I couldn’t be more excited to launch the 2nd edition of the ChartMogul SaaS Benchmarks Report.

In this report, we analyze anonymized and aggregated data from over 2,100 SaaS businesses to bring you the latest SaaS benchmarks and growth trends.

Here is a summary of what we are seeing in the data:

- SaaS growth in 2022 was the slowest it has been in years

- Companies are relying more on expansion revenue to drive growth

- There are signs of stabilization. Growth for a subset of companies accelerated in Q1 2023

- After 5-6 quarters of lackluster growth, new business ARR is finally ticking up

- Retention was the key to growth in the last 12 months

- Retention in 2022 was harder than ever

You can read the full report here.

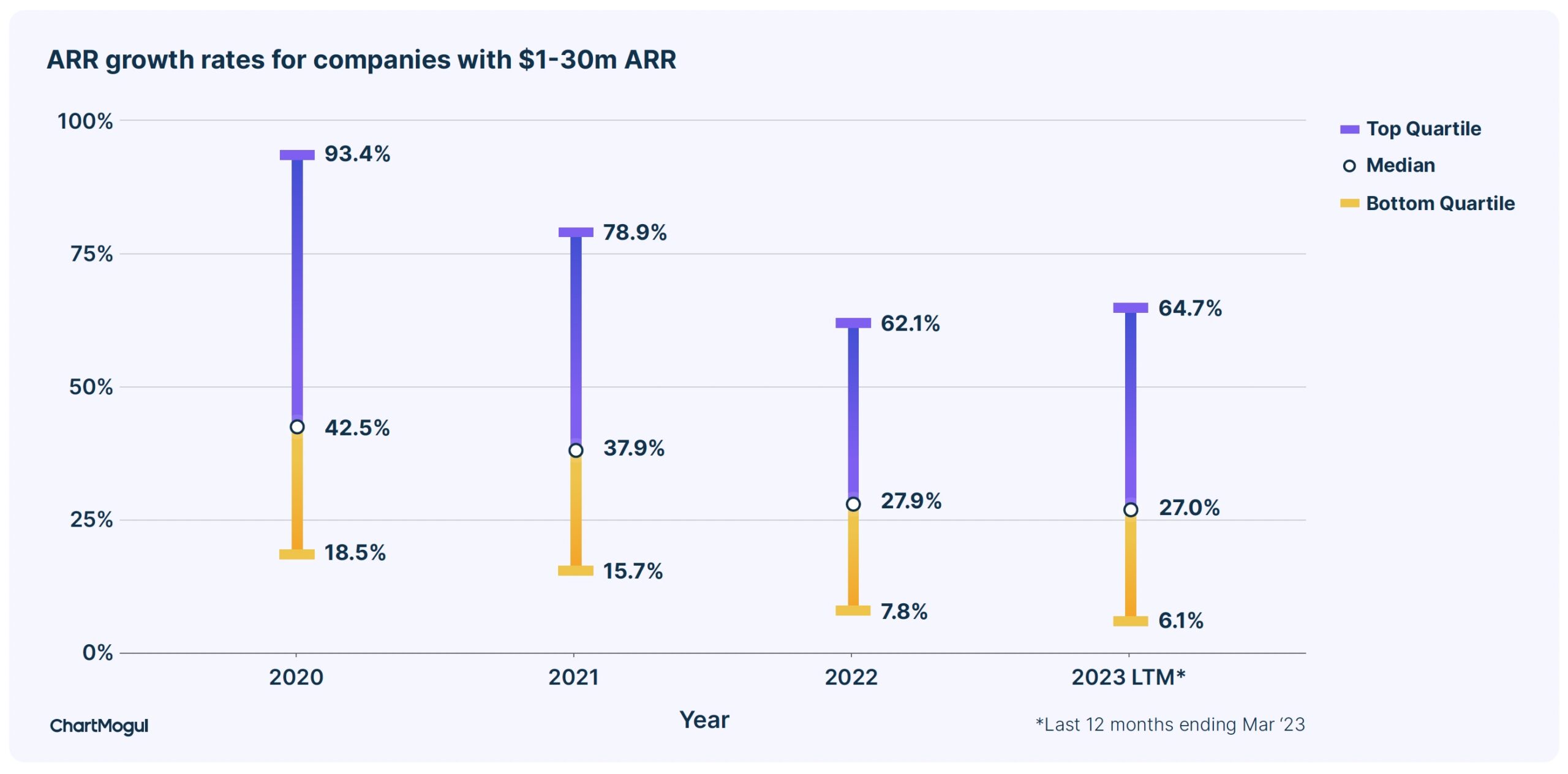

SaaS growth in 2022 was the slowest it has been in years

After a phenomenal 2020 and 2021, 2022 was much slower. The top quartile of SaaS businesses with ARR between $1 and $30 million grew 62.1% in 2022 (vs. 93.4% in 2020 and 78.9% in 2021)

It’s not just private companies, public SaaS experienced a slowdown too. The top decile of public SaaS companies grew 48% in 2022 (vs. 66% in 2021) while the top quartile of companies grew 39% in 2022 (vs. 54% in 2021).

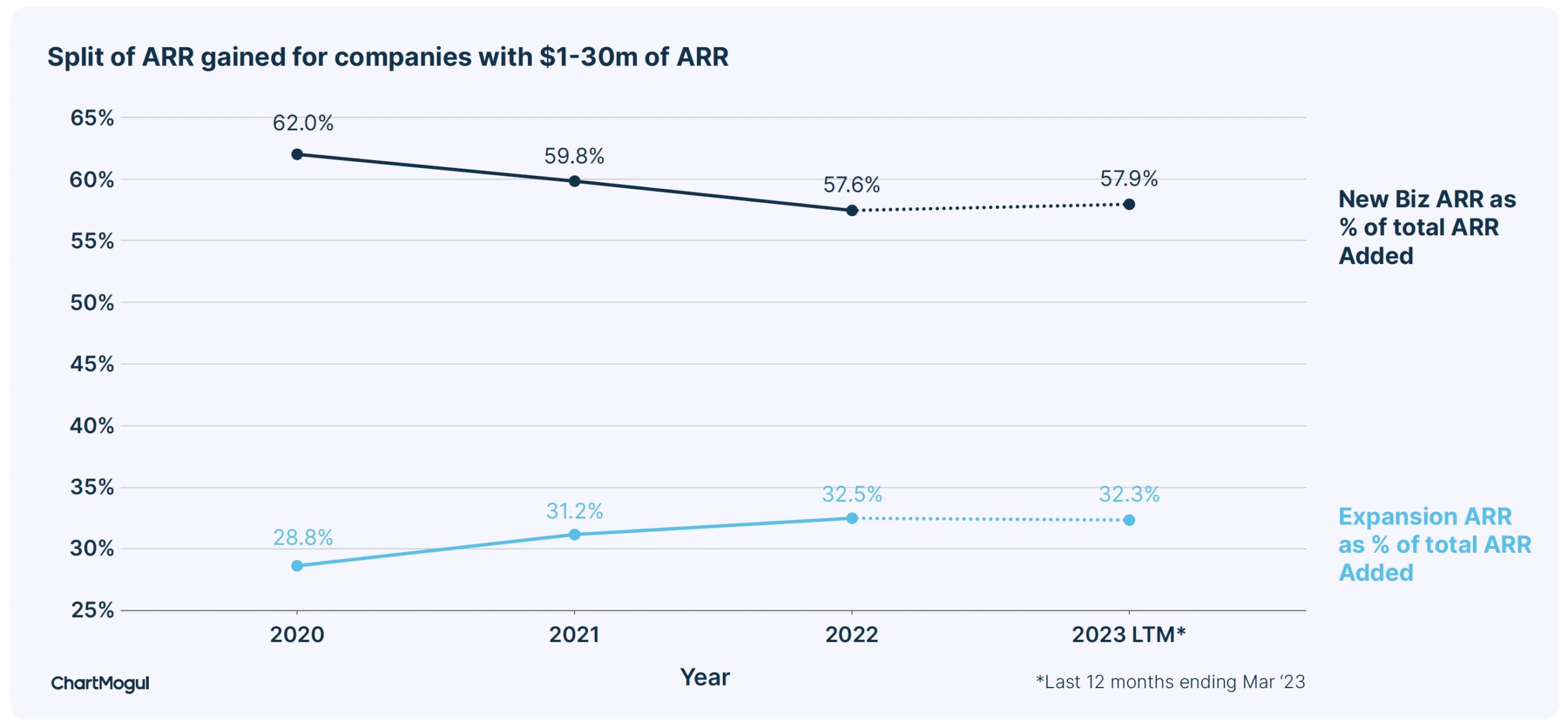

Companies are relying more on expansion revenue to drive growth

Given the landscape, companies are finding it harder to acquire new logos. The proportion of ARR gained from new business activities has come down from 62.0% of ARR gained in 2020 to 57.9% now. In contrast, the portion of ARR gained from expansion has increased from 28.8% in 2020 to 32.3% now. The reactivation component has remained roughly stable at 10%.

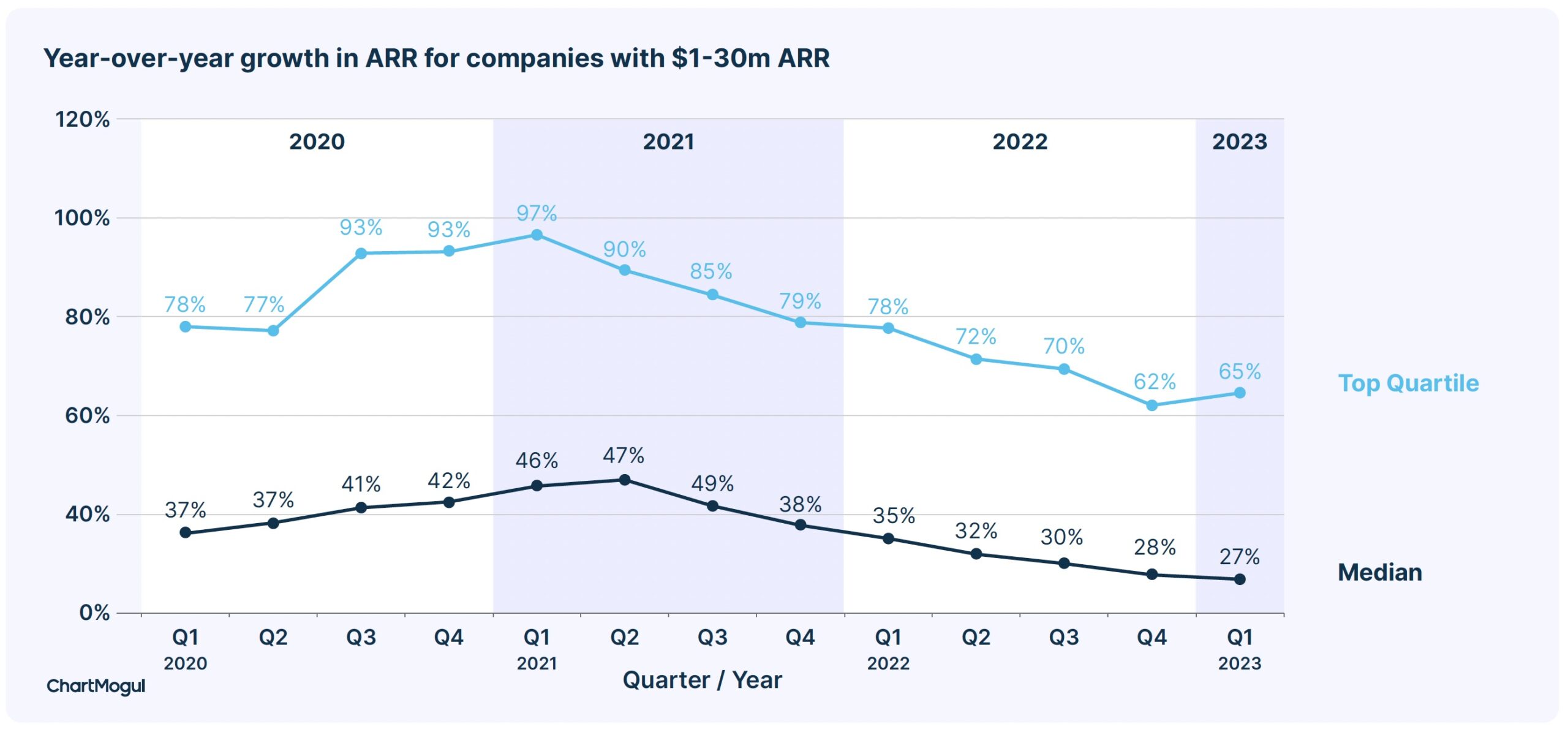

There are signs of stabilization. Growth for the top quartile companies with ARR over $1m accelerated in Q1 2023

After 7 straight quarters of slowing growth rates, the top quartile of SaaS companies with ARR over $1m saw growth accelerate slightly in the first quarter of 2023. It’s too early to say if this is a temporary stabilization, an outlier, or part of a wider trend.

“Even though efficiency is a key factor in whether a startup is more or less exciting for investors, growth is the clear #1 consideration.“

Christoph Janz, Managing Partner, Point Nine Capital

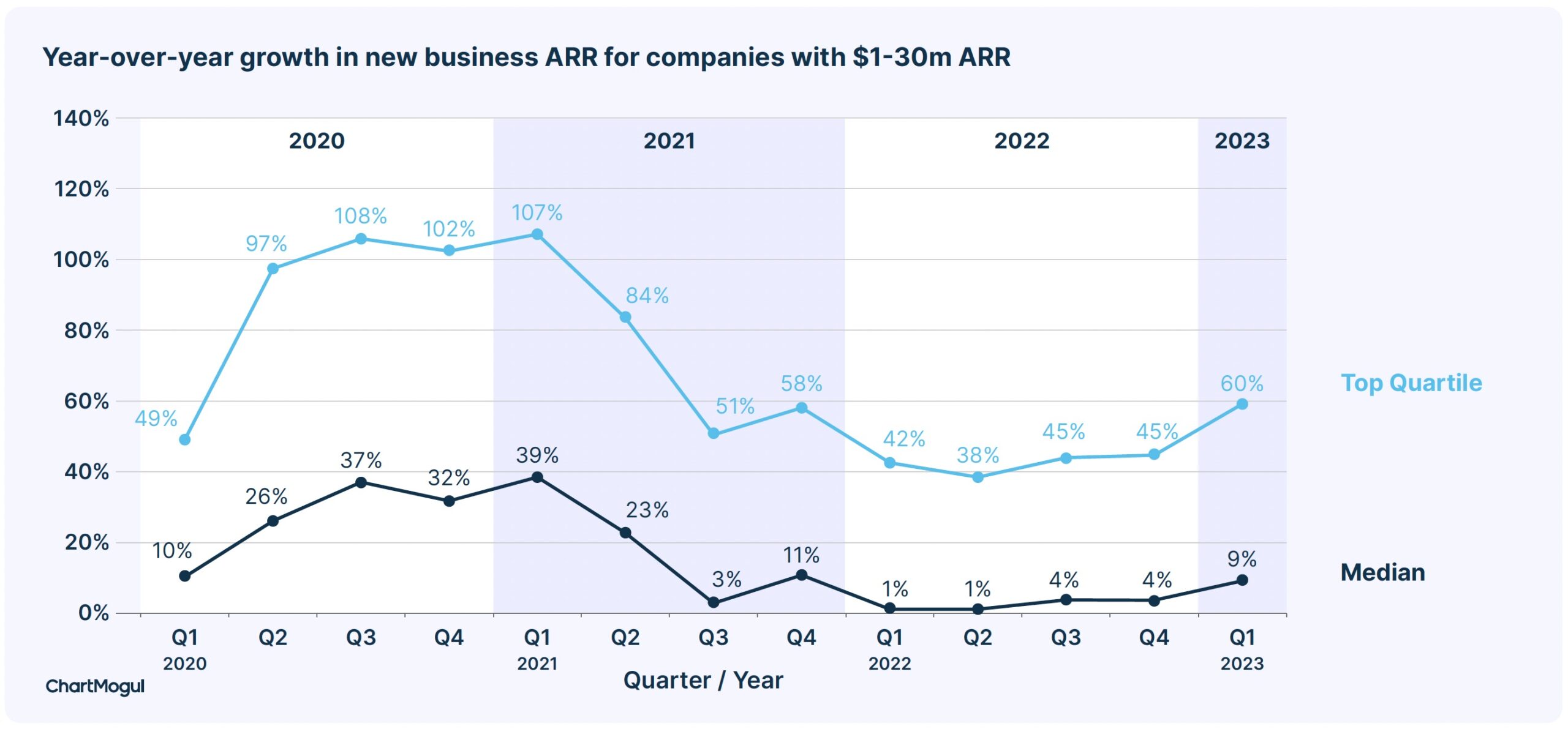

After 5-6 quarters of lackluster growth, new business ARR is finally ticking up

Late 2020 and the first half of 2021 were the golden periods of new business for most SaaS businesses. The journey from there on has been rough. More recently some green shoots are starting to emerge. Businesses with over $1m in ARR are seeing an acceleration in new business ARR in Q1 2023.

“In today’s market average is losing – or more accurately, median is losing. There is a huge difference between being in the top quartile and being on the median. It’s the same difference between having a very strong business and a very meh business. We certainly saw this when I was a VC. We had around 2,000 companies in our portfolio, but all our fund returns came from the top 5%. Things might have looked better for median companies during the free-spending boom of 2020, but that was the anomaly. 2023 is a lot more typical of long-term economic conditions”

Matt Lerner, ex-PayPal, 500 Startups VC, Founder at Startup Core Strengths

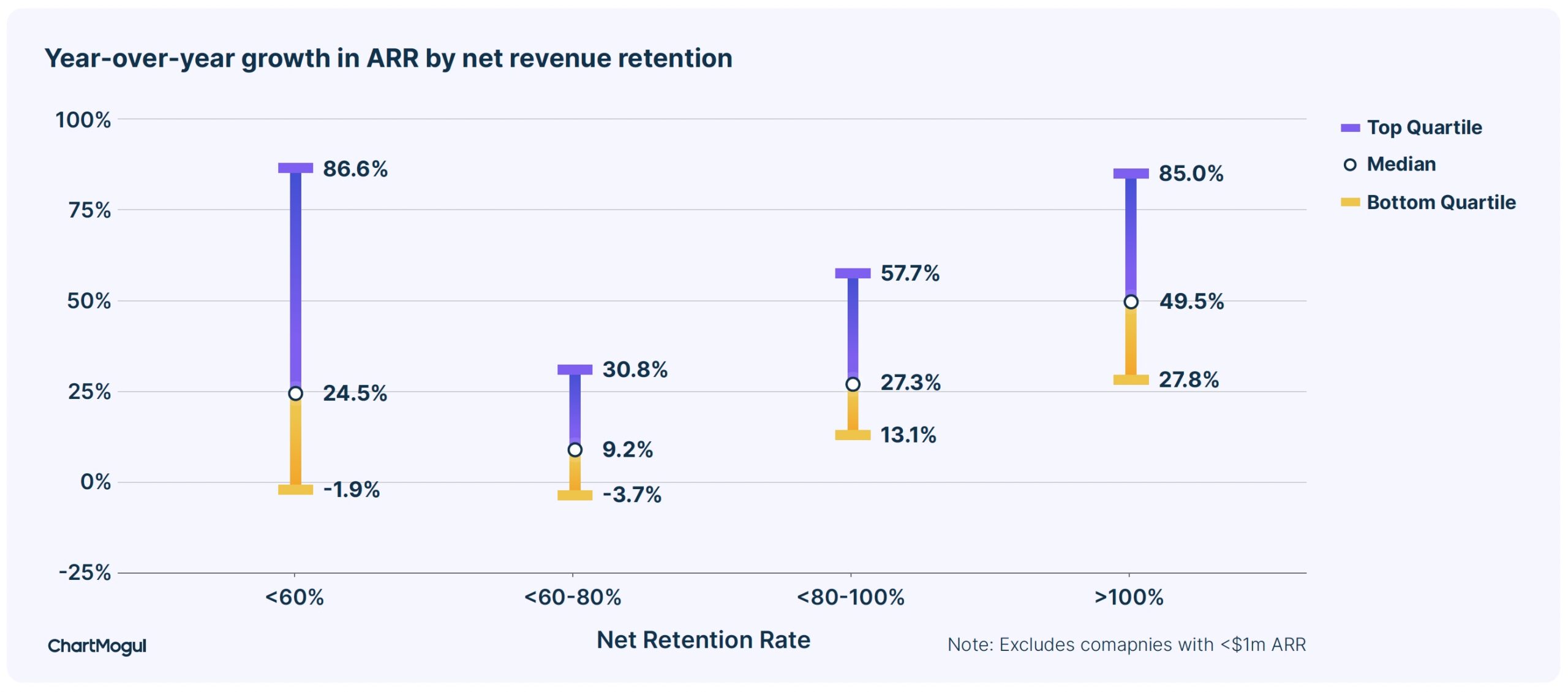

Retention was the key to growth in the last 12 months

Companies with best-in-class retention grew at least 1.8x faster than their peers. On average, SaaS businesses with a net retention rate of over 100% grew 49.5% in the last 12 months. In comparison, businesses with net retention in the 60-80% range grew by just 9.2%.

“In reality, for every B2B SaaS business retention becomes the biggest growth driver in a way. So it is worth focussing on retention really from day one, perhaps even before you actually have any meaningful retention data to look at.”

Nick Franklin, Founder & CEO, ChartMogul

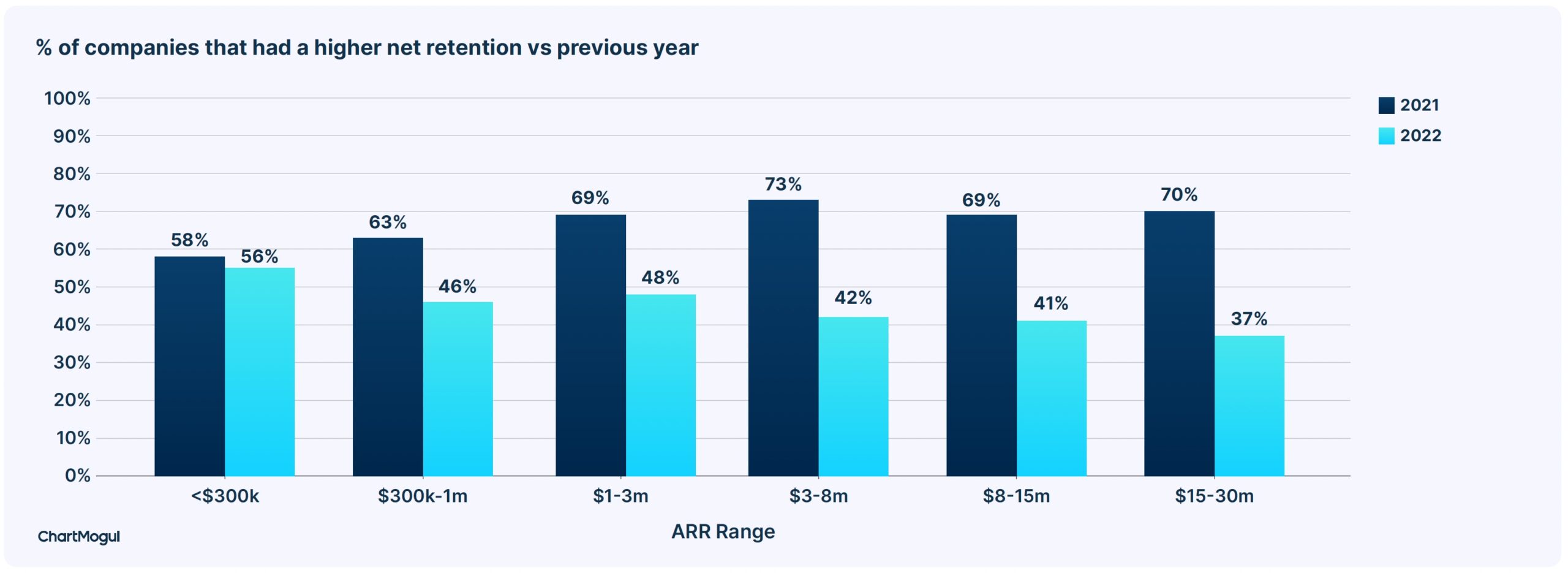

Retention in 2022 was harder than ever

2022 was a challenging year for most SaaS businesses. A tough macroeconomic environment meant customers reassessed and cut their SaaS spend. More than half of SaaS businesses saw lower retention rates in 2022. This is in sharp contrast to 2021 which saw almost 70% of businesses having a higher retention rate in 2021 when compared to previous year.

Read the ChartMogul SaaS Benchmarks Report

These insights only scratch the surface – there’s a lot more data and charts for you to explore! We share all our learnings and benchmarks in the full report.

- What is a good growth rate in 2023?

- What is a good retention rate?

- What is a good churn rate?

- Do companies with higher ARPA grow faster?

- What percentage of businesses have net retention over 100%?

- Expansion: is it key to growth?

- Do B2B businesses have a higher retention rate vs B2C?