Drive B2B SaaS Growth

Expert advice, data-backed reports, and proven strategies to grow your business.

Subscribe to The SaaS Roundup

Explore ChartMogul Resources

Filter by type

-

How to Raise in a Bear Market

-

How SaaS Pricing is Evolving

-

Being “Product-Led” in 2023 Means Product-Led Sales

-

The Complexities of Revenue Attribution

-

Scaling the Sales Tech Stack

-

Calculate your Customer Lifetime Value

-

How to Identify High Quality Free Trials

-

How Growing ARPA Drives Sustainability

-

How Retention Drives Growth in SaaS

-

Mitigating Churn in an Economic Downturn

-

B2B SaaS Retention Trends

-

Gross Retention vs Net Retention

-

Negative Churn aka SaaS Nirvana

-

How to Leverage Expansion and Reactivation

-

The Metrics Investors Want to See

-

What is Revenue-Based Financing?

-

How to Build Board Confidence

-

B2B SaaS Growth Trends in 2023

-

How to Prepare your Startup for Acquisition

-

To Bootstrap or be VC Backed

-

How to Leverage Data in Product Development

-

How to Optimizing your Pricing Model

-

The B2B SaaS Pricing Masterclass

-

Pricing Experiments, Migration and Risk

-

Measuring Go-To-Market Success and Efficiency

-

How Pricing Migration Clarifies your ICP

-

All you need to know about Freemium

-

How to Approach Pricing Localization

-

What we've learnt about growing from $1M to $10M

-

Growing to $30M ARR and Beyond

-

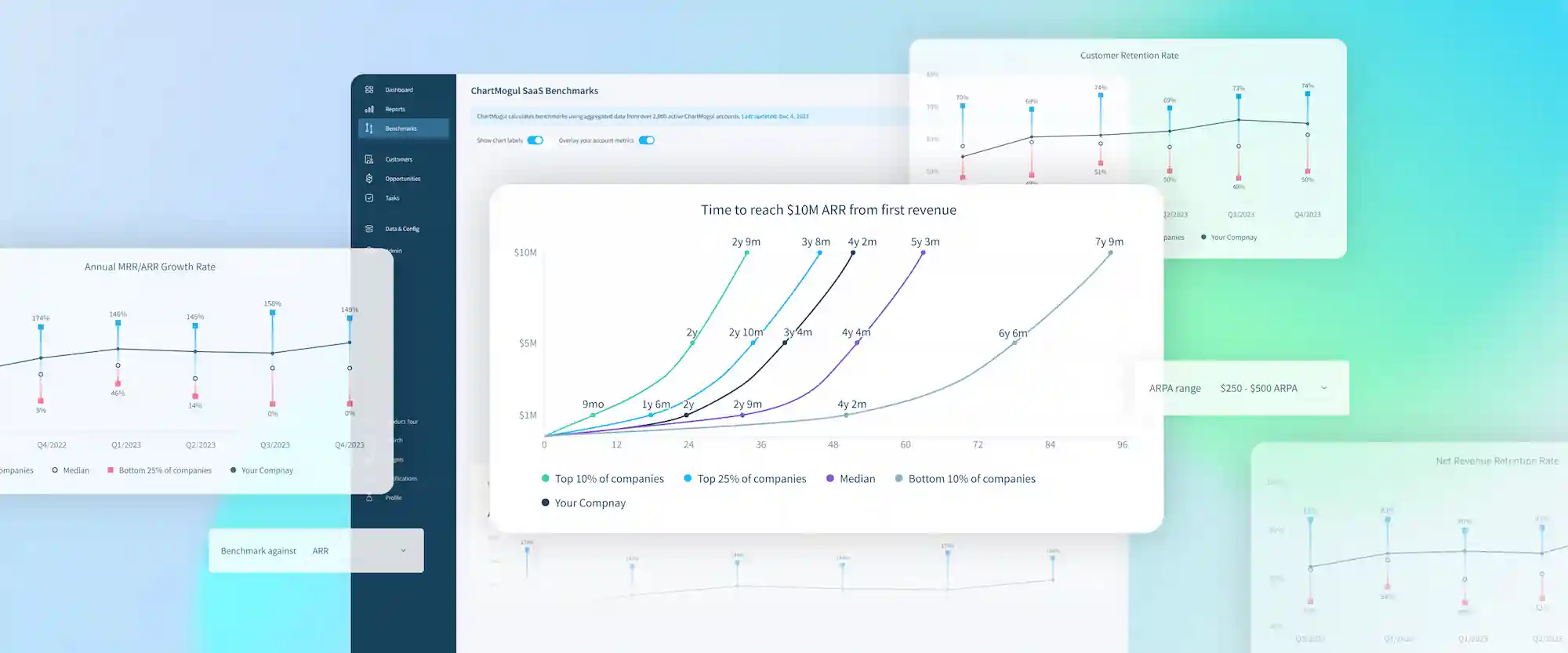

The SaaS Benchmark Report

-

Compare Your Performance to the Market with ChartMogul Benchmarks

-

Databox Now Integrates with ChartMogul for Deeper Analysis

-

Unlocking Revenue Growth with Segmentation

-

Strategies to Reignite SaaS Growth