How good is your business at retaining customers? Are you effectively expanding revenue from your existing customer base? And, is your poor retention the reason for your slower growth?

If you’re unsure, check your retention metrics. Gross revenue retention (GRR) and net revenue retention (NRR) are the key metrics to understand how well your SaaS business executes on the promise made to customers. They can help you run your business over the next month, quarter, and year.

In this post, we will explain what are GRR and NRR, how to calculate them, why they matter, and what a good retention rate looks like in 2023 based on a study of over 2,100 businesses.

- What is net revenue retention (NRR)?

- Net retention benchmarks

- What is gross revenue retention (GRR)?

- Gross retention benchmarks

- Gross Retention vs Net Retention

- 2 tips for tracking retention rates

- 3 tactics to improve your retention rate

Net revenue retention (NRR)

To build a healthy SaaS business, revenue retention should be at the center of your business. Net revenue retention has been in focus, especially with the recent economic downturn.

Net Revenue Retention, also known as net dollar retention (NDR), measures the percentage of revenue retained over a period of time.

For example, if have a total monthly recurring revenue (MRR) of $100k on day one, what percentage of that revenue do you still have 12 months later?

Retention can be measured over any time period, but it is common to measure it over 12 months. Analyzing retention over 12 months works well for both annual and monthly subscriptions. It allows for the full customer lifecycle, including adoption and expansion. And it also nullifies any impact from seasonality, which can cause short-term fluctuations. If you’d like to track shorter intervals, make sure to look at the same intervals consistently.

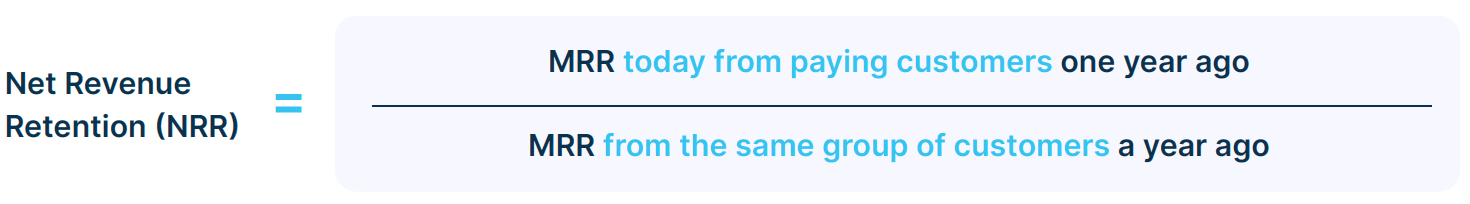

How to calculate the net revenue retention rate?

To calculate net revenue retention, divide your monthly recurring revenue (MRR) today from customers one year ago by MRR from the same group of customers one year ago.

This is the net revenue retention formula.

For example, one year ago, you had 4 paying customers with a total MRR of 770. Fast forward one year, some of those customers churned, some contracted, and some expanded, and the total MRR today from the same group of customers who existed a year ago is 800.

So to calculate net revenue retention, you divide 800 by 770. Your NRR is 103.9%.

What is a good net revenue retention rate?

