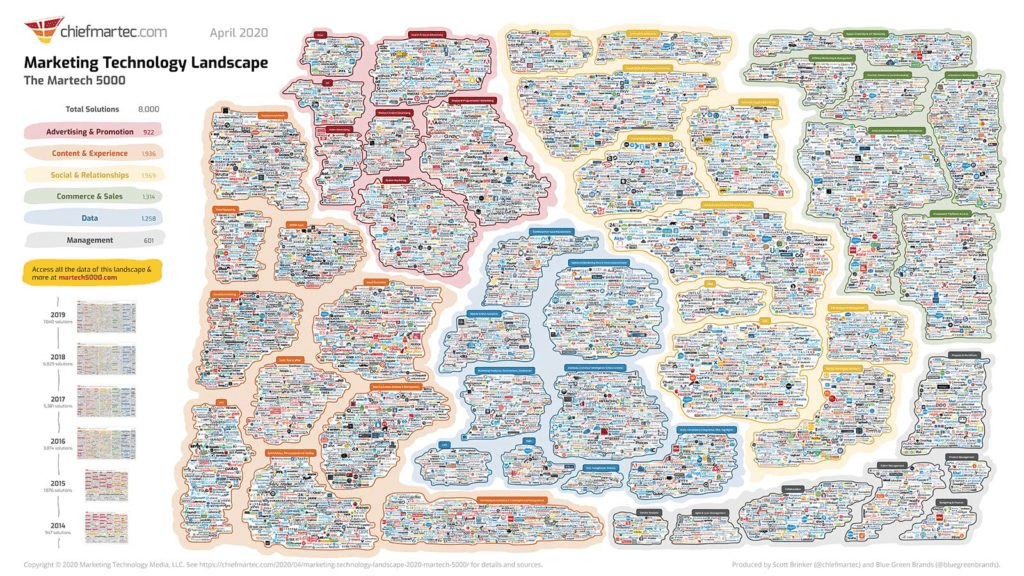

A glance at The Martech Landscape graphic is enough to understand how competitive SaaS has become:

(It’s the Martech 8000 in its latest edition.)

