Amongst everything else on your ever-growing to-do list, sending investor updates is a key part of your job as a CEO.

This can sound daunting and almost frustrating, especially knowing you have to send them often, but they’re a great tool for reflecting on the past month. They keep you on track, provide an opportunity to ask for advice, and allow potential bottlenecks to be identified before it’s too late.

Sending monthly details about your progress will keep your name and the company at the top of your investor’s mind.

It doesn’t have to be overwhelming, either. Follow along to learn how to make investor updates that include all of the details you should include—your investors will thank you for it!

In this article

- What is an investor update?

- Why you need to create an investor update.

- How often should you send your investor an update?

- What should you include in your investor update?

- Investor update template for SaaS business

- Top tips for writing an investor update

What is an investor update?

An investor update is a monthly or quarterly document that details team updates, operational progress, core metrics, recent wins and losses, product roadmap prioritization, and a snapshot of the finances.

This is created by the startup and provided to investors to ensure insights are given regularly and often, maintaining open communication at every step of the building journey.

Some people like to put this together in a slide deck, whereas others share it through a simple email format.

Why you need to create an investor update

Not only does an investor update provide a guaranteed moment of communication between the necessary people, but it can be a great tool for measuring progress as a startup too.

It shows where headway has been made and which areas of the business may need improvement or some prioritization for the month ahead. With the updates typically coming at an agreed time, these reports provide clarification and ensure everyone is up to date with the finer details of the business.

Keeps everyone in the loop

A lack of communication could lead to investors feeling disconnected, which could result in them contacting you regularly for updates. When you have multiple people to report to and involve, this can be incredibly time-consuming and disruptive to your day-to-day life.

With an investor report, people know when they will receive information from you. This helps them stay involved and shows you’re in control, too.

Allows investors to see how they can help.

There may be areas that need re-jigging or updating, especially if strategies aren’t working as you had hoped.

While sharing this with investors can be nerve-racking, it does give them an opportunity to speak out if they notice something they can help with. Their tailored advice could change the business trajectory and help departments get back on track.

Holds the business accountable.

“While the act of sending updates is itself valuable, the quality of the update is critical. Writing a good update forces a founder to focus on the right things and keeps your investors engaged and helping,” writes Aaron Harris for Y Combinator.

Nobody likes to see red lines or numbers on an update report, but it could give you the insights you need to make necessary changes when something occurs.

Rather than providing ad hoc updates every six months or so, investor reports help identify bottlenecks and challenges as they appear.

How often should you send your investor an update?

Now, there’s technically no right or wrong answer for how to make investor updates and how often they should be sent. However, it’s advised to do these on a monthly basis.

Even if the last few weeks don’t show the performance, you’d quite like, always show the data, and remember these will tell a story over time rather than being a one-shot report.

The worst thing would be for your investor to forget about your company or become less interested due to a lack of engagement. When passion for your business is high, the emotional checking out by investors can seem impossible, but it does happen.

The founder of SaaStr, Jason Lemkin, shares how engaging in regular communication (instead of going quiet) can make all the difference when it comes to the founder and investor relationship: “When startups struggle, VCs get it. They are looking for founders (1) that are still truly giving it 110% and (2) that have a genuine plan to get back to real growth.”

What should you include in your investor update?

An investor update doesn’t have to be extensive, but it should include all of the information the internal stakeholders need to stay in the know.

Here are the 16 things you might want to include in your investor update.

Overview

On the first slide of your investor update, you should include a summary of the startup.

Remember that some investors work with other startups, so including a very brief refresher is a good way to start the document. This should include the time frame you’re informing on, who prepared the update, and a message about the period of the update.

Product and market updates

Next, consider any product or market changes that have taken place since the last update. This will likely be dependent on your offering and how quickly the industry around it is changing.

Have some key shifts taken place that the investor may not be aware of? Include this within the section.

Team and company culture updates

This is the chance to introduce new team members and describe them, their roles, and the experience they’re bringing to the company.

Going beyond the team, sharing some key milestones and big wins from the last few weeks would be positive. This should include a description of the accomplishments, what was achieved as a team, and the people that should be acknowledged.

Roadmap

We all know that startups aren’t linear, but providing a roadmap overview helps everyone see where the business is at and what the next steps are.

