The last decade has seen the explosion of Freemium as a growth strategy in B2B SaaS, and companies like Canva, Notion, and Slack have contributed to the rise of this new normal. While 2012 saw notable SaaS experts questioning the Freemium model, fast forward to 2020s and buyers now expect to have access to a free, ungated version of a product, or at the very least, access to a free trial.

While Freemium has seen its fair share of vacillations over the years, today, SaaS companies have become A LOT better at mitigating the risks associated with the strategy. For instance, by offering premium product features, and leveraging scalable pricing tiers that are directly proportional to user growth, companies can limit their free offerings to cost-strapped SMBs and startups, while monetizing on selling premium pricing to customers with more complex needs.

Why is Freemium becoming so popular?

Let’s address some of the basics:

Larger Total Addressable Market (TAM)

By removing entry-level cost barriers to product adoption, companies using a Freemium strategy are able to increase their total addressable market to include price-sensitive audiences, startups, and SMBs. A free plan also drives bottom-up discovery from end-users in larger organizations, so businesses can target more buyers within a single company.

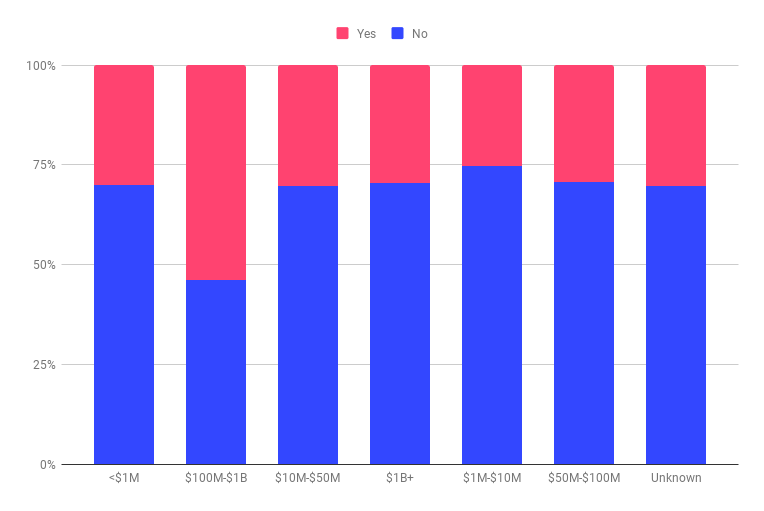

A study from ChartMogul finds that B2B SaaS companies on a path from $100M to $1B in ARR are more likely to offer a Freemium plan, suggesting that it’s a favored strategy for businesses that need to aggressively grow TAM to reach new revenue milestones.

Companies using the Freemium model, by ARR band:

Word of Mouth Acquisition

Possibly one of the most coveted reasons for offering a Freemium plan is the word of mouth acquisition and virality it can drive. Offering a free version of your product is one of the few critical factors in creating a viral growth loop at scale — the more people experience your product, the more likely they are to talk about and evangelize it.

To quote Jason Lemkin in his updated post on the evolution of Freemium:

Even if freemium is only 20% of your revenue, if it represents 2,000 customers that are happy, spreading the word, tweeting, telling their friends … this is powerful. All the best software companies are built on word-of-mouth. The more happy customers you have, the faster that positive word-of-mouth spreads.

Self-serve Revenue & User Experience

Freemium creates an opportunity for self-serve revenue that doesn’t require large, expensive sales teams to drive it. This self-serve model then pushes companies to provide better user experiences: from seamless product onboarding and exhaustive documentation to better communication across customer touchpoints.

Consider the online video hosting software, Vidyard. In a funding pitch deck they recently published, they reported that over 60% of closed-won ARR began with free users.

Measuring the revenue impact for Freemium can get complex if you consider the time it takes for users to hit a usage or feature limit on a free plan, before converting to a paid version — depending on your product’s pricing structure, its stickiness, and the needs of the customer, this can take anywhere between 30 days to up to 2 years, as in the case of the note-taking app, Evernote.