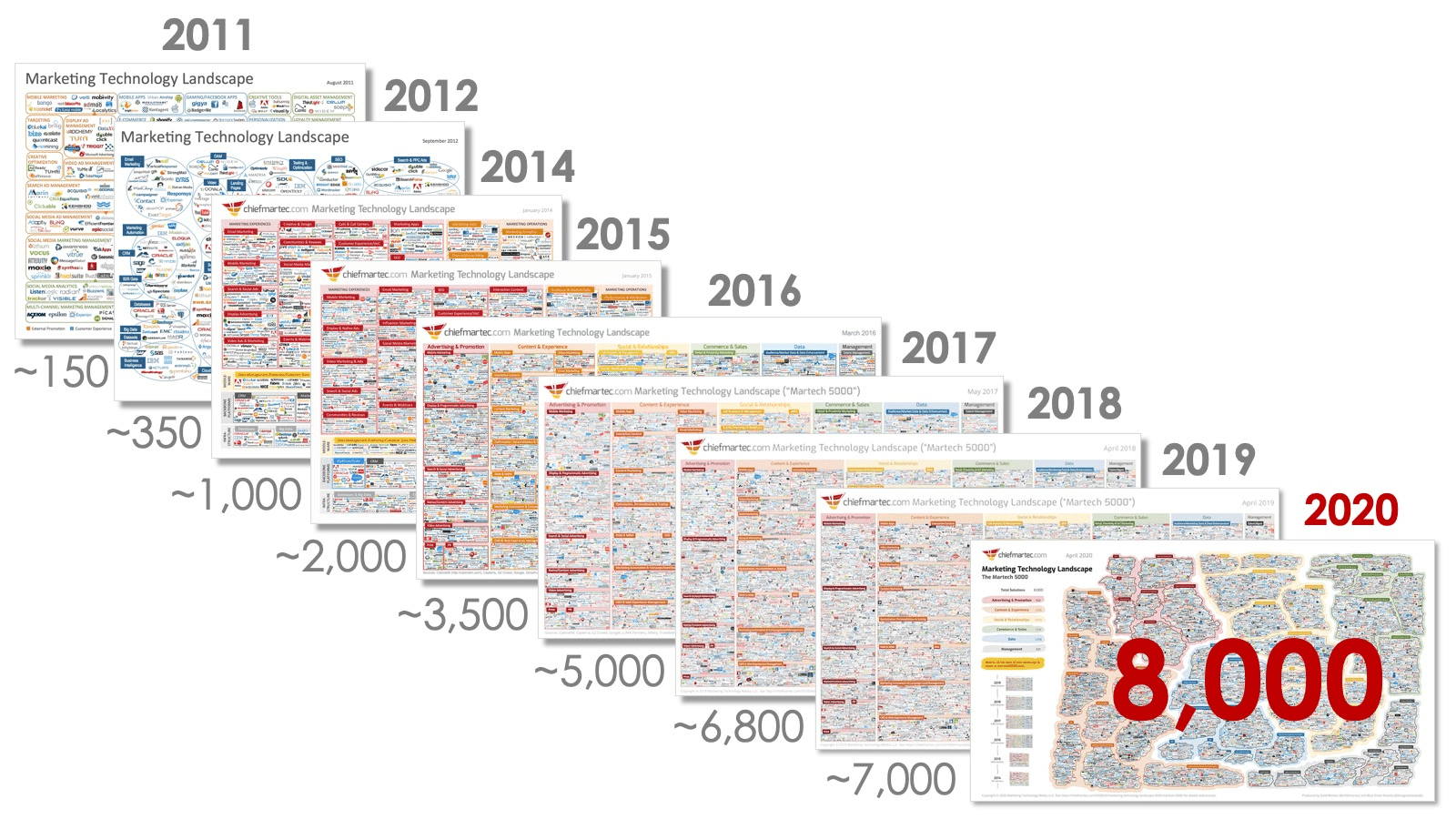

But if we look at how that diagram has evolved over the past 10 years, we’ll see that it’s grown from ~150 companies to today’s staggering number:

At every step, the prevailing opinion has been that the industry has become too competitive. That it’s too hard, impossible even, to break into anymore — without some killer new technology or similarly significant advantage.

Yet, every year we’ve seen new companies emerge and carve out a place for themselves without having to rely on a buzzword technology like AI or Blockchain.

These companies typically achieve breakthrough success by relying on one of the following approaches:

- They pick a niche that’s currently underserved by a large incumbent and provide a better solution to the problem this niche audience is facing;

- They create a new category (or redefine an existing one) and capture a broad audience.

Both approaches can support the creation of a successful SaaS business. We see it in the comparison between Intercom ($150m in ARR) and Drift (valued at $360m at their latest funding round):

- Intercom (founded in 2011) was one of the first companies to offer live on-site chat going after a broad audience of companies and teams.

- Drift started 4 years later with a similar product offer but focussed intensely on marketing teams as their (initial) core audience.

So how do new SaaS companies choose which route to pursue?

