Monthly recurring revenue is one of the least exciting topics to take on in 2020.

- It is simple (to calculate).

- Everyone knows what it is about.

- It is hard to act on it (especially if you’re gunning for immediate results).

So why deal with it in the first place?

Well, the reality is people aren’t that familiar with MRR.

While I was researching this topic, I reached out to our Customer Success and Sales teams to see if many customers were coming to them with questions about MRR. I didn’t expect to get many.

But in fact, they bubble up all the time.

And they range from the simple (What’s a good MRR?) to the really complex “down-the-rabbit-hole” type (What specific experiments can I run that would affect MRR?)

In addition, some of the most popular searches on Google suggest that people still struggle with the basics:

We wanted to produce a holistic guide that covers everything people want to know about MRR in 2020 and beyond (it’s never too early to start planning for next year!), so we reached out to our customers, partners, and readers to learn what gaps still exist in their knowledge of the subject.

This is our attempt to answer all the questions people ask about MRR daily.

We start with answers to the basic questions (no guide on MRR would be complete without getting the fundamentals right) and gradually explore some of the more advanced topics.

Feel free to jump forward to the topics that feel most relevant and interesting to you.

And if you still feel some questions remain unanswered, you can always reach us at marketing@chartmogul.com or on our Twitter account to ask your burning question about MRR or anything SaaS metrics-related.

What is MRR?

MRR stands for Monthly recurring revenue. It measures the total repeatable revenue your company generates each month.

Because MRR is based on subscriptions, it has a strong forward-looking element. For example, if a customer pays for a whole year in advance, you should spread their payment over the 12 months it covers and count each share towards your MRR for the year ahead.

You should exclude any type of non-recurring payment from your MRR calculation. Any setup or consulting fees that are not recurring naturally shouldn’t be included in the calculation.

How do you calculate MRR?

Add up all the revenue that customers pay on a monthly/subscription basis.

If customers pay for an extended period — for example, a full year — you should split the payment by the number of periods (12 in this example) and add that to your MRR.

Let’s look at another example:

You have 5 customers:

- Customer A is paying you $10/month

- Customer B is paying $10/month as well but also paid a one-time $100 setup fee

- Customer C paid $60 in January for the whole year

- Customer D was at risk of churning, so you offered them a 20% discount and they’re now paying $8/month

- Finally, Customer E recently converted to your Premium plan and are now paying $15/month

In this example your MRR is (10 + 10 + (60/12) + 8 + 15) = $48

MRR should only include the recurring portion of the revenue — any type of one-time charge or fee should be excluded from your calculation. Thus, the setup fee has no effect — the MRR includes only subscription charges.

What is the difference between MRR and ARR?

The abbreviations are misleading!

MRR stands for Monthly recurring revenue. ARR is short for the Annual run rate.

This is not just a detail of vocabulary. ARR is a forward-looking metric that projects your revenue over the next 12 months based on the MRR you have today.

In terms of a formula, it is as simple as ARR = 12 x MRR.

Do discounts affect MRR?

There seems to be a bit of confusion and discussion around whether discounting should influence the MRR calculation.

Some argue that a one-time discount or such that applies only to a specific period (for example 3 months or 1 year) should not affect MRR (because they’re not recurring).

However, lifetime discounts are treated differently — because they affect MRR for the whole lifetime of a customer. If someone signs up on a $500/mo plan, but only pays $100/mo for the duration of their engagement, counting their MRR as $500 would be misleading.

But the same logic can be extended to cases where you apply a time-limited discount (say 3 months) and a customer churns after 2 months. They never paid the full price, so why would you apply it to your full MRR calculation?

We are big proponents of consistency. We believe the MRR calculation should include the true recurring revenue that your business is generating. If a customer is going to be paying $100/mo for the first 3 months and then switch to paying $500/mo after that, then those are the numbers that should go in your MRR.

(Committed MRR or CMRR is an especially useful metric that can help you navigate all these forthcoming corrections to MRR.)

Do custom enterprise deals count towards MRR?

The same rules apply as with your other customers — the subscription payment is divided over the period it covers (typically 12 months) and gets added to your MRR.

Consulting and setup fees (which occur much more frequently in custom deals) are excluded from the MRR calculation.

You should include custom deals in your MRR — without it, you won’t have a full view of how your company is doing.

What are the types of MRR?

I thought MRR was just a single number?

