The spreadsheet used to make the charts included in this blog post can be found here.

Ugh! It’s budget season.

How many meteorologists does it take to accurately predict the weather?

Nobody knows, it’s never been done.

I’ve built a lot of revenue and growth models in my life. It’s not something that I particularly enjoy, but it’s something that I think I do a pretty reasonable job of. It’s sort of like being the weather forecaster — perfection unattainable.

One thing I do enjoy is going back to look at the models that I’ve built in the past. It’s fun to have hindsight on assumptions that you made in your model. It’s also sometimes humbling to look at models that were outrageously aggressive.

I just reviewed a forecasting model that I built 6 months ago where actual MRR is going to beat the modeled prediction for MRR a month early. In this case, a 2-month period with substantially lower than normal churn caused the model to miss the mark. The funny thing is that even with hindsight, we can’t really put our finger on the reason for those 2 months having abnormally low churn.

So what is the best way to model MRR growth for SaaS businesses?

I once built a model, and the response I got to it was very lackluster It’s not complex enough. On another occasion I was told $15M ARR is the number I want, work the model back from that.

To a large degree MRR is a vanity metric for CEOs and a yardstick for venture capitalists.

Tweet this quote

If we are being honest, to a large degree MRR is a vanity metric for CEOs and a yardstick for venture capitalists. Because of that truth, MRR forecasts and goals many times get set based on emotion, a nice round number, or what you should do because that’s what other companies of your size have done. There’s nothing wrong with that, but this model should be a good sanity check.

So let’s dive in. There are probably 1001 ways to model out a forecast for MRR. What I’m going to suggest is a very quick and dirty way that seems to work best for me, while pointing out some of the pitfalls that I’ve encountered.

To start with, I’m going to assume that your business or product has at a minimum a few years of history. Should that not be the case, you will need to try a different approach. I’m also going to assume that you use a product like ChartMogul that allows you to have an in-depth understanding of your historical MRR changes by month.

Simplicity

The model that I like to use is very simplistic. It’s based on month-over-month growth rates of MRR. The reason I pick a model that is so simplistic is that I fundamentally believe that for every assumption you make in a model, the greater the error introduced into the model, many times in a compounding way.

For every assumption you make in a model, the greater the error introduced into the model.

Tweet this quote

The guy that told me It’s not complex enough, what he really meant was he wanted something analogous to a zero-based budget model that predicted MRR growth based on growth channels, organic and paid — starting from the ground up.

That model started at the top of the funnel estimating conversion rates on websites and multiple app stores for organic traffic. Likewise, for paid acquisition, it estimated conversion rates on advertising through various channels. Then once a customer converted, it accounted for retention / expansion / contraction of users across the various platforms we had. Had the model worked it would have been beautiful, but it didn’t.

Our funnel was very complex: we were aggressively ramping up our advertising and we didn’t have a good enough understanding of the paid acquisition funnel metrics. I think a model like this might work for more mature companies that have a lot of data, measure and track that data, and have the time and patience to build out the model. But most SaaS businesses don’t have this luxury.

There are 5 components that make up MRR. You could build your model at that layer (new business, expansion, contraction, churn, and reactivation) but frankly that’s five things that could go wrong. Each one of them is a complex thing to model in and of itself. Or you could even go a layer lower, modeling the things that make up each of the five components — but again — that is destined for error without a lot of effort and reliable historical data.

I start my forecasting models by first building out the history of the month-to-month growth rate of MRR. Step 1 is to export my historical MRR data from ChartMogul into a spreadsheet.

History

Knowing the history of a business will help you understand the present and predict the future. This should help you understand a few possible trends.

- Does the company see seasonality in its growth?

- Has the company noticed a slight decline in growth rate as it grows?

- Are there any other anomalies that stand out?

