Spotify has revealed its intentions to go public with a novel “direct listing” approach. This means that the company will not embark on the usual roadshow, there will be no pre-defined opening share price and more freedom for existing stakeholders who want to sell their shares.

This somewhat risky direct listing is likely to be a benchmark for other future public listings in 2018, with the likes of Airbnb predicted to follow suit if all goes to plan. Spotify even states in the company’s F-1 filing that it expects a volatile share price in the early days after listing.

Spotify’s filing gives us a rare look into the metrics of a large-scale consumer subscription business. Here’s a quick rundown of some key findings from the F-1 document.

Customer Churn Rate

TL;DR: Churn rate declined from 7.7% to 5.5% over three years, despite strong subscriber growth

Churn rate in consumer subscriptions is generally higher than in B2B, particularly where consumers are more sensitive to the ongoing cost of subscriptions.

First of all, the fact that Spotify’s customer churn rate is even under 10% is promising. That they’ve managed to add 43 million subscribers in three years and still see a decline in churn rate is highly impressive. It’s worth remembering that this is all happening during a period of strong competition in the form of Apple Music, Google Play Music and others.

What decreases churn?

- The introduction of a Family plan — Spotify’s Family plan allows multiple users in the same household to share a subscription — sees significantly higher retention (lower churn). With multiple users lumped under a single paid subscription, a decreased likelihood of churn makes sense.*

- Increased product personalization — This can lead to a stickier product with more invested, engaged users. Undoubtedly, Spotify’s array of personalized playlists (especially Discover Weekly) keep people subscribed.

- User-generated value within the product — A great example of this is the large collection of Spotify playlists that users might create over time. These are artifacts into which the user has put significant effort, making the decision to cancel all the more difficult.

*The Family plan is widely known to be exploited by groups of friends seeking a lower subscription cost by sharing with others. Perhaps Spotify isn’t bothered by this, given that the retention is higher?

Average Revenue Per Account (ARPA)

TL;DR: ARPA is down from €6.84 in 2015 to €5.32 in 2017. This is likely due to family subscriptions and internationalization.

ARPA is the lifeblood of any subscription business. How much money do I make from my customers?

So why is Spotify’s ARPA steadily decreasing? In the SaaS world, businesses generally aim to drive higher ARPA through add-ons and paid upgrades as the product matures. Things are very different for B2C though. Two possible drivers behind this decrease are:

- Global expansion to new markets (i18n) with less purchasing power, and therefore lower price points. In some markets such as the Philippines, premium subscriptions are the equivalent of less than $3.

- The adoption of family subscriptions, which cost $14.99 for up to six people, thus a large discount on the individual premium plans.

How might Spotify increase ARPA in the future?

- Paid upgrades, such as higher-quality streaming at a higher price point

- New platform products such as a (rumored) smart speaker

- Raising the price of the Premium plan, similarly to Netflix (which recently increased from $9.99 to $10.99, seeing a profit margin rise from 6.2% to 7.5% year-over-year in Q4 2017)

Ad-supported Freemium

“Our Ad-Supported Service serves as a funnel, driving more than 60% of our total gross added Premium Subscribers since we began tracking this data in February 2014.”

Spotify’s free plan uses in-app advertising to monetize freemium users. Ad revenue from free plans is a small proportion of total revenue (about 10%) but is growing steadily year over year.

Like most freemium subscriptions, the free plan is a core driver of the growth of paid subscriber and Spotify’s ability to acquire and convert users on the free plan is critical to future revenue growth.

Gross Margin

One huge difference between a typical SaaS businesses and a music streaming service like Spotify is gross margin — the difference between cost of goods sold (COGS) and revenue. Median gross margin for SaaS is 71% — virtually unheard of in less scalable revenue models.

Revenue is growing faster than the company’s costs, so Spotify’s gross margin is increasing — it rose from 16% in 2014 to 21% in 2017. But those costs are still huge and predominantly attributed to one thing: royalty payments to rights holders. These grew by 27% year over year in 2017. Spotify has paid more than $9 billion in total royalties since its founding! This has been (and will likely continue to be) a primary cause of the company’s annual losses — a whopping $461 million from revenue of nearly $5 billion in 2017.

Customer Lifetime Value (LTV)

First of all, how long do customers stick around on average? We can calculate customer lifetime as:

1 / customer churn rate

So the average premium subscriber remains subscribed for 18 months.

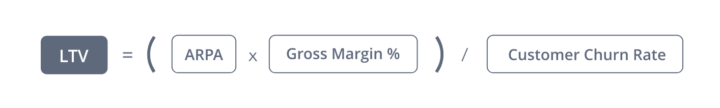

LTV is not a metric that’s included in the company’s F-1 filing, but the components to estimate it are all there. In SaaS, the accepted (highly simplified) formula for LTV is as follows:

In 2017:

- Gross margin (for Premium) was 22%

- ARPA was €5.32

- Churn rate is 5.5%

Estimated LTV = €21.28

(If we don’t take into account gross margin, LTV is €96.73.)

Increasing LTV

There are two key ways of driving higher lifetime value in a subscription business:

- Lengthen customer lifetime (better retention)

- Increase average revenue per account (ARPA)

For Spotify, there are a number of concrete options on the table for increasing ARPA (see ARPA section), but when it comes to increasing retention, it’s really about customer satisfaction and perceived value in the face of industry competition. Retention in a subscription business is all about delivering significant ongoing value to the customer. If the company continues to innovate on features and builds a sticky platform, the prospect of jumping ship to another streaming service becomes less attractive.

Spotify’s biggest challenge: becoming a platform

Today, Spotify has 71 million premium subscribers. That’s nearly double that of their (arguably biggest) competitor, Apple Music. But post-IPO success for Spotify will need far more than a vast library of streaming audio to survive against Apple, Google and Amazon’s platform-focused strategies. These companies don’t need to have a profitable streaming business — they rely on revenue from other products and services (e.g., iPhone) so the music streaming component is merely a value add.

A $12.99 Amazon Prime subscription gets me streaming music, streaming video, e-books, fast shipping and a whole host of other benefits. A $10.99 Spotify subscription gets me… well, Spotify.

EDIT: As has been highlighted out in the Hacker News thread for this post, the $12.99 Amazon Prime subscription does NOT get you Amazon’s complete library of music. That’s called Amazon Music Unlimited and costs an extra $7.99 for Prime subscribers.

Spotify desperately needs to demonstrate that it can make music licensing and streaming profitable (unlikely) or it needs to add other high-margin revenue streams to offset the massive cost of licensing deals. We’re seeing hints of this with recent job openings in hardware, but the question remains whether the company can adapt to compete in this space with its tech giant rivals.

Sources and further reading: