed Monthly Recurring Revenue and Contracted Monthly Recurring Revenue are the same metric. When you see each of these names, they refer to the same thing. To avoid further confusion, we’ll just refer to it as CMRR.

What is MRR?

Monthly Recurring Revenue (MRR) is a calculation of your normalized (amortized), monthly subscription revenue. If your SaaS pricing model uses a monthly subscription, your MRR is simply the total of all your customers’ subscriptions. If you have annual subscriptions, you should divide these by 12 to calculate MRR.

MRR Calculations should always exclude any one-off payments and metered charges for customers – we only want to look at the recurring portion of revenue.

Example: If I have 120 customers, each paying $60 per month in subscriptions, my MRR is $7200.

What is CMRR?

Defining CMRR isn’t so easy. There is no fixed definition, and there are certainly no fixed rules about what to include in the formula. Here’s what most businesses provide as a definition:

“CMRR is the value of recurring portion of subscription revenue.”

CMRR is a metric that’s also used in more traditional fixed-term-based payment structures (i.e. non-recurring revenue).

For non-fixed-term-based models (SaaS, subscription), we can use a slightly clearer definition of what CMRR really equates to:

“CMRR for a SaaS business is a projection of MRR in a future period, modified to take into account any guaranteed revenue expansion or anticipated churn over the period.”

Now that makes more sense as a definition for subscription businesses. CMRR is similar to MRR, but gives us a more realistic projection of monthly revenue, accounting for adjustments to recurring revenue that we already know about.

Remember: this is not guaranteed monthly recurring revenue! It’s predicted with as much knowledge as SaaS companies have available to them.

How to calculate CMRR?

Now we’ve got a clear understanding of what CMRR is and how it lines up with MRR. Let’s look at the formula you can use to calculate CMRR if you want to do this manually.

CMRR Formula

At a high level, the formula for CMRR is fairly simple:

Despite this simple formula, there may be other elements that could be included in the CMRR calculation – there is no standard definition for this so you’ll need to decide what makes sense for your business.

Example:

I have 120 customers, each paying $60 per month in subscriptions. For the next month I have a guaranteed expansion MRR of $1200 and an expected churn of $500.

My CMRR for the next month is 7200 + 1200 – 500 = $7900.

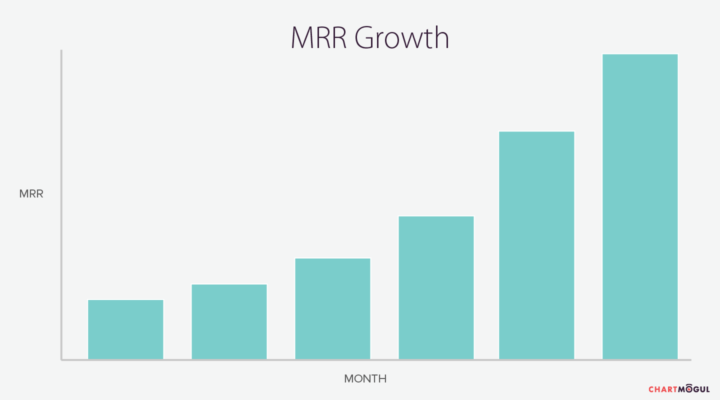

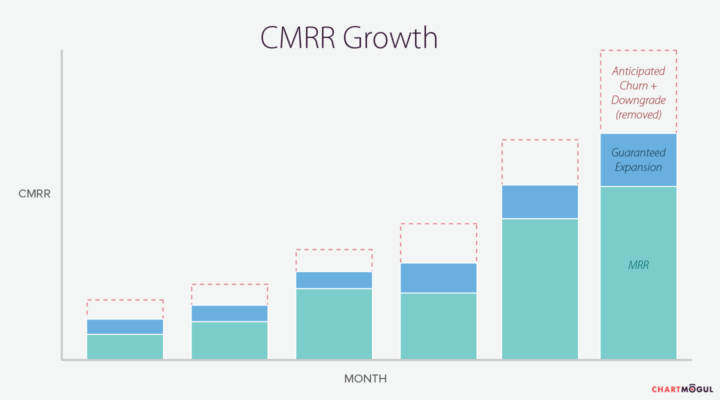

Here’s a visual representation of the difference between measuring MRR and CMRR:

What’s Included in CMRR?

- MRR! You still need to include the core MRR of your business.