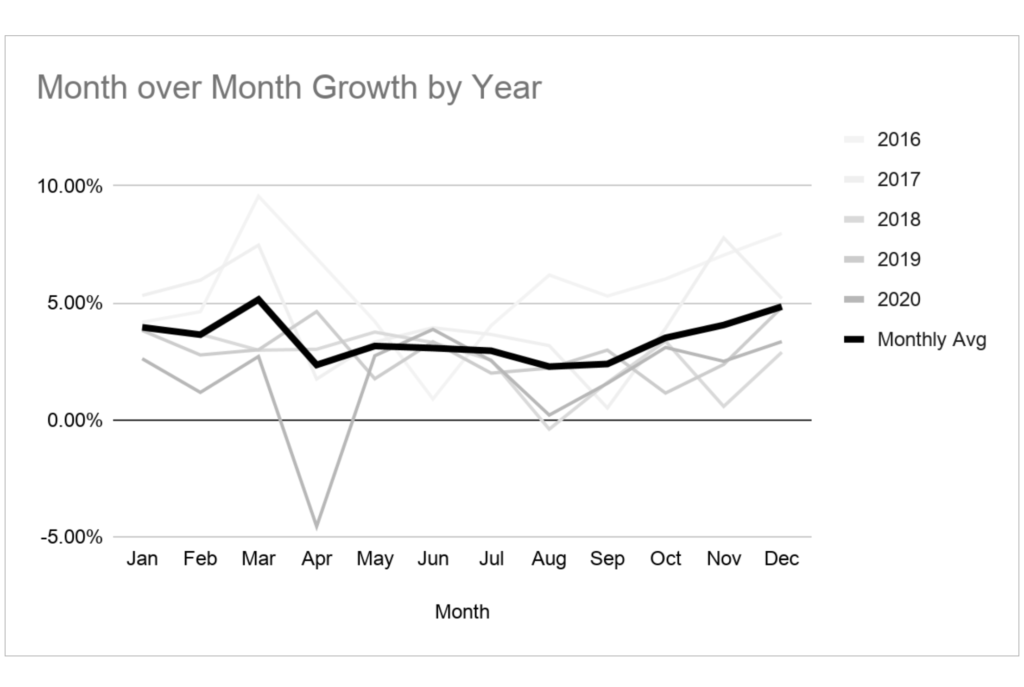

I like to not only look at the history by year, by overall average, but I also like to do a weighted average. What happened last year is probably more indicative of future growth than what happened 5 years ago. Usually, a picture is worth 1000 words.