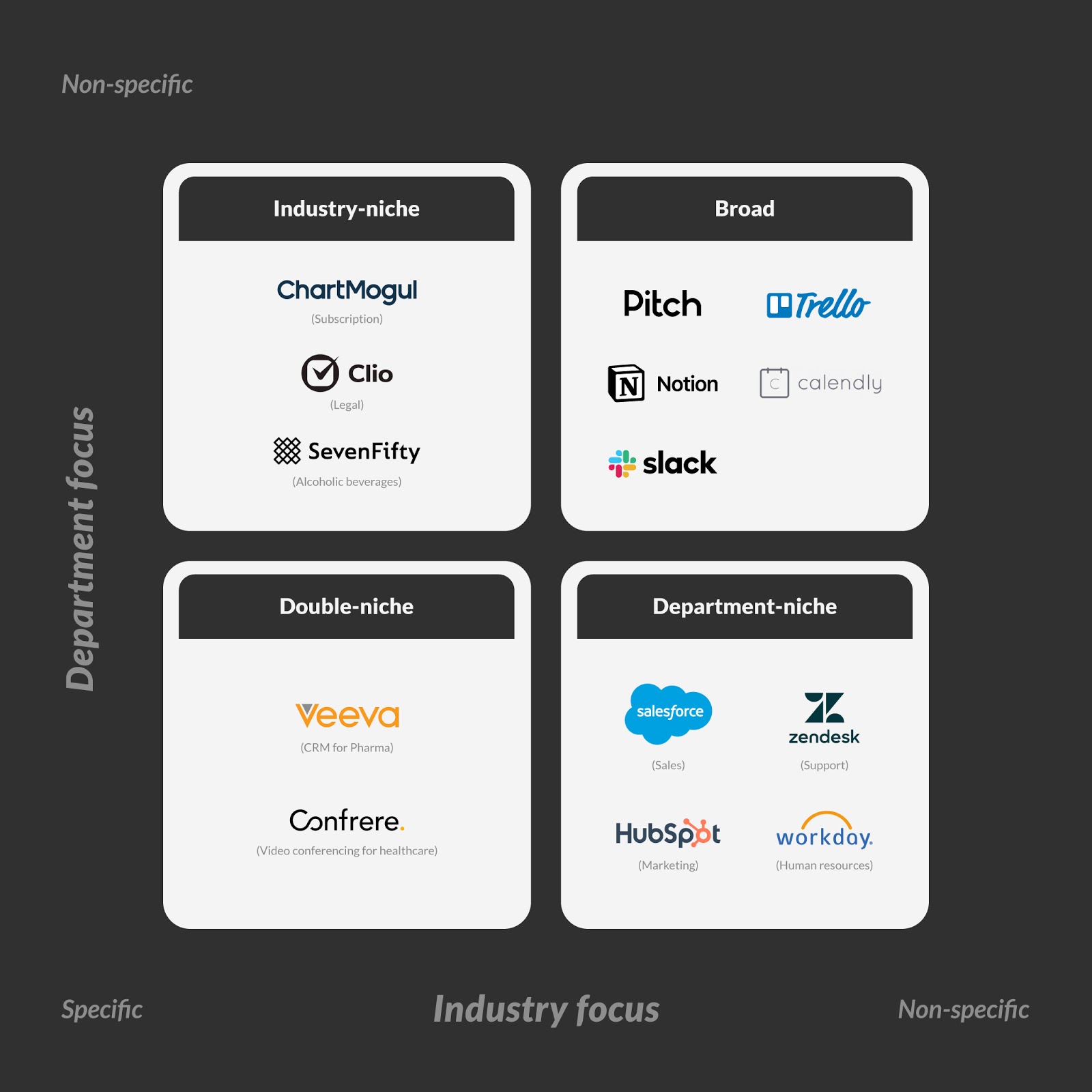

They have to decide whether to go for a niche or broad audience along 2 vectors — industry and department. At ChartMogul, we think about this as a 2×2 matrix, which we call the SaaS Types Matrix.

Introducing the SaaS Types Matrix

SaaS companies start with a solution to a problem. One of the first decisions a founding team needs to make is whether their solution is aimed only at a particular industry and/or department.

This gives us 4 possible categories or types of SaaS companies:

- Super-niche: Those that go after a specific team/department within a particular industry. An example of this would be Veeva, which produces CRM software for the pharma industry.

- Industry-niche: The second example covers companies building software that every department in a specific industry can use. We put ChartMogul in this category (for Subscriptions), but another great example is Clio, which goes after lawyers and everyone who works in the Legal industry.

- Department-niche: The next category captures companies that go after a specific team/department(s), regardless of the industry they operate in. Companies like Salesforce (sales) and Zendesk (support) demonstrate the market opportunity such niches generate.