- Guaranteed new business that you know about for the period – e.g. If a customer has signed a contract for an account with you which only comes into effect in the following month – you can include this New Business MRR in your CMRR calculation.

- Guaranteed account expansion from upgrades that you know will take place in the period – e.g. If a customer is on a plan that requires them to upgrade after a certain time, this is expected Expansion MRR that you can include in your CMRR calculation.

- Anticipated churn for the specified period – e.g. A customer has stated that they don’t intend to renew their account in the following month, so you can factor this as churn in your CMRR calculation. Note: This churn is not 100% guaranteed – you still have the chance to reverse the customer’s decision!

- Anticipated downgrades for the specified period – e.g. You expect the customer to downgrade their account, due to either the customer stating so, or to features of your pricing model.

Where can you use CMRR?

CMRR is always a forward-looking metric, i.e. it’s only applicable when calculated for future time periods, where you have potential expansion and churn that hasn’t happened yet.

Because of this, CMRR paints a more realistic picture of a recurring business. Particularly in the case of a high churn rate, CMRR would produce a slightly more pessimistic outlook – taking into account the anticipated churn (although additional revenue from expansion may balance this out).

Here are some uses of CMRR:

- CMRR appears to be more of a “VC metric” – i.e. something that investors would want to see, particularly as an indicator of the health of a business, based on projections.

- As Philippe Botteri (Accel Partners) mentions, breaking down the average CMRR by different dimensions (such as per customer) can lead to a more insightful analysis.

- Christoph Janz (Point Nine Capital) also mentions that CMRR is more relevant for enterprise-targeted businesses, where the sales cycles are typically much longer and the need for such projections are greater. Smaller SaaS startups selling mainly monthly deals to SMBs may not find so much use in the metric.

Why is CMRR important?

CMRR is important because it helps a SaaS company proactively manage future budgets! This is something that typically wouldn’t be possible for businesses to understand. One of the joys of working on a monthly subscription revenue model is that you’re able to ammend strategies quicker and on the fly—rather than waiting for end-of-quarter or (worse) end-of-year financial reports.

It’s so crucial that your team trusts subscription metrics like CMRR. When you’re able to trust in your data, you’ll be making some hefty spending decisions in answer to your findings. Here’s what Bessemer Ventures say about CMRR in their Laws of Cloud Computing report:

“This single metric gives you the purest forward view of the “steady state” revenue of the business based on all the known information today. The monthly focus also tends to drive many positive behavioral changes within a team including a monthly sales and development cadence, better sales compensation plan and cash flow alignment, reduced customer price sensitivity, and heightened awareness around small MRR changes. Many leading cloud companies therefore use CMRR as the basis for everything from the financial model to the sales commission plan. This is the single most important metric for a cloud business to monitor, as the change in CMRR provides the clearest visibility into the health of any cloud business.”

There’s no doubt that SaaS founders use CMRR to give a more accurate projection of recurring revenue, by taking into account expected adjustments to the core MRR. However, for most SaaS startups, it’s not clear how it can be useful on a day-to-day basis for measuring and growing the business. You’ll be required to develop your own definition – and the added complexity may not add much value over simply using MRR.

If you want to read more on CMRR, and the nuances of calculating and using it, check out the following resources:

CMRR SaaS FAQs

How can you track CMRR?

In the Charts section of the ChartMogul app, you’ll see the CMRR Forecast report. You’ll be able to see the most complete picture of your company’s financial health with a breakdown of all scheduled monthly MRR movements from now into the future, and how they will impact your MRR and ARR.

What is the purpose of tracking CMRR in SaaS?

Committed monthly recurring revenue (CMRR) enables SaaS businesses to predict revenue growth or loss and act on the results they see. CMRR calculates predicted revenue based on planned contract changes such as churn, upsells, downgrades, and more.

How can I use CMRR to grow a SaaS business?

SaaS businesses can use CMRR to predict income and plan against that. For example, a SaaS business can use CMRR data to better understand if they’re going to hit revenue goals, identify churning accounts, and hypothesize strategies to combat any harmful changes on the horizon.

How to plan using CMRR?

You can plan using CMRR by clearly outlining where your predicted losses are coming from and finding ways to combat them before they happen. CMRR can also highlight where your budgets will be at the end of a period, and will allow you to tweak your spend accordingly so that your end-of-year accounts remain healthy and happy.