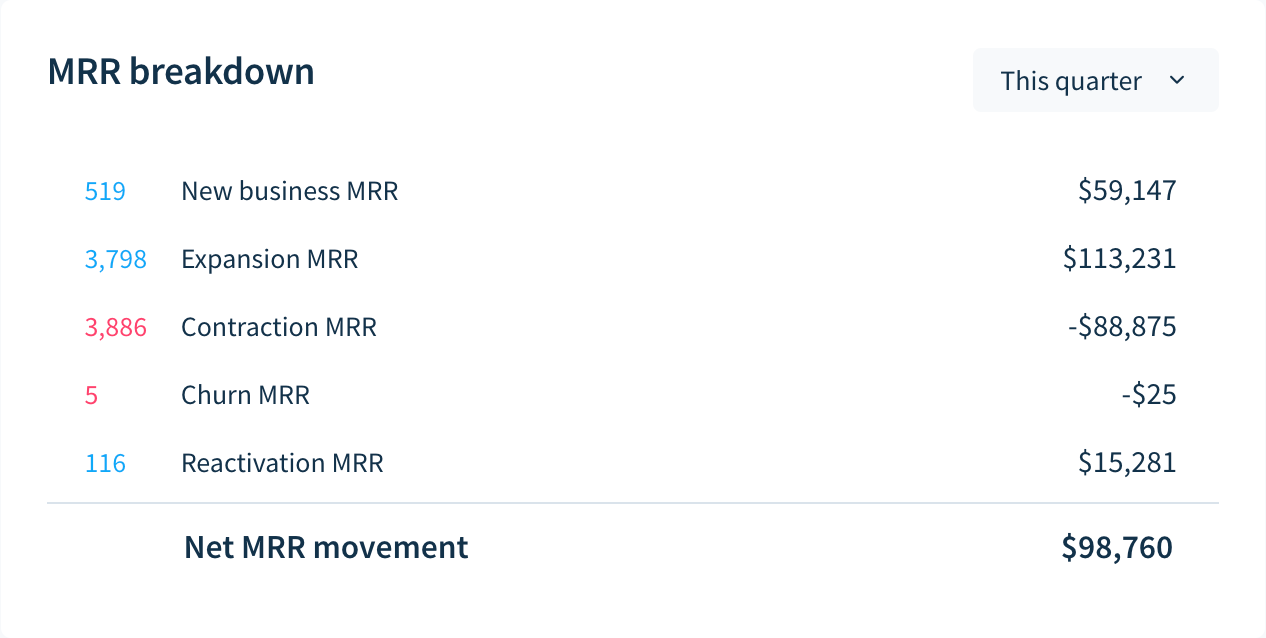

Sure, it is. But your MRR changes based on decisions your customers make about their subscription — they can buy new, upgrade to a more expensive plan, downgrade to a cheaper plan, reactivate an expired subscription, or cancel altogether. We call these the 5 MRR movements.

The better you understand these 5 elements, the sooner you can start influencing them — and thus growing your total MRR.

Understanding the MRR movements allows you to implement initiatives to influence them. These 5 elements include:

- New Business MRR: This is the new (recurring) revenue you added during a given period. A typical example is a new client who signed up during a given month.

- Expansion MRR: Includes the revenue added during a specific month from existing customers. This typically covers two common cases:

- Customers paying more as a result of upgrading to a higher pricing tier (like the customer who went from the Standard plan to the Premium plan in the example above) or due to expanding their usage of the product (something like adding more seats/users to the plan).

- Customers who buy add-ons (these should also be recurring).

- Reactivation MRR: Sometimes customers who have churned come back and start paying again. Their revenue is counted towards Reactivation MRR during the period in which they reactivate their accounts.

- Contraction MRR: This is the opposite of Expansion MRR — customers do not always switch to paying you more, sometimes they will switch to a lower-priced plan, lower their usage of your product, or stop using an add-on they were paying for.

- Churned MRR: This section covers the people who cancel their plans during a given period.

Each of these elements has either a positive or a negative effect on your total MRR.

Keeping track of these 5 categories is useful because it allows you (and different teams within your company — such as success, product, marketing, etc.) to focus on different segments and customers and understand what is driving their behavior.

Why is MRR important?

Subscription revenue is powerful. It accumulates and compounds over time.

Subscriptions (and SaaS in particular) are great for buyers as well. They’re low-commitment, low-cost, and you can upgrade/downgrade or even cancel at any time. There’s no lock-in and you typically get additional features and functionality for no additional cost.

As a seller, once you’ve won a customer, you don’t need to sell to them every month. Some churn is natural and customers will leave over time, but with subscriptions, you can focus on acquiring new customers and retaining those who are most likely to leave you. This is where the compounding effect kicks in.

(Also remember that happy customers not only tend to stick longer but also advocate your product in front of friends, peers, etc.)