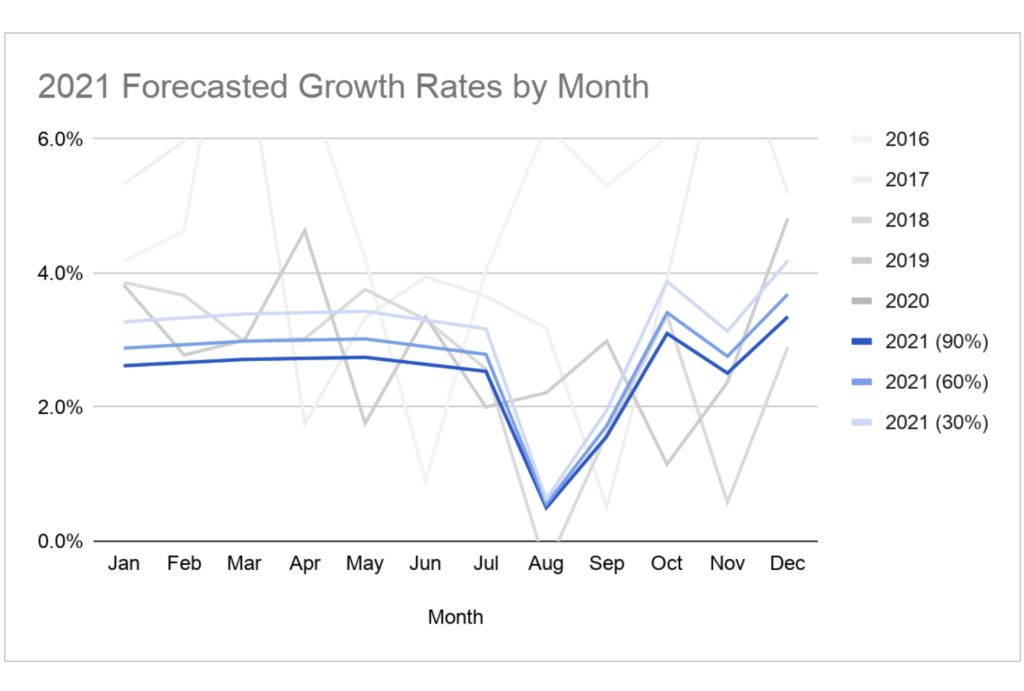

In this fictitious example a few things stand out:

- It does indeed look like the growth rate is reducing over time. As the company ages, the growth has slowed — it’s a lot harder to grow big numbers than small numbers.

- April 2020 stands out like a sore thumb. I’m sure you can guess what happened there. I wouldn’t expect future Aprils to take on this same behavior, however, your business may have some sort of impact in general in 2021 and beyond that may need to be accounted for.

- While it’s not super obvious, it looks like there might possibly be some seasonality in growth?

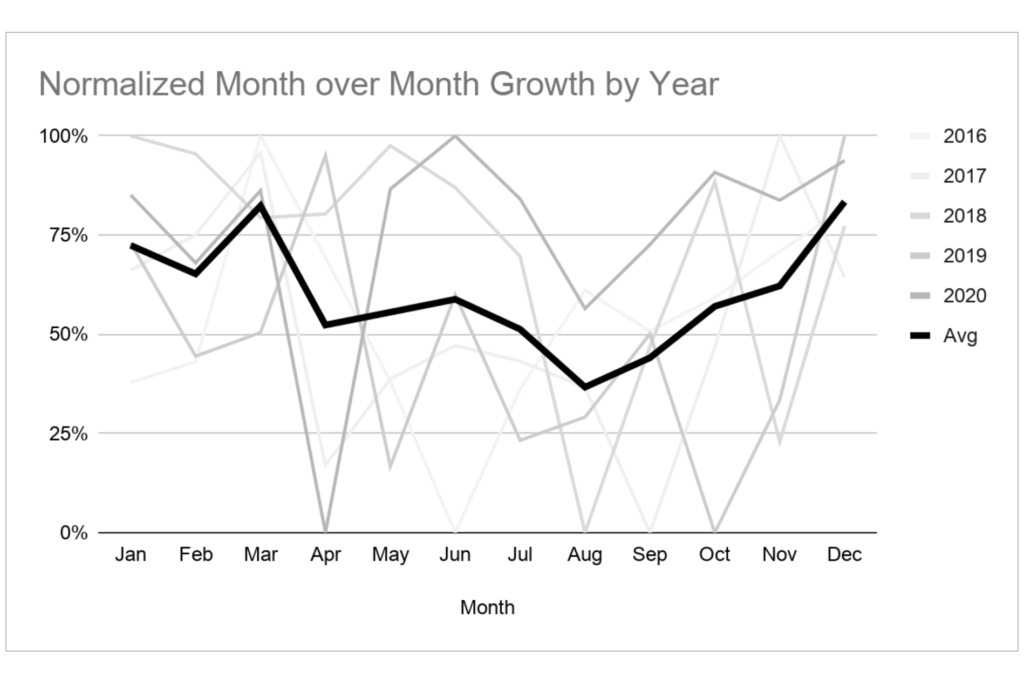

If we dig into this data a bit further by normalizing the data on an annual basis, a few things stand out even further.

What we see is that there indeed seems to be some seasonality. December through March have historically been the better growth months while July through September have been slower months. That said, the seasonality isn’t extreme such as some companies that do all of their business in the months of November and December.

I should point out that I like to use shades of grey to represent years, using a very light shade as you go further back. The reason for this is that when I look at trends I want the more recent years to stand out more — I’m less interested in trends from 2016.

Future

The next thing I do is look to the future, carefully. What are the things that the company is doing that might impact your growth rates? Are there major product improvements or changes in go-to-market strategies?

