As more self-service analytics products enter the market, data professionals are choosing to buy vs build more than ever. This is freeing them up to do higher-value work focused on achieving strategic outcomes, while offloading the heavy lifting associated with non-differentiated parts of their business models to self-service products.

Early-stage startups were previously at a big disadvantage, their scarce analyst/data resources were typically consumed generating fairly standard reports, leaving less time to focus on extracting valuable insights that could be used to help optimize their businesses and gain a competitive advantage.

Well-funded companies can afford the luxury of a larger data function. But a considerable portion of that investment still goes towards just moving data around, cleaning it, deciding what to measure, how to measure it, and finally generating reports. That time could be better invested in more creative or exploratory data science.

I asked myself “If we were starting today, what would we put in place?” [We saw] many new startups were adopting the likes of Segment, Mixpanel, and ChartMogul from the get-go.

— Joel Gascoigne, Buffer

Previously, self-service, opinionated analytics products could only get you so far, you would hit up against their limitations before too long. Players like Google Analytics and CrazyEgg forged the way but were no replacement for what was possible with a custom build.

Fast forward to 2020 and things have changed dramatically. Power players like Mixpanel have built out sophisticated, opinionated analytics products. These products have their own domain-scoped data platforms and enough power and flexibility to service the majority of requirements of startups and SMBs out of the box, while having the data integration (input/output) tooling to be complementary parts of a custom data stack once a company is ready to start building that out.

A New Breed of Domain-Specific Data Platforms

Self-service analytics tools have built data platforms specializing in a specific data-domain (user behavior events, billing history, etc), which gives them the power and flexibility to service the full set of requirements of startups and SMBs out of the box. At the same time, they now feature advanced data integration tools that allow them to be a complementary part of a custom data stack if a company needs it.

More and more startups are realizing it’s better to buy rather than build. Unless teams have a strong need to do truly exploratory data work, they can delay building out a custom data stack until much later on.

Even then, the tooling of this new breed of power players allows data teams to continue using self-service analytics products as “sources of truth” for their respective domains and pipe the domain-specific data into a data warehouse for combining with other datasets and doing exploratory analysis not possible within the self-service system. In other words, these self-service analytics products eventually end up becoming part of the data ingestion and processing layer.

Using a subscription data platform allows us to focus our resources in the areas that drive the most impact. With these changes, SevenFifty has improved visibility into how the business operates and what drives its success.

— Jonathan Tartell, SevenFifty

In these scenarios, the user-interfaces of these SaaS products typically continue to get used for fulfilling 90%+ of reporting and analysis requirements in their respective domains, as the ease and accessibility mean that non-technical users across the organization can have day-to-day access.

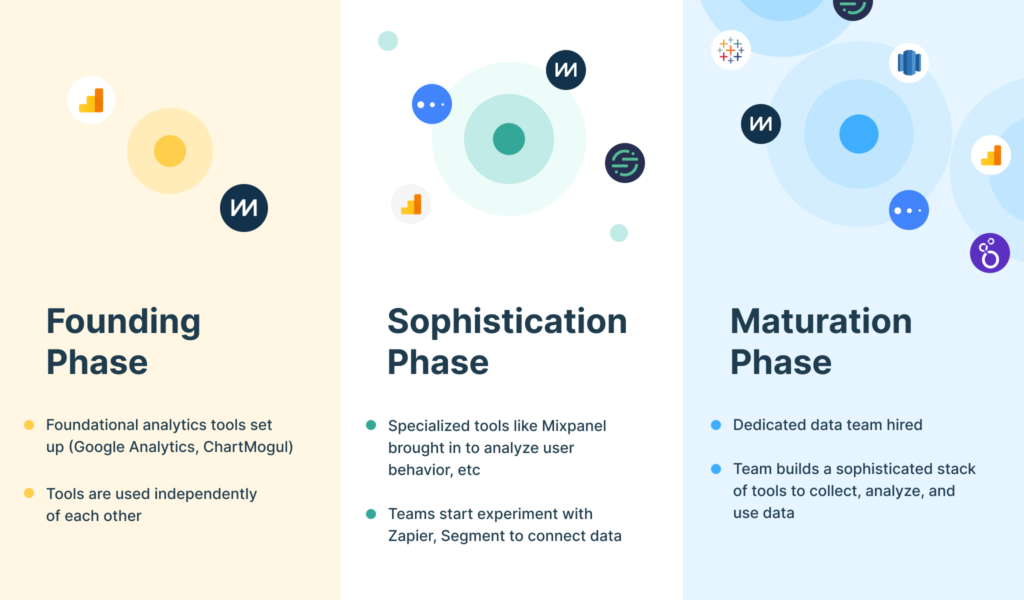

The Three Phases of Data Evolution

At ChartMogul, we talk to a lot of startups every day, and we’re typically seeing them go through these three phases of evolution when it comes to working with their data.

- Founding phase: Founders set up Google Analytics and ChartMogul to track user and revenue data respectively.

- SaaS sophistication: At this point, the companies are at $2m-$5M in ARR and have also deployed a solution like Mixpanel, Pendo or Amplitude to understand user behavior. At this phase, companies experience a need to unify user, customer and revenue data. As a result, they start to tie their various SaaS systems (Mixpanel, ChartMogul etc.) together using products like Segment or Zapier.

- Data team maturation: Once a startup needs to do more sophisticated data science, they begin the process of building a dedicated data function. This team will consist of data engineers, data scientists, analysts, etc. The “data team” will need to deploy the tools to allow them to manage and analyze large data sets – the most common setups we are seeing are a combination of Looker or Tableau for visualization and querying, Amazon Redshift for data warehousing, and Segment for integration. Data teams at these companies continue to use best-in-breed, domain-specific SaaS platforms like Mixpanel and ChartMogul as integral parts of their larger data stack.

“ChartMogul has enabled our BI team to focus effort elsewhere instead of replicating what you do.”

Cliff des Ligneris, Senior Product Manager at Doodle

It’s an exciting time for startups looking to harness the value of their data. The number of available SaaS tools in the market is growing almost exponentially — and thanks to the rise of this new breed of domain-specific data platforms — data professionals can focus more of their efforts on initiatives that deliver true business value, versus time that was previously spent reinventing the wheel.