MRR is one of the most important metrics for subscription companies of any kind. It shows how far along the road you are in a way that is easy to communicate to internal and external stakeholders alike. It makes it easy to communicate goals and progress towards attaining them to your team and to report on your progress when you’re talking to investors.

Many founders we talk to say that MRR is their “North Star” metric.

I’m always looking at MRR. At the end of the day, that’s our revenue and drives a lot of other strategic decisions such as hiring and other spend.

Joel Gascoigne, Buffer

However, it is important to remember that MRR is a trailing metric. You can act on it and the efforts you put into it will be reflected in your MRR, but sometimes it can take weeks or even months to see that effect.

MRR vs. Cashflow: How are they different?

It seems that quite a few SaaS operatives struggle with the difference between MRR and cashflow reporting and the usefulness of each.

What happens when someone pays you a full year in advance? Let’s use an example again:

In terms of MRR, you should split the charge over 12 months and add the monthly charge to your MRR. In this case, your MRR grows by $5,000 for the next 12 months (the MRR calculation excludes one-time charges as we discussed above).

But in terms of cash flow, the money is already in your bank account (including the one-time fee) and you have taken on a promise to provide a service (implementation + the use of your product) for the next 12 months.

Cashflow reporting allows you to look at the actual cash you have in the bank and compare it against the expenditures you have and the services you have to provide before it becomes earned revenue.

Both MRR and cashflow reporting are useful for different things. We already spoke about MRR at length above. Looking at cash flow allows you to do things like:

- Planning your runway: making sure you have enough money to make payroll 3-6-12 months down the road.

- Understand your expenditure: since cashflow planning also requires that you look at the money you spend, it is very helpful to understand where all your money goes and whether it’s spent wisely.

- Play out and plan for different scenarios: As discussed above, MRR is a great metric, but it only looks at the current state of your business. Cashflow planning allows you to play out different scenarios and see what would happen with your company if they materialize. For example, you can see what your vital stats would look like with a 2% vs. 3% churn.

How do you grow your MRR?

That’s a very common question that comes up very often. The challenge here is that a lot of the initiatives you can implement are reflected in MRR at a much later stage.

Nevertheless, MRR can be influenced (obviously) and it is important to understand how that works. There are only 5 ways you can grow your MRR — it’s by changing one of the 5 movements we covered above (New Business, Expansion, Reactivation, Contraction, and Churn).

New Business and Churn usually get the most coverage, but all 5 elements can be influenced and they all change the outlook on your MRR.

And there are many different ways in which these elements can be influenced. For example, devising a monetization strategy that uses scalable pricing is one way to optimize the Expansion element of your MRR.

A consistent feature in some of the most successful subscription companies is a strong Net Dollar Retention number — they grow very fast not just because they add new customers, but also because the revenue they generate from their existing customer base expands faster than it churns.

In essence, that means companies like Slack continue to grow even if they don’t add any new customers.

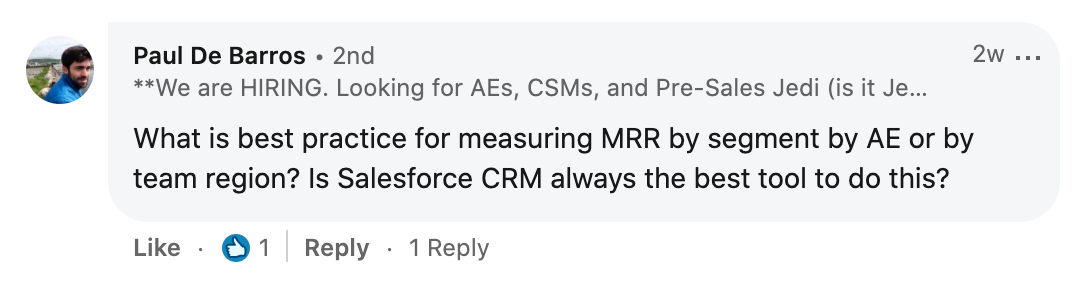

Segmentation and MRR

I do not want to imply that MRR is a static metric. Using segmentation along with your monthly revenue can help you make better decisions.

Segmenting customers allows you to understand what initiatives drive (long-term) customer loyalty.

We often hear people ask about segmenting MRR per sales rep/account executive — this is something we use for our team at ChartMogul as well.

But there are many additional ways in which you can use this — segmenting MRR (especially when looking at New Business MRR) per marketing channel is used by many teams for attribution and to figure out how to optimize marketing budgets.

Success teams would often compare NPS scores vs. MRR to make sure the best customers are getting value out of the product and so on.

MRR segmentation allows you to gain insight and generate new ideas to optimize your product, monetization, and go-to-market strategies.

