Jason Lemkin talks about how SaaS compounds. It’s a pretty simple concept — but it’s incredibly powerful and is big part of what makes SaaS so attractive to private equity and wall street. Compounding happens when the value of an investment increases over time.

The difference in SaaS between growing say 80% YoY and 100%, or between 100% and 120% YoY, isn’t trivial. It’s epic, compounded over time.

Jason Lemkin (source: Medium)

I spent some time with our Net Cash Flow reports in ChartMogul and applied some filters in order to better understand the effect of compounding and how it affects our cash flow.

MRR and cashflow cohort analysis

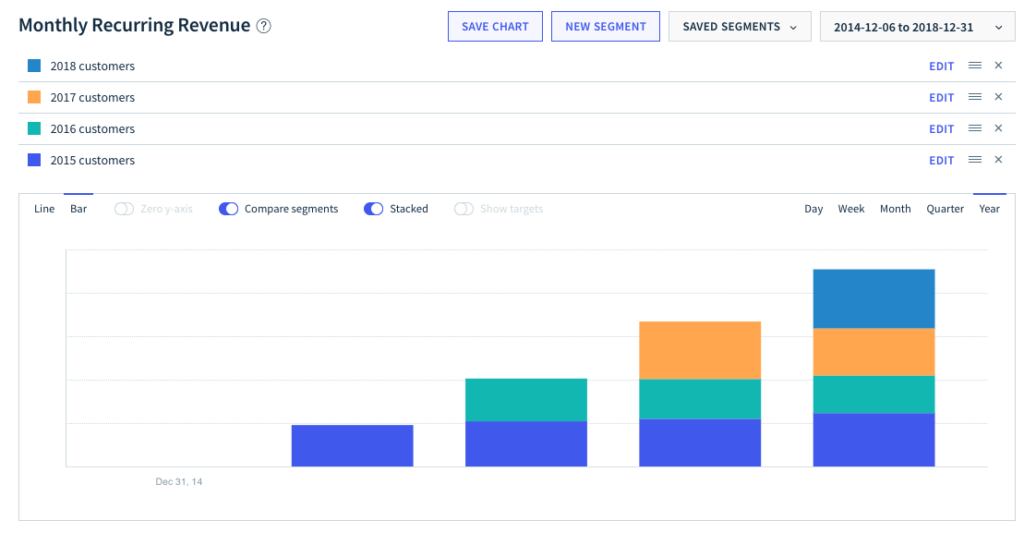

First, I created a cohort for each year we’ve been in business since 2015 and the result was this MRR breakdown:

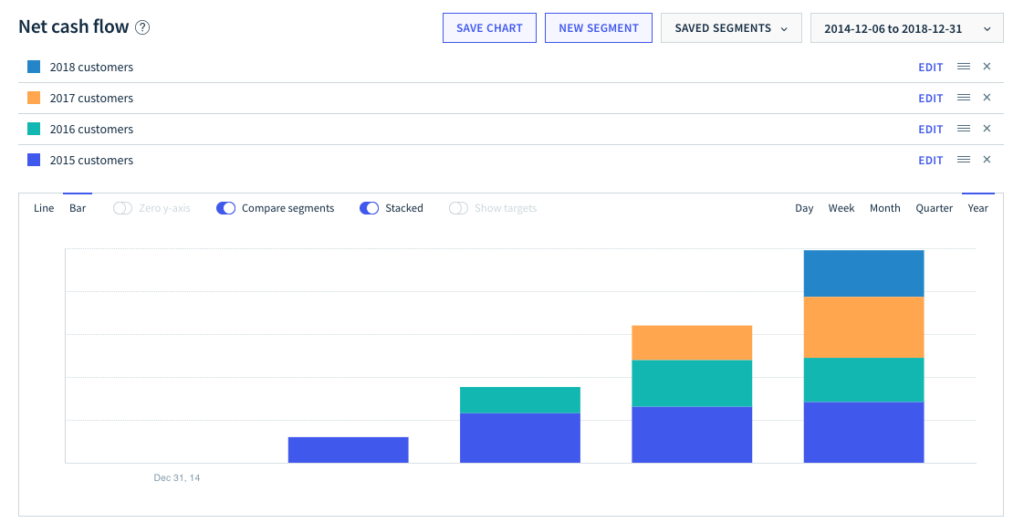

Next, I looked at the same segmentation in our cash flow chart:

We talk a lot about SaaS and subscription metrics — but this is cash received. A simple analysis like this can show how much cash was received from customers that signed up last year, the year before that, and beyond.