“Evernote found out early on that inactive users didn’t stick around very long. Fortunately, those who did came to rely on the product and were more willing to pay for it.

In fact, after a year of using their product, users were 8x more likely to convert into premium subscribers than they were after using it for only a month. These individuals had experienced the benefits of using Evernote and depended on it as a solution to their everyday organizational pains.”

While Evernote wasn’t successful in monetizing its Freemium strategy, the fact remains that the more engaged free users are, the more likely they are to become paying customers.

Given everything we know about building better self-serve product experiences today, this path to user engagement and revenue can (and should) be shorter. Still, it’s important to address that for many, a self-serve Freemium plan is a long-term monetization strategy that generates revenue and compounds over time. This is even more so for pure B2B SaaS where Freemium’s ROI can take longer to manifest.

Playing the long game

For businesses that offer Freemium, understanding its “true ROI” starts with measuring the right metrics.

For example, perhaps one of the most commonly discussed metrics is the free-to-paid conversion rate, which is the % of new sales won from customers who went from a free plan to a paid plan. While companies like Slack report a whopping 30% conversion rate, the average tends to be somewhere between 2-5%.

While this metric is a strong health indicator of your Freemium strategy (and is viewed as a north star KPI by many), looking at it in isolation can be deficient. Primarily because it fails to attribute future gains as customers land, expand, and grow with you.

Let’s put this in context for a minute. Freemium buyers can be largely organized into two categories:

- Price-sensitive early-stage and SMB users who get started with your product for free, and convert to paying customers as their needs (and businesses) grow.

- End users from large businesses. As these users discover more value in your product, they’re likely to invite more colleagues from their company and grow their account with you. This guide by OpenView is a great introduction to driving product-led growth in the end-user era.

Looking at new sales won (also known as New Business MRR) in isolation fails to account for the expansion potential of graduates from your free tier.

David Skok outlines two common ways to drive expansion revenue:

- Use a pricing scheme that has a variable axis, such as the number of seats used, the number of leads tracked, etc. That way, as your customers expand their usage of your product, they pay you more.

- Upsell/Cross-sell them to more powerful versions of your product, or additional modules.

Adding expansion levers to your product pricing will ensure that you build a symbiotic relationship with your customers and grow as they grow.

Ultimately, this cycle is a long game, with your product and customer success driving it — that’s why, at its core, Freemium is a long-term monetization strategy whose true ROI is best measured and witnessed over time.

Segmenting free-to-paid metrics for a better picture of ROI

To effectively measure Freemium’s ROI, I’d argue that we’d need to:

Segment metrics: Aggregating revenue metrics of free and paid users hardly gives you a full picture of the success of your Freemium business model. To understand Freemium’s true ROI, you need to filter and segment users who have successfully converted from a free to a paid plan (let’s refer to them as “free-to-paid” customers), and analyze them in detail. These are your “ideal” Freemium customers who continue to contribute towards your revenue until they churn.

To understand Freemium’s true ROI, you need to filter and segment users who have successfully converted from a free to a paid plan, and run detailed analyses on their revenue data.

Tweet this quote

Analyze “long-term” ROI: As outlined previously, a Freemium user’s revenue contribution hardly ends on their first conversion to a paid plan. It’s therefore important to look at metrics like expansion MRR, to understand Freemium’s compounding effect on ROI.

Let’s look at some examples of segmented metrics you can build into a free-to-paid revenue dashboard.