- Broad: Finally, we have companies that have neither industry nor departmental focus. Here, we find the biggest names in SaaS and some of the fastest-growing companies — such as Slack, Notion, Pitch, and Calendly.

Why is this helpful?

Knowing where you stand within this matrix is essential when working on a new SaaS product. Picking the most appropriate type of SaaS to build will help you figure out a range of important product and strategy decisions:

- Who are your early customers, and where do you find them?

- How can you expect to grow once you exhaust that initial opportunity/group of people? By expanding into other verticals or other teams (or both)?

- How important is it to build your product for product-led growth? This is especially relevant to companies that rely on winning large enterprises team by team.

Finding the right place on this matrix can help create a clear product vision, an essential first step to finding success in SaaS.

How to figure out your position on the matrix

Finding the exact place along the matrix that will allow you to capture a competitive position takes equal parts art and science.

Here are some things you should explore to decide what type of SaaS business you should aim to build.

Understand where the market currently stands

We’ll go back to Drift because their growth provides a useful example for SaaS founders. They weren’t the first company to offer an on-site asynchronous messaging/bot functionality — Intercom was already growing very fast in that space.

By redefining the category and targeting their product specifically at marketers, Drift established themselves as a viable competitor.

Drift’s example should help you understand why you need to think about the quadrant where you want to be.

It would be hard to capture market share with a generic support solution because Zendesk is already dominant in that category.

But you might be able to find space by narrowing down and focusing on a single niche/team (or both). This is a strategy pursued by Kayako with their focus on ecommerce/DTC brands.

It’s easy to say you need to identify opportunities like this, but much harder to spot them.

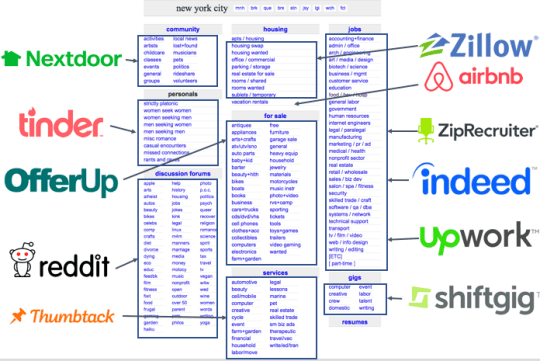

One way to do this is by looking for opportunities to unbundle existing platforms.

Going after a specific niche (or team) allows you to create a product that fulfills the needs in that niche in a much better way.

Tweet this quote

The result is that you can build a business that’s bigger even than the whole original platform.

We see this with companies like Airbnb, which is at least double the size of Craigslist (estimated at a little over $1B in 2018 revenue) even after it got decimated by the pandemic.

Nail down your positioning

The positioning of new products is one of the most overlooked areas in SaaS. There’s hardly a territory where you have a combination between so much control and such an opportunity for impact early in your company’s lifetime.

It is also strongly related to the point in the previous section — defining the market in a way that would allow you to create an opportunity for yourself.

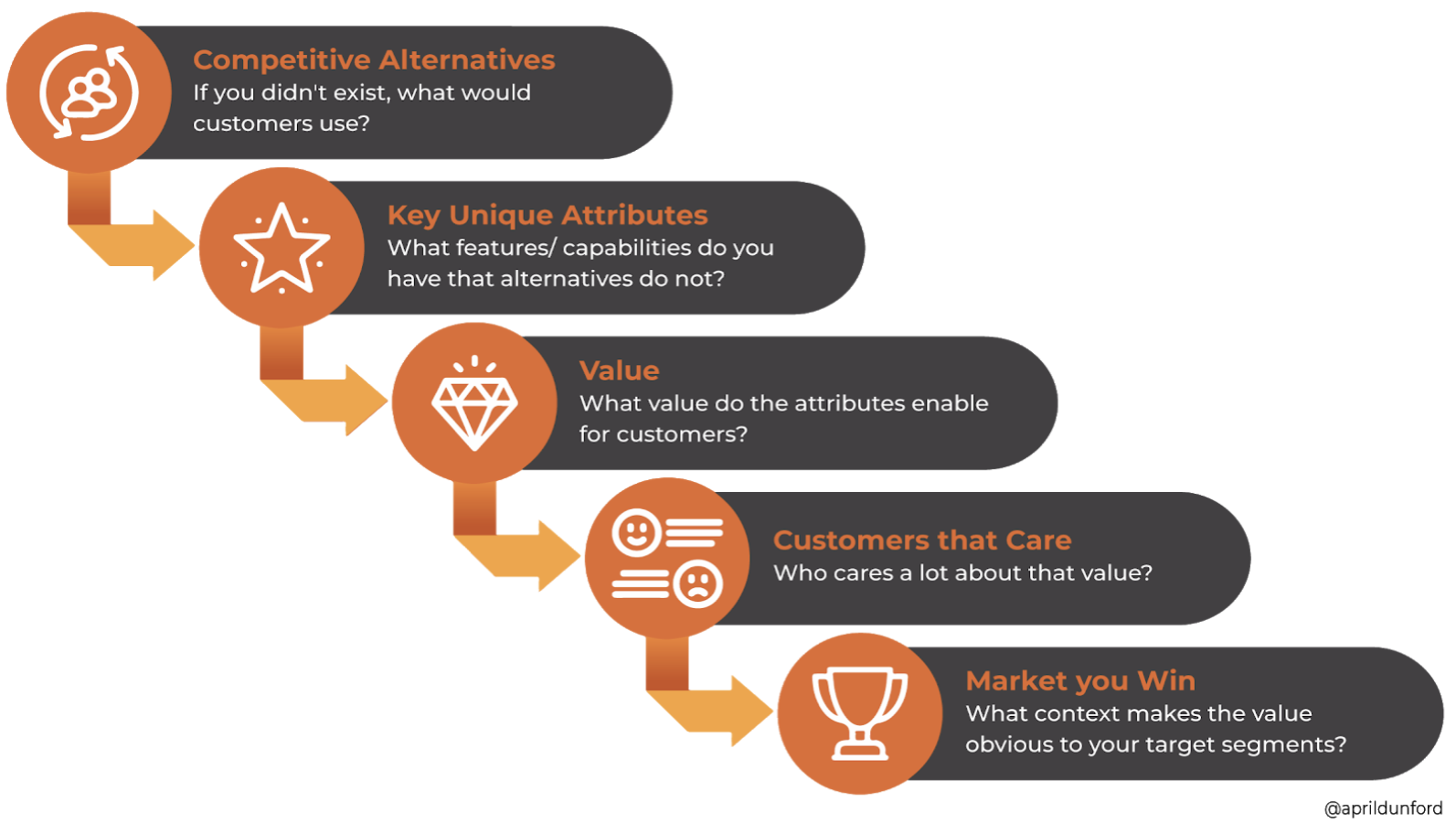

I highly recommend April Dunford’s excellent book on the topic as a starting point. (We recently shared an overview in The SaaS Roundup newsletter.)

In any case, the most important takeaway from this is that you should craft a positioning that’s concurrent with the place you’ve chosen on our framework. That would maximize your chances for success.

Make data your ally

You don’t have to make decisions out of thin air when figuring out your niche and positioning. Data can help you make better decisions about these strategic questions even in your company’s early stages.

Tweet this quote

We consistently see the best performing startups rely on data from the very early days of the company.

Even basic metrics can help you navigate these decisions better, for example:

- Metrics like Average Revenue per Account/User (ARPU) and Annual Contract Value (ACV) will tell you what part of the market you should be aiming for.

- Your Churn Rate can guide your search for product/market fit when you’re developing a new category.

And this is just scratching the surface with what you can do with data.

Does it even matter how many types of SaaS there are?

On the surface, we can easily reject the need to deal with this question at all.

Defining where you fall on the types-of-SaaS spectrum might seem like a matter of cosmetic importance.

However, as I’ve tried to outline in this article, it’s a question, which carries essential strategic considerations for your business.