This is probably where a lot of models go sideways. They become overly optimistic about what the future holds. As I mentioned before, the company growth rate tends to slow down as a company ages up until it’s about 12 years old where it then stabilizes.

So as you build your model and you begin to estimate future monthly growth rates keep in mind that gravity — or in this case the size of your company — is pulling against you.

At this point, you could dig deeper if you desire. Is there seasonality in the components that make up your MRR, such as in your New MRR or your Churn MRR? But that’s for another day.

Scenarios: 30-60-90 Model

I don’t know who introduced this methodology to me, possibly Brad Feld, but it’s something that we used regularly in my last company and it was a really good way of framing forecasts and budgets. Here is the way that it works.

- The 90% Case represents the base case. This model should be met or exceeded 9 out of 10 times. So if we use this model for the next decade, it should only miss one time. As we saw in 2020, sometimes things happen that just can’t be accounted for in a simplistic model.

- The 60% Case represents a more aggressive case. In this model, you are only 60% confident that you will hit the target, or 6 of 10 times you will meet the mark.

- The 30% Case represents the most aggressive case. In this model, you expect to only hit the target 3 of 10 times.

While this topic is just looking at forecasting MRR, this same concept can be applied to financial budgets and forecasts. Typically the 30% model while much more aggressive in revenue also has accompanying additional expenses — as growth usually doesn’t come for free.

We now start working through each scenario, only altering the monthly growth rates. Here is where the cognitive dissonance starts to kick in. On one hand, we believe that we have all of these great things that we are going to do to increase our growth. On the other hand, we know that as we get larger our growth rates will tend to slow.

Every business is different, and the approach you take is probably unique to your situation. For the sake of simplicity and given that my data set is for a fake company, I’m going to do the following:

- For the 90% case, I’m going to assume that we see growth rates that are 100% of last year’s growth rates. For the 60% case, I’ll assume that we do 10% better than we did last year. And for the 30% case, I’ll assume that we beat last year’s growth rates by 25%.

- I’m also going to assume that the huge decline in growth in April of 2020 was an anomaly so I’ll factor that out. I’m also going to smooth out a couple of months where I believe the peaks and valleys aren’t warranted.

- Finally, I’m going to assume that in this particular case, I don’t feel like Covid-19 has any appreciable impact on my 2021 growth. I picked 2020 as the baseline, you could have easily used a weighted average or really a variety of other methods. I think much of it comes down to how realistic you believe 2020 was representative of how things will go moving forward.

Again, I like to visualize the data and the forecasts including previous years’ data as I find that it helps to drive home a model based more on reality. Nonetheless, you can change this to be your own, be more aggressive, less aggressive, it’s up to you.

You’ll notice that up until this point there has been no discussion on the actual MRR of the company in this data set. Ignoring that to start with, and focusing solely on the monthly growth rates removes the emotion and bias from the forecast. Really, at this point, it comes down to 12 assumptions that you have made, all of which are backed up by historical data that is very relevant in where your growth will likely be in the following years.