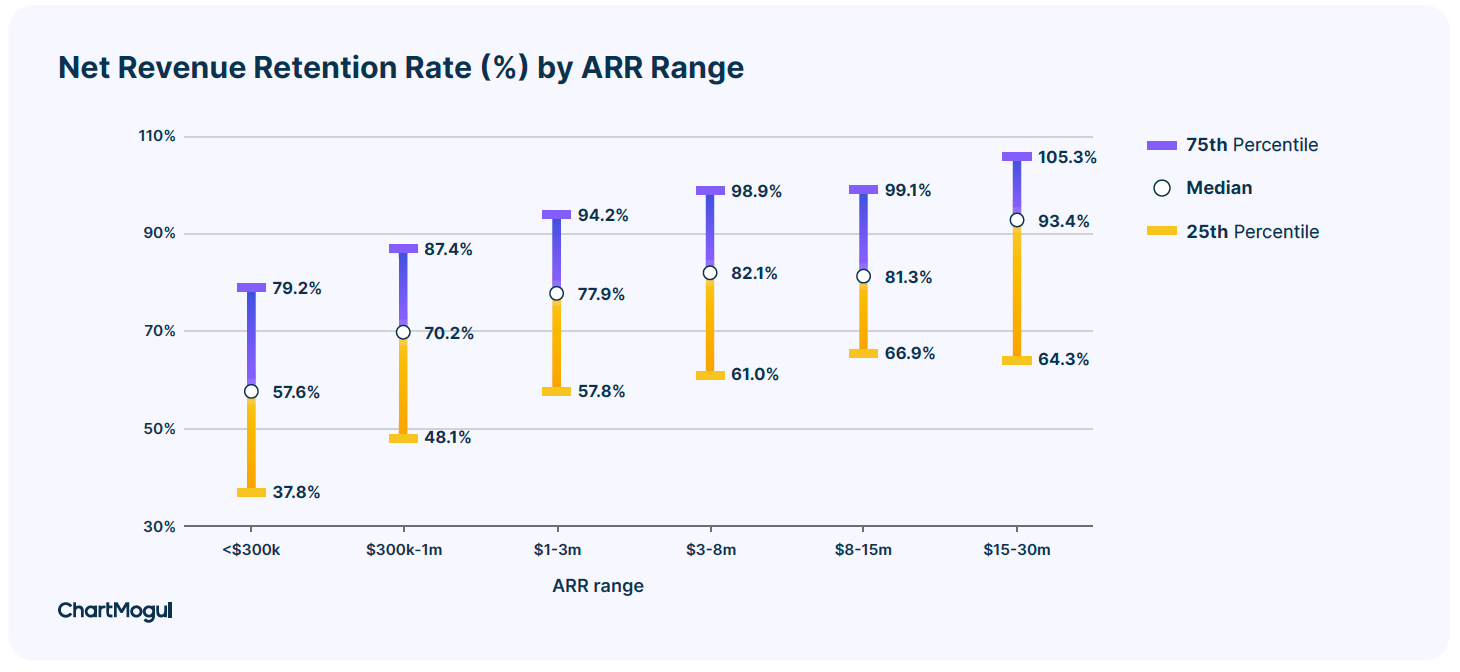

Well, it differs by the stage of business you are in.

In the pre-product market fit stage of the business, net retention is usually poor. The best early-stage companies have net revenue retention of 79%. At this stage, you can use segments to analyze which customers are the best fit for your product. If your retention is higher for certain customers, you’re getting closer to product market fit.

In contrast, as companies reach scale, net revenue retention goes over 100%. Our research found that the most successful companies in the $3-15m ARR range have a net retention rate of 99%. And businesses at scale with ARR in the range of $15-30m have a net retention rate of over 105%.

See the chart below for a more detailed look into net retention by ARR range.

In addition to ARR, when benchmarking, keep ARPA (average revenue per account) in mind. SaaS companies at a particular ARPA band are often quite similar in terms of the length of the sales cycle, the tenure of contracts, discounting, onboarding, the type of customer support, and even retention strategies.

In short, the higher the ARPA, the higher the net revenue retention rate. Learn more about how retention and ARPA are correlated in the SaaS Retention Report.

Gross revenue retention (GRR)

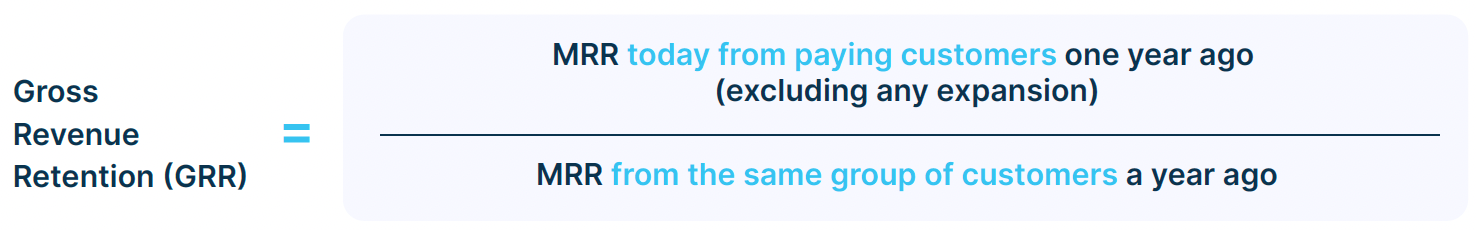

Gross Revenue Retention (GRR), also known as gross dollar retention (GDR), measures the percentage of revenue retained, excluding expansions, over a period of time.