What this shows is that in 2018, the biggest chunk of cash received (in yellow) came from customers who signed up in 2017. 2015 (in royal blue) contributed the second biggest chunk. Our 2016 (in teal) cohort wasn’t quite as strong (I think mostly this was due to poor pricing decisions in 2016). Finally, you can see that our (sea blue) 2018 customers contributes the smallest amount of cashflow in 2018. This makes sense, though — as this cohort was still being formed. You can also observe that, at the end of 2018, this cohort represents the largest chunk of MRR. We can expect that in 2019, our biggest chunk of cashflow will come from customers who signed up in 2018.

This is why subscription businesses are so magical; every year you’re in business the cashflow generated by each year’s cohort of new customers compounds on top of the previous year.

What this means is that the total cashflow received from your oldest customer cohort always outstrips that of your newer customers — you’ve had those relationships longer, and therefore more monthly payments.

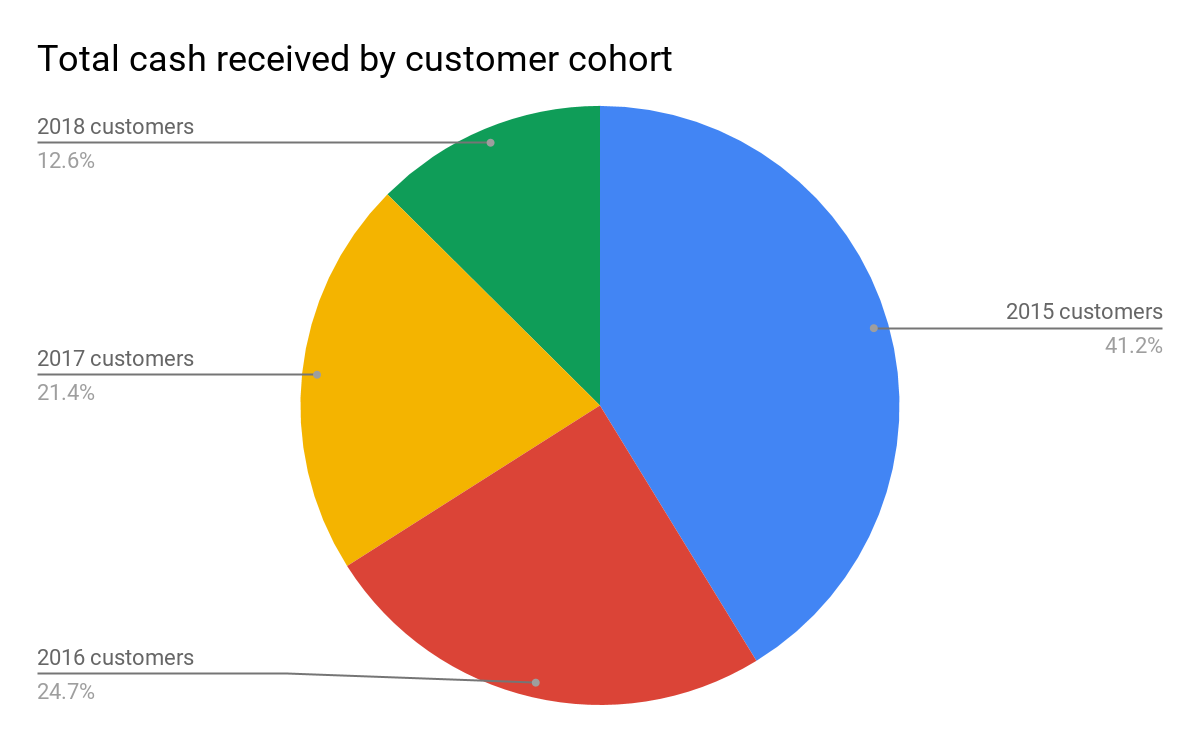

This is what that looks like for the above customers:

This analysis illustrates another reason why retention should be top of mind. In a subscription business with healthy retention, the cash you receive from customers in the year in which you win those customers is almost insignificant compared to how much cash you will collect from those customers over the next several years and beyond. Optimize for customer relationships that last for years — the benefits are striking.