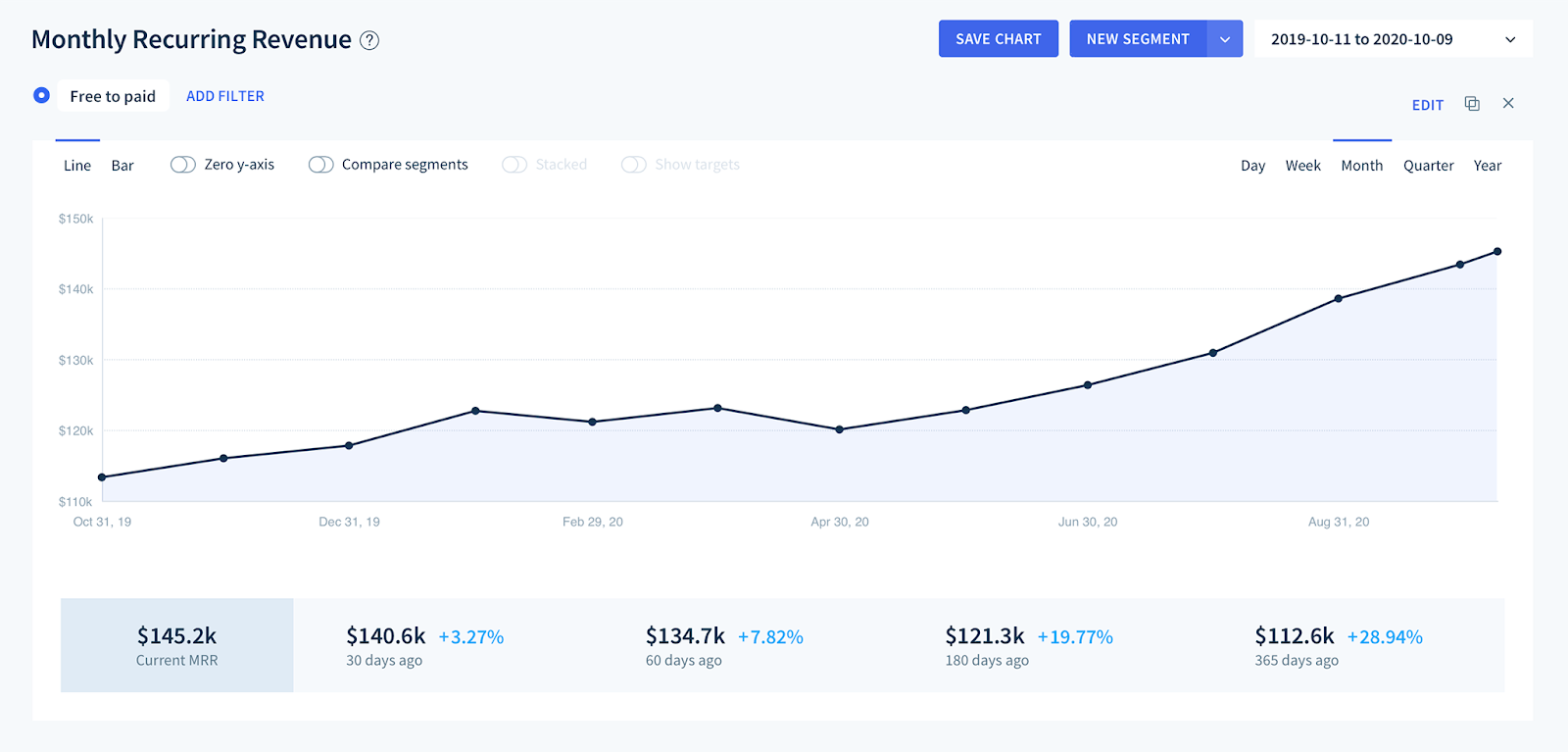

MRR Breakdown for Free to Paid Customers

Segmenting your MRR charts by applying a free-to-paid (customers who started their subscription with a free plan, and subsequently upgraded to a paid subscription) filter will give you a true picture of the revenue contribution and growth of this segment.

Check out our 2021 MRR guide if you’re interested in learning more about the MRR metric and how it’s calculated.