What’s a good MRR?

The only good answer to this question is the Winnie the Pooh-esque The higher, the better.

There’s no straight answer to this question and a lot depends on your circumstances — what your goals are for the business, how big your team is, and so on.

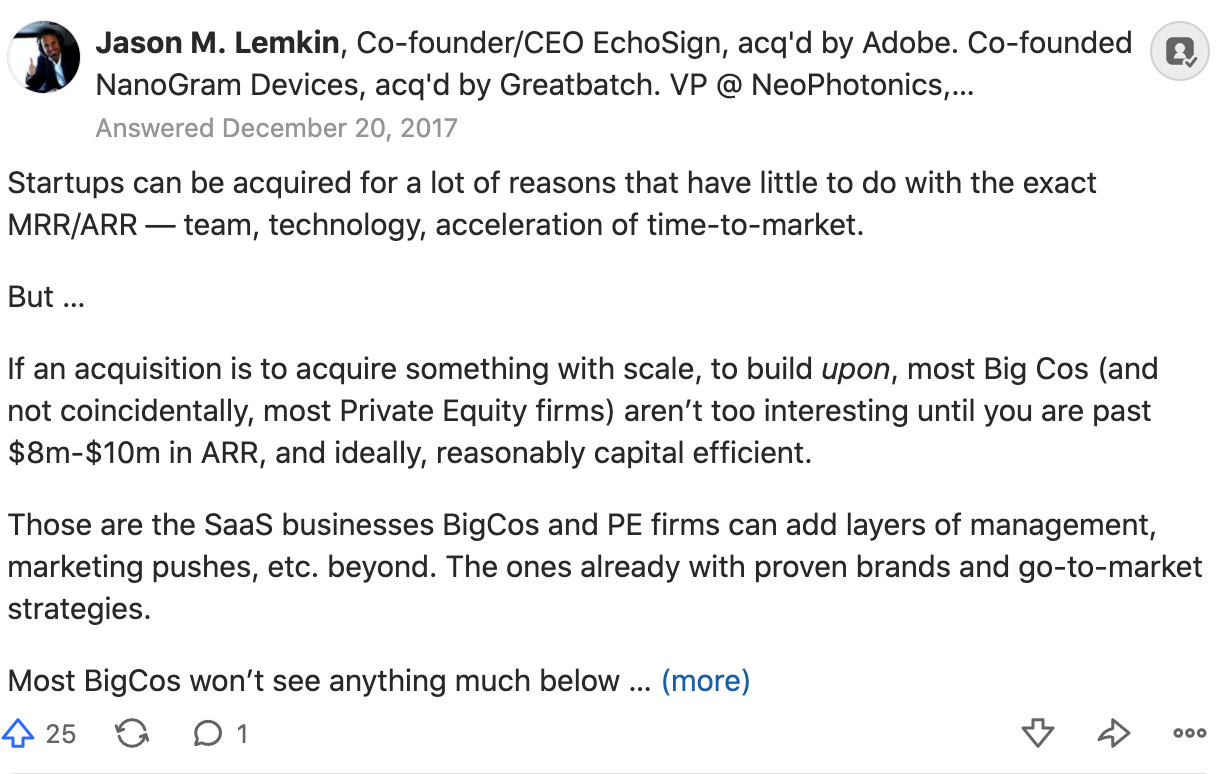

We often see this question attached to the topic of selling your business. Jason Lemkin gives a good answer to this:

But if you’re not looking to sell or to hire more people on your team, a good MRR is one that allows you to continue operating the business.

What effect does reducing churn have on MRR?

Churn is one of the 5 MRR movements we reviewed above. Reducing churn also generates a compounding effect — customers who do not churn, continue to generate revenue in every month after that.

Managing churn is one of the most commonly discussed ways of growing your MRR.

But there are other ways in which reducing churn has a (positive) effect on your MRR. A churned customer cannot upgrade their account or buy an add-on (thus limiting the potential of Expansion MRR). They also can’t (or most likely won’t) refer your product to a friend/peer, which is a lost opportunity in terms of word-of-mouth New Business MRR for you.

MRR is the mother of all metrics

MRR is a reflection of everything about your company — your decisions as a founder, your hiring, even your culture.

Make good decisions, hire good people, and create a nurturing environment and your MRR will grow. Of course, this is an oversimplification — you can write a book on each of these — but it’s how companies grow in reality.

However, it might take a while before you start to see it moving.

Learning how to segment and analyze MRR in a way that allows you to extract actionable insight is what you can do with your MRR number today.

We hope you found this useful, but if any questions remain get in touch with us @ChartMogul!