Identified issues

It’s not a good idea to hide any issues that have arisen over the last few weeks. Instead, you should share these with the investors to see what guidance or advice they may have.

You should include a description of the issue, the thought process on how to fix or prevent it from occurring again, and even ask for support if needed.

Growth channels

Identifying where your customers are coming from can help decide future marketing strategies and efforts, with this being of interest to current investors.

In this section, include the growth channels that you’re seeing work best with your audience and how this plays into your business growth strategy.

Metrics to include in your SaaS investor update

Metrics are the most vital part of an investor update as they give an immediate snapshot of the finances and where the startup is at. The items that are included will, however, depend on the investor’s requests and the business.

You may not need to include all of these aspects, but here are the most commonly included metrics to keep in mind when you’re seeking guidance on how to make investor updates.

Basic – Month-over-Month growth

We spoke with Slidebean’s CEO, Caya, who shared his expertise on how to make an investor update and what metrics should be included.

“For most industries, investors will want to see double-digit percentage growth during the first stages, in many cases ranging between 15-25%. Showing both the chart and the number also confirms whether this growth has been constant or if it’s speeding up or slowing down.”

Annual Run Rate (ARR)

The Annual Run Rate helps you project your company’s future financial performance.

It’s a really helpful tool for investors to see the potential for long-term growth and to gain a clearer understanding of the business’s size.

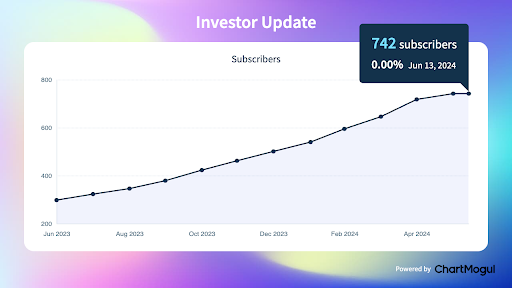

Number of customers

While it’s the most basic metric, showing a graphic detailing the number of customers and how this has changed over time is incredibly effective for showing customer response and brand awareness.

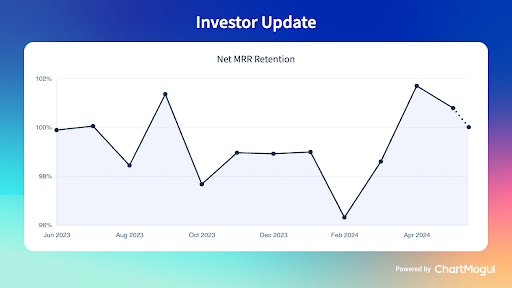

Retention

Some say it’s easier to gain new customers than it is to retain existing ones. Keeping old customers engaged provides some proof that your service is of genuine value to your target audience.

“Net Dollar Retention is a big metric we’re always looking at. I just love the NDR metric and picking it apart to try and figure out where we have market fit and where we don’t, and how our pricing and packaging is coming together,” said FP&A David Fitzgerald.

Basic – Churn Rate

The churn rate details the company’s ability to target the right people and retain them long enough to make a significant profit over the cost of acquiring them.

“Low churn and/or churn trending down is a reflection of a team understanding their users and their business (let’s call this product-market fit) and taking the appropriate actions to increase the LTV of their customers,” said Caya.

Deep Dive – CAC vs LTV

The ‘Cost of Acquisition vs. Lifetime Value’ has long been one of the backbones of SaaS metrics, but this one does sometimes require a little more work than the rest of them.

Caya explains how there are some variables you need to consider or ignore in your CPA, with possible CPA measures including:

- Direct cost of ads

- Direct cost of content promotion or any other

- Cost of retargeting ads

- Cost of the marketing team and the sales team

- Cost of the onboarding/customer success team (if they affect conversions).

“In our case, we have a ‘standard’ CPA which covers elements 1 through 3, and a ‘full’ CPA which includes all of the above.

It is quite standard to aim for LTV > 3x CAC (your lifetime value should be three times your acquisition cost, at least), and you should be able to recover the CAC within the first 12 months.”

Deep Dive – CAC vs growth spend over time

“Proving that you are able to increase your customer acquisition budget while maintaining or lowering your CAC is a scalability test for your product.