Further breaking down MRR will help you understand the health of your free-to-paid customer base at every stage of the funnel, so you can prioritize what to focus on. If you’re losing more MRR than you’re gaining, it may mean you need to dig deeper, and perhaps revisit pricing and product value, or analyze the quality of your freemium leads.

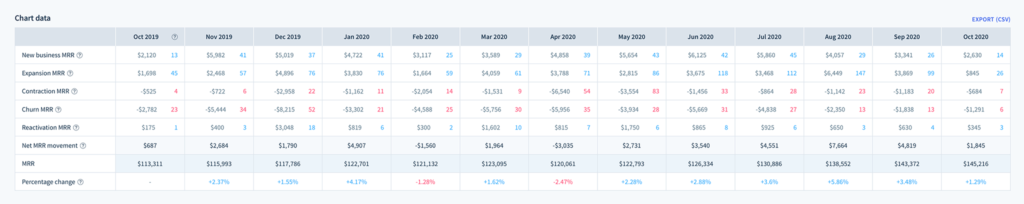

Here’s how your MRR can be visualized and broken down in a table:

This breakdown will help you answer questions like:

- How much MRR is generated from a customer’s first conversion from a free to a paid plan? (New Business MRR)

- Are free-to-paid customers expanding and growing with the business? (Expansion MRR)

- How much free-to-paid MRR is lost due to churn and contraction (Churn & Contraction MRR)

- Are churned free-to-paid customers coming back? (Reactivation MRR)

The “Net MRR movement” is a great metric to then give you a picture of how MRR is changing for your free-to-paid customer segment.