For example, if you have a total monthly recurring revenue (MRR) of $100k on day one, excluding any contribution from expansions, what percentage of that revenue do you still have 12 months later?

In SaaS, people tend to focus overly on NRR as the key revenue retention metric, and GRR is often overlooked. However, in many cases, gross retention can help provide a more complete picture of retention. Gross revenue retention tells you how much revenue you maintain when activities like upsells, cross-sells that increase your average customer value aren’t factored in.

Gross revenue retention answers the question of how well you retain your customers, while net revenue retention digs deeper into your ability to expand revenue from those customers.

How to calculate the gross revenue retention rate?

To calculate gross revenue retention, divide MRR today from customers one year ago (excluding any expansion) by MRR from the same group of customers one year ago.

This is the gross revenue retention formula.

Going back to our former example, one year ago, you had 4 paying customers with a total MRR of 770. This time, we’re excluding any expansion, and the MRR today from the same group of customers who existed one year ago is 630. So the gross revenue retention rate is 630 divided by 770. GRR is 81.8%.

What is a good gross retention rate?

Best-in-class gross retention at any stage of the business is over 86%. That means that successful SaaS businesses can only afford to lose 14% of gross revenue in a year.

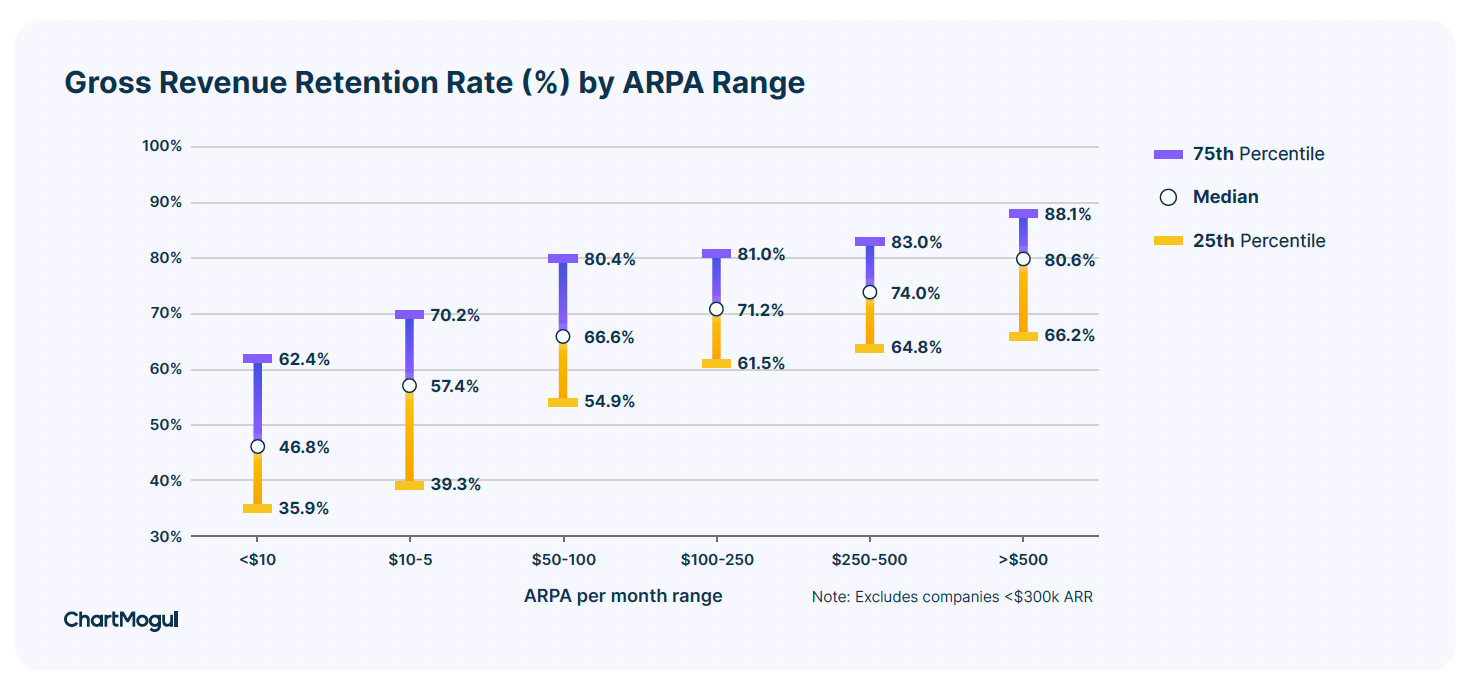

Take a look at the chart below. The top quartile of companies with an ARPA over $500/month hit 90%+ gross retention, while the top quartile of companies with an ARPA less than $50/month only hit 60 to 70%. When judging whether a SaaS company has good gross revenue retention, keep ARPA in mind.

Net vs gross retention

Both GRR and NRR are important metrics to measure customer retention, but they are used in different contexts.

In short, GRR is useful when a company wants to measure its core customer base’s retention without factoring in any expansion revenue, while NRR is useful when a company wants to measure the overall revenue growth from its existing customer base, including expansion revenue.

You may choose to measure GRR when you want to assess your retention strategies and how well you are at keeping existing customers. In contrast, you may choose to measure NRR when they want to assess how effectively you are growing revenue from the existing customer base through expansion efforts.

GDR and NDR are both important metrics to measure customer retention and revenue growth, and the choice of which metric to use depends on the specific context and goals of the analysis.

