In 2015, Social+Capital VC Mamoon Hamid unveiled SaaS Quick Ratio at the SaaStr Convention. Since then it’s been a hot topic, emerging as part of investors’ standard fundraising asks.

So, we’ve put together everything you need to know about the metric, how (and when!) it’s helpful to a SaaS business, and other things to consider when using SaaS Quick Ratio:

- What is SaaS Quick Ratio?

- How to calculate SaaS Quick Ratio

- What does SaaS Quick Ratio show?

- SaaS Quick Ratio examples

- Low, average, and high Quick Ratios

- What’s a good SaaS Quick Ratio?

- How can you use Quick Ratio?

- Final Word

- Quick Ratio: Dive deeper

What is SaaS Quick Ratio?

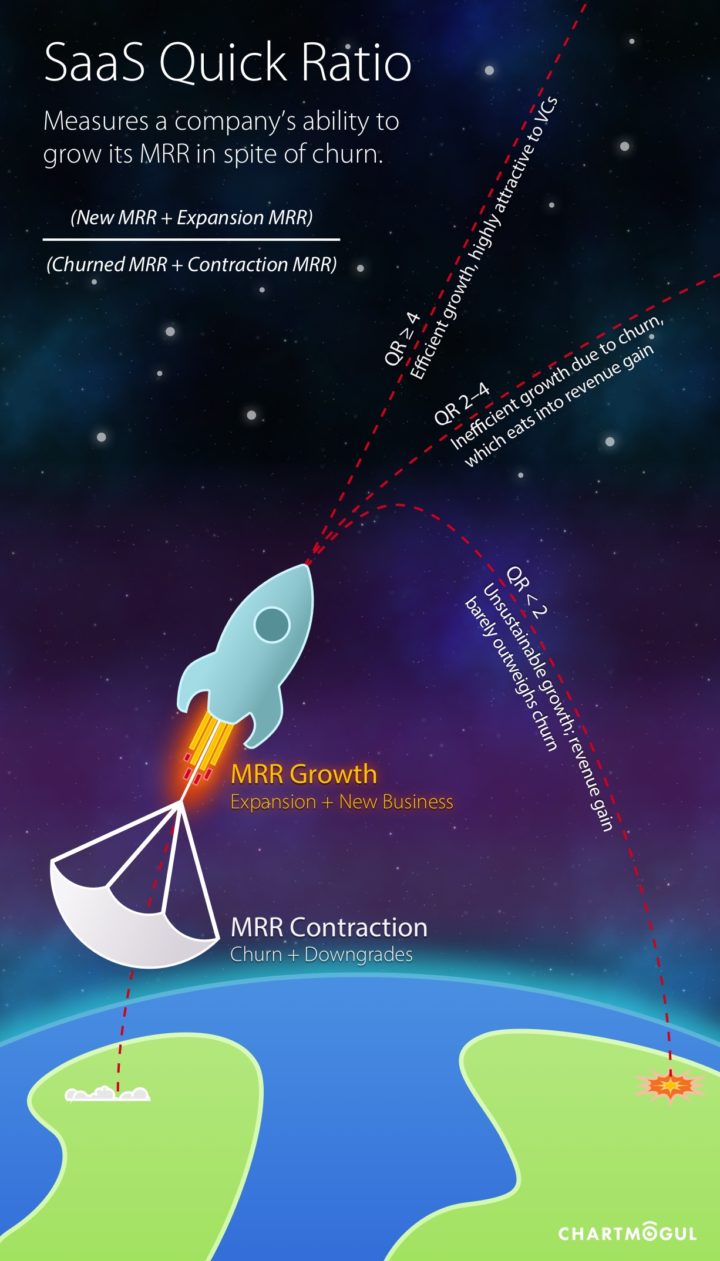

A SaaS company’s Quick Ratio measures its ability to grow recurring revenue in spite of churn.

The metric pits your gains against your losses, new business and upsells versus cancellations and downgrades.

Quite simply: what is the ratio of the money coming in to the money going out? The higher the ratio, the more efficient the growth.

Let’s take a look at how to calculate the ratio.

How to calculate SaaS Quick Ratio

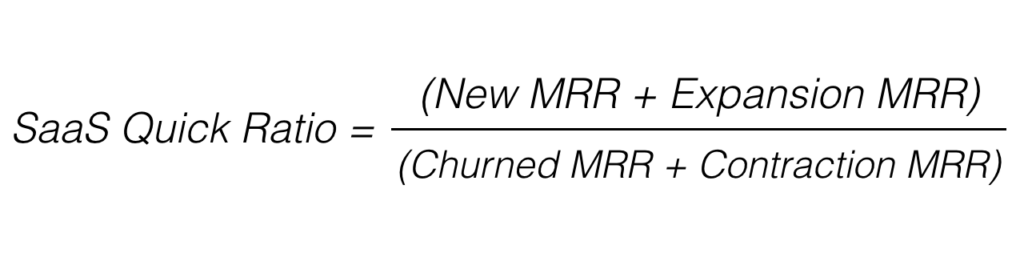

To find SaaS Quick Ratio, divide added MRR by lost MRR. New and expansion MRR / churned and contraction MRR.

In order to calculate your SaaS Quick Ratio you need some revenue metrics at hand:

- New MRR– Monthly recurring revenue from new customers

- Expansion MRR– Monthly recurring revenue from existing customer upgrades

- Contraction MRR– Lost monthly recurring revenue from existing customer downgrades

- Churned MRR– Lost monthly recurring revenue from customer cancelations

*Note: Depending on your business model you can substitute MRR for ARR.

Need to brush up on other SaaS Metrics mentioned here? You can find them all in The Ultimate SaaS Metrics Cheat Sheet.

What does SaaS Quick Ratio show?

The SaaS Quick Ratio looks at the bright and shiny side of your business and the underbelly at the same time (probably why investors like it so much).

Sustainable growth

As Tomasz Tunguz (Redpoint) put it, “The quick ratio measures a SaaS company’s growth efficiency.” It’s less about how much you’re growing. It’s more about how good you are at it, and if you can scale that revenue growth rate over time.

Can you bring in new business and keep the old?

It’s no secret that maintaining low churn is key to the success of a SaaS business. It’s key to a strong SaaS Quick Ratio as well.

On their own, forward-looking metrics like MRR and customer acquisition all suggest promising growth. But upon deeper investigation, those metrics aren’t able to mask a revenue-draining high MRR churn rate.

As a result, a low SaaS Quick Ratio exposes the unhealthy side of even the most impressive MRR growth.

SaaS Quick Ratio examples

To better illustrate what Quick Ratio shows us, let’s take a look at three hypothetical companies. It’s important to note that on paper they have identical Net MRRs ($8000). Keep in mind the formula above as we move forward.

- Company 1- $10,000 (New MRR + Expansion MRR) / $2,000(Churned MRR + Contraction MRR)

- Quick Ratio = 5

- Company 2- $16,000 / $8,000

- Quick Ratio = 2

Both companies have equal Net MRRs ($8K). Company 2, boasting $6K additional new business, might even appear to be the healthier business at first glance.

Quick Ratio is a favorite among investors because it reveals that Company A is in a much better position to scale and reach revenue milestones with less effort than Company 2.

In the most broken down form: Company 1 makes $5 for every 1$ lost while Company 2 only makes $2 in the same situation.

Low, average, and high Quick Ratios

- Low quick ratio (less than 2): New revenue is not driving the business forward. Rather, it’s merely replenishing the revenue lost through cancellation and contraction. Over time, more and more effort must be poured into New + Expansion MRR just to compensate for churn. Something, be it the product or customer success efforts, needs tuning before investors will commit.

- Average Quick Ratio (2-4): Churned and contraction MRR are eating into the new business and expansion revenue. The company is growing but it’s unclear if the growth is sustainable or scalable. Steps need to be taken to either reduce churn and contraction or greatly increase new business to achieve a higher Quick Ratio.

- High Quick Ratio (4 or more): Growth rate is both high and stable. The product is successful, the customers are happy, and there is a good framework in place for the business to scale efficiently. Revenue will continue growing at an attractive, predictable rate. Ding, ding, ding!

What’s a good SaaS Quick Ratio?

Isn’t that the question? There’s an emerging debate around Quick Ratio benchmarks.

Hamid says that a SaaS Quick Ratio of 4 indicates a healthy-enough growth rate for him to invest. This would mean you’re adding revenue 4x faster than you’re losing it. Sounds great, right?

But Tomasz Tunguz raises a very valid flag when it comes to the 4 score.

He found that, with a Quick Ratio of 4, companies can still sustain monthly churn rates of 5.0% or higher. And, to quote ourselves, “Anything over 3-5% should be sending warning signals.”

For some businesses, a Quick Ratio of 4 isn’t high enough to overcome issues with churn.

So, Quick Ratio is relative and evolves throughout a company’s lifetime.

Quick ratio changes with the company

InsightSquared, in their study around benchmarking Quick Ratio, points out that “Achieving a SaaS Quick Ratio of 4 is a good benchmark for young, high-growth companies but the equation changes as those companies reach scale.”

The growth characteristics of an established, fully-scaled company will be different than an early-stage startup. As the chart below illustrates. Therefore the SaaS Quick Ratio target, and the strategy toward it, will differ as well.

In reality, you’ll need to find the right target for your company. What’s certain is that no matter your Quick Ratio score — you should always keep an eye on churn.

How can you use Quick Ratio?

Here are some ways you can use Quick Ratio:

Tracking

VCs absolutely ask about your Quick Ratio. You can make sure you’re in the best possible position by the time they come knocking.

- Take note of accounts that are on contract, as they may skew the calculation!

- For companies in the first year of business, SaaS Quick Ratio isn’t so helpful. With young customers and customers still in a commitment period, the ratio isn’t a reliable indicator of anything. Focus your attention on individual metrics instead.

Insights

Tweak your analysis to discover new ways to improve.

- Segment the metric into different business elements (such as payment plan or business vertical) to identify any weaknesses in specific parts of your business. Tightening up there will boost your score.

- Examine the metric for specific time periods. Though the formula is defined across a monthly period, analyzing quarterly or yearly periods could yield different results and prompt further investigation.

Final Word

Investors are looking at SaaS Quick Ratio to spot a profitable next move in the SaaS world.

The currently accepted Quick Ratio benchmark is 4, but you need to evaluate what makes sense for your business. If you don’t feel confident with your SaaS Quick Ratio performance, identify what’s bringing it down.

Let Expansion MRR actually drive your growth forward, not just replenish losses. Put that hard-earned new revenue to effective use by lowering churn, which will amplify your Quick Ratio score and deliver an impressive number to VCs.

SaaS Quick Ratio FAQs

You might have heard of Quick Ratio before. Traditionally, “Quick Ratio” is a finance metric that gauges a company’s liquidity, or a company’s ability to pay off all current liabilities ASAP (aka the “Acid Test Ratio“). SaaS Quick Ratio is different.

Acid Test Ratio and SaaS Quick Ratio share something: they both give investors a snapshot of how promising — or risky — an investment may be. Let’s see how this new metric works for SaaS, specifically.

Quick Ratio: Dive deeper

If you’d like to read more about SaaS Quick Ratio, the surrounding discussion, and the concepts involved, check out these other resources:

Mamoon Hamid’s SlideShare introducing the metric

Tom Tunguz on what Quick Ratio is hiding

Christoph Janz on aiming for negative MRR churn

InsightSquared on benchmarking SaaS Quick Ratio