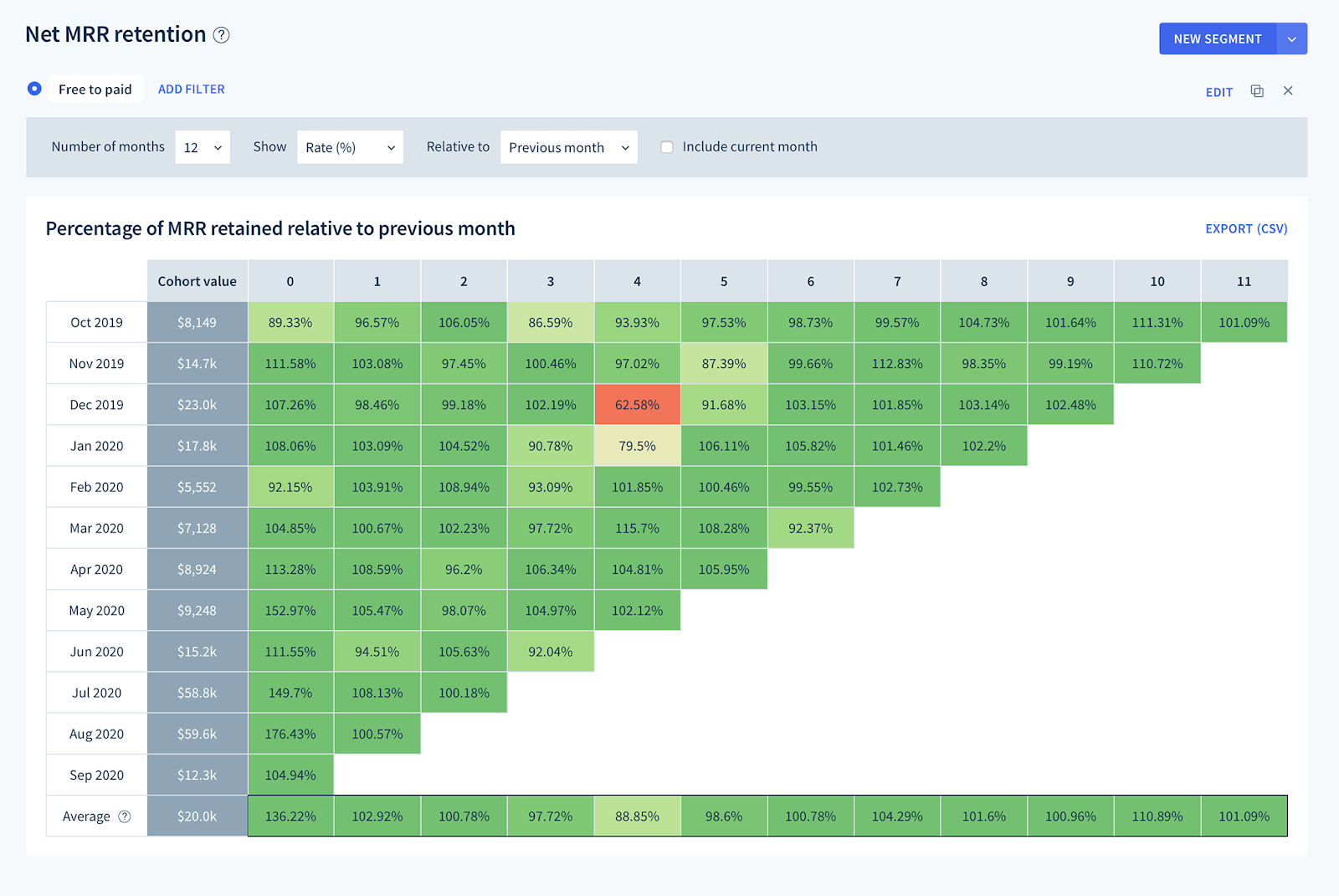

Net MRR Retention (or Net Dollar Retention) for free-to-paid customers

Net MRR retention reports the rate at which revenue is retained from existing customers during a given time period. This metric is inclusive of expansion MRR, downgrades or contraction MRR, and cancellation MRR.

A Net MRR Retention rate of over 100% means your existing customers are expanding at a faster rate than they are churning. In other words, you’ve achieved net negative churn, also referred to as the holy grail of SaaS.

In their analysis of public SaaS companies’ S1 filings, Crunchbase reported that the median net retention was 109%, 109%, and 106% in the years leading up to the IPO. Some companies like Box, Crowdstrike, and PagerDuty achieved average net retention as high as 139%. For example, in their recent $55 million funding announcement, subscription billing platform Chargebee reported net dollar retention of over 160%. In other words, this metric is a strong indicator of SaaS growth.

Segmenting Net MRR Retention for free-to-paid customers can give you a good sense of the health of your Freemium strategy. A high Net MRR Retention would suggest that your Freemium plan is doing a good job of generating early product adoption and stickiness and driving expansion and loyalty over time. It would also be a strong indicator that your Freemium plan is attracting customers who are a good fit for your product.

Visualizing this metric in a cohort (with a “free-to-paid” filter applied, as in the sample chart below) can be especially useful.

LTV, CAC, and Payback Period for free-to-paid customers

“Customer Lifetime Value (LTV) represents the average revenue that a customer generates before they churn, offset by gross margin.”

Additional resources:

Measuring the LTV of customers who go from free-to-paid helps you understand if customers in this segment generate more revenue than you spend on them, over time.

Customer Acquisition Costs (CAC) have risen significantly in the past few years, and while going the Freemium route means you may not need to invest in an expensive sales process, acquiring Freemium customers can still prove to be cost-intensive — channels like paid marketing inevitably attract free users, so measuring LTV, CAC and payback period (which is the time it takes to recover customer acquisition costs) for free-to-paid customers is especially important if you use them.

Additionally, this resource by Hubspot breaks down the payback period metric and how to effectively split costs (like hosting) between free and paid users.

Assessing Freemium’s compounding success starts with sound measurement

If implemented right, Freemium can be a long-term revenue driver for businesses. However, this can only be realized by measuring metrics that showcase this strategy’s impact over time. Segmenting your free-to-paid audience and analyzing them deeply can give you a better sense of what happens after Freemium users convert, and help you determine if the strategy can indeed drive compounding revenue growth.