Cost of acquisition is bound to increase as you start targeting broader audiences and that is understandable, however, a month over month increase in CAC should be accompanied by an increase in LTV, always being careful about not breaking that 3x ratio.”

Deep Dive – MRR Distribution by plan

Visualizing revenue distribution on an area chart helps investors see the evolution of the MRR distribution over time.

In the case of Slidebean, the CEO writes how this metric “reflects the focus we’ve made on implementing new plans every few months and whether we can scale them to keep growing.”

Deep Dive – Revenue vs CAC by Cohort

“Last but not least, one of my favorite visualizations of SaaS metrics is this Growth Expenses vs Revenue from Cohort report. It reflects how much cash was spent in a given month to acquire customers and how much revenue those users have generated to date,” writes Caya.

“The revenue from a cohort should exceed that month’s spend in no more than 12 months. In the case of Slidebean, we’ve been able to expedite this by encouraging users to subscribe to yearly plans instead of monthly.”

Include benchmarks

If you’re unsure how your growth rate compares to the industry standard, it’s always a good practice to benchmark your performance against your peers and competitors.

Without the knowledge of the exact performance of your competitors, benchmarking can be a difficult task. To make benchmarking performance in SaaS possible, ChartMogul released Benchmarks which are calculated using real revenue data from SaaS companies around the world.

Investor update template for SaaS business

Structuring your investor update in the same way each time will speed up the process and bring some consistency to the meetings, too, as everyone will know what comes next and what they should be expecting.

Slidebean has created a customizable template that includes the key details.

Monthly Investor Update – [State the Month and Year]

Introductory Slides

- Brief Executive Summary

- Product and Market updates

- Team and Company Culture updates

Plans and Strategies

- Roadmap

- Identified Issues

- Growth Channels

Metrics

- Annual Run Rate (ARR)

- Benchmarking

- Number of Customers

- Retention

- Month-over-Month Growth

- Churn Rate

- CAC vs LTV

- CAC vs Growth Spend over Time

- MRR Distribution by Plan

- Revenue vs CAC by Cohort

Top tips for writing an investor update

We all know that investors are busy as they usually have multiple startups to assist with, so being exact with your information is vital.

You should keep it concise while including all the necessary details and clearly stating what you need support with.

Decide on what you’re reporting on.

When it comes to communicating with stakeholders in the most effective way, the key aspects have always been true even though the communication channels may have changed over the years.

An article from Y Combinator, published in 2014, explains that the fundamentals shared can still be relied on today.

The first step of any successful investor update is direction. “Figure out what you’re going to report each month – this should probably be your growth (in revenue or users), your cash/burn, what you need from investors, and a qualitative measure of how things are going.

“As your business matures, these metrics may grow and shift, but stay consistent.”

Writing your metrics down for everyone to see can feel incredibly vulnerable, but it should be used as a forcing function to keep those involved accountable.

“Make requests of your investors after you report your key metrics. You could just as easily lead with this,” writes Aaron Harris in his post which is still referred to today.

Tell a story

In our interview with investor Jess Bartos of Salesforce Ventures, she urges founders to use SaaS metrics to tell a great story.

Besides, the art of any great communicator and, arguably, a business owner is to find a connection with the relevant audience. This is often done best through storytelling.

“In the noise of all these numbers, use your numbers to tell a great story.”

Sharing the compelling inner workings of your business in a story format allows investors to be a part of the excitement of any growing startup.

Segment your data when it’s appropriate.

Some investors may have unique ideas on what you should be prioritizing, especially if they tend to work with startups who have a few years under their belt.

As your startup grows, you’ll be focused on fundamentally different things. In the product-market fit stage, you’re likely not going to have piles of information but once you’re focused on scaling, segmenting your data will tell a clearer story.

During an interview from ChartMogul, where we asked a panel of experts how they define impactful investor reporting, Keith Wallington shared his thoughts.

“So be very clear on what you’re optimizing for. Get consensus with your board. What are the key questions we’re trying to answer? And then agree what the lead and lag metrics are around those things. And don’t let them push you to a later stage than you really are.”

If you want to brush up on the SaaS metrics mentioned here, for inclusion in your own investor updates or simply to understand your business, check out the ChartMogul collection of free cheat sheets and resources.