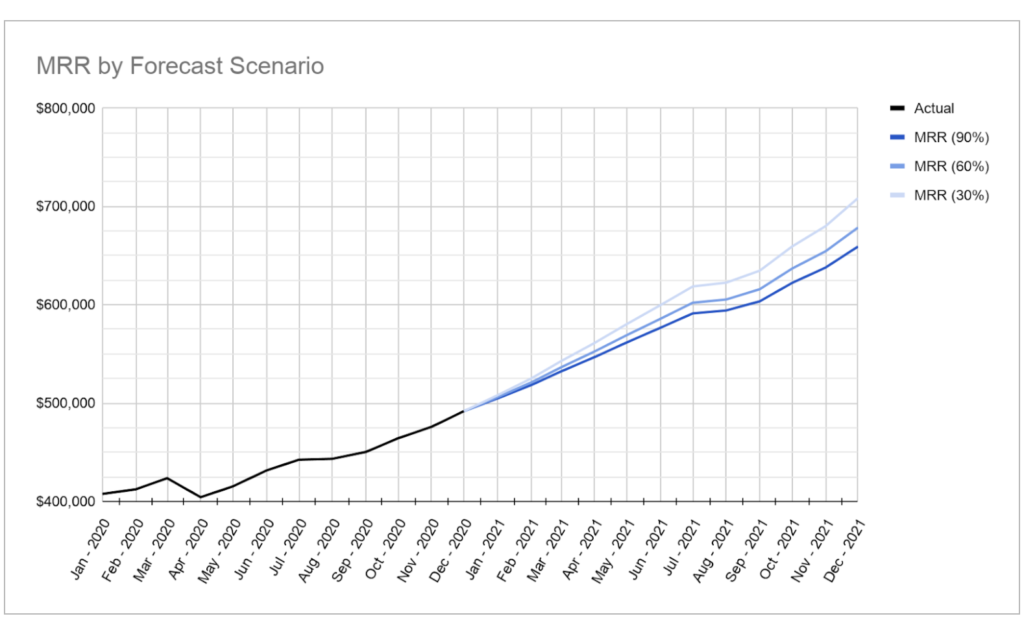

Finally, we now add the MRR to the equation to see where these growth rates project the company to be over the course of 2021.

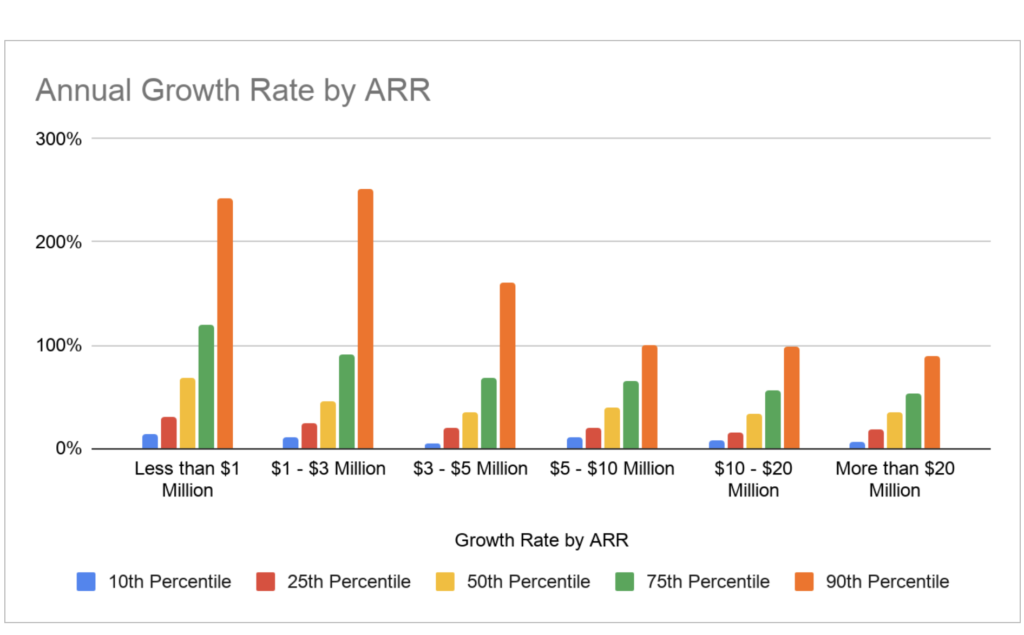

These 3 scenarios would put this fictitious company at an annualized growth rate of 34% in the most conservative case and 44% in the most aggressive scenario. If we look at a company that is roughly an $8M ARR company in the Growth Rate by ARR graphic above, we’ll see that these projections would put this company at just shy of the 50th percentile in growth rates for companies of its size.

So why do multiple scenarios? I think it’s a good exercise to go through — granted there is usually a cost that comes with stretching growth. Examples might include extra advertising spend, hiring another account representative, etc.

I also highly encourage you to talk to your team about ideas as to how to hit some of the stretch scenarios. It tends to help get buy-in which is always a good thing when an annual MRR goal comes down from a high.