2 tips for tracking revenue retention rates

Run cohort analysis

In SaaS, a cohort is a group of customers that start their first subscription in the same month and year. Using cohort analysis helps you identify trends in a particular group of customers. A cohort analysis is commonly used to uncover trends in your customer churn, revenue churn, as well as the inverse, your customer retention and revenue retention.

Carry out segmentation

For example, you can determine the health of your customers in their first few months of paying for a subscription and identify when customers are dropping off.

Or, your customer success team might segment your data to determine if customers with discounted plans are more prone to churn.

A marketing executive, on the other hand, might look into how retention data compare against different acquisition channels – which channels are bringing in customers that stick around?

3 tips to improve your revenue retention

Target the right customers

A few years ago, we learned how important it is to retain the right type of customers. During a pricing migration, we discovered that some customers were simply not the right fit; we found that we had been trying to keep some customers happy for years at great expense to our business.

Losing customers when migrating to the new pricing model or implementing price increases is inevitable. However, keeping existing customers that are highly engaged can enable continued growth.

Targeting the right customers is essential for improving revenue retention. After all, not all existing customers are equally valuable to a business.

Drive expansion

Driving expansion through cross-selling and up-selling to existing customers can increase revenue and prevent churn

Keep your customers engaged by offering them upsells and upgrades to your product. This can include new features, additional services, or higher-level plans. Make it easy for customers to see the benefits of these options and how they can help them achieve their goals. In many cases, you’ll need to depend on your customer success team.

Your customers are the lifeblood of your SaaS business, and keeping them happy and successful is crucial to driving expansion and growing revenue.

Proactively identify churn

Proactively identifying revenue churn is key to retaining customers. By monitoring usage patterns, engagement metrics, NPS, and customer feedback, businesses can identify potential revenue churn risks and take action to address them before it’s too late.

Offering targeted promotions, improving product functionality, or providing exceptional customer support can help retain customers and drive revenue growth.

You can use self-service support to assist users faster and boost customer satisfaction or rely on customer success teams.