This is our tenth and final outing in the SaaS Metrics Refresher bus. At this point we’ve touched a range of topics pertinent to SaaS businesses — some of them core metrics you’ll find on any investor report, some more loosely defined characteristics or tools you can use to understand your customers.

One of the goals I had when building this ten-step course was to bring together a lot of the knowledge and lessons we’ve churned (sorry) through over the years at ChartMogul. Those of you who’ve been in the industry for some time might be intimately familiar with the subtleties of LTV prediction or the power of deep segmentation, but for anyone starting out today at building or growing a SaaS business, there’s not a clear path through all of those lessons. So that’s what this course has been — a way to connect the many dots of knowledge available

The 8 biggest takeaways from the course

Any good lesson or course ends with a recap — going over what’s been learned is critical for retention, so listen up! Let’s summarise and walk through some of the biggest learnings on each of the topics covered.

Takeaway #1: Recurring revenue

“The advantage of MRR is that because it’s pretty consistent and predictable, it helps your company more accurately forecast. Plus, calculating MRR encourages a growing SaaS provider to focus on achieving the essential short-term objective of building a steady revenue stream.”

Mikayla Middleton, ShipEngine

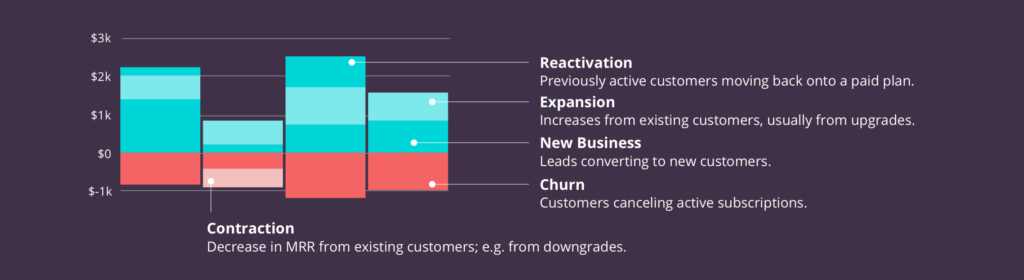

Recurring revenue is the foundation upon which every SaaS business is built. But the biggest takeaway for me is that it almost always helps to break a metric like monthly recurring revenue (MRR) into its component parts — MRR movements. Here’s an MRR movements chart from ChartMogul:

Takeaway #2: Churn

“Companies put people on to a customer when they begin to show signs of leaving. A sensible approach to staying in control, is to engage and help customers find value from the very beginning. Adopt a proactive method towards building a trustful business relationship from the start and at various touch points throughout the customer lifecycle. This presents opportunities to iron out churn indications as they emerge, rather than having to firefight and being reactive.”

Arun Mani, Freshworks

In the SaaS world, one thing is inevitable: Churn. Just as all software has bugs, all SaaS has churn. The biggest lesson for me with churn was classification. Understanding trends in the reason behind customers leaving is often more important than the number itself — especially at the early stages of a business. As a reminder, churn can be:

- Proactive

- Passive

- Happy

- Not really churn at all (read more)

Takeaway #3: Expansion

“Expansion MRR shows if the company can deliver more and more value to customers and monetize that value. Being able to generate expansion MRR is extremely valuable, especially longer term. Most of the best later-stage SaaS companies get a significant portion of their growth from existing customers.”

Christoph Janz, Point Nine Capital

My biggest takeaway when it came to expansion was that it should be woven into the design of your pricing — it doesn’t need to be a product of luck! Take the time to design a pricing model that leads to healthy expansion over time, ideally as your customers grow and see more success with your product.

Takeaway #4: Lifetime value

“For subscription-based businesses who have negative churn (they expand revenue from retained customers at a greater rate than lost revenue from churn), you need new formulae to calculate LTV that includes both this expansion rate and churn.

David Skok, Matrix Partner

Time for a controversial hot take(away): Most people reading this probably shouldn’t worry about estimating LTV accurately. In fact, it’s probably better if they don’t look at LTV at all! I discussed this with David Skok in a recent podcast. David also reiterated the point that early stage SaaS businesses shouldn’t focus on LTV, it’s just not possible to predict accurately with such a small volume of data.

Takeaway #5: Cohorts

“One of the most important tools to better understand the usage of a web application – or a service, a game or a mobile app, it doesn’t matter – is a cohort analysis. In fact, it’s almost impossible to get a really good understanding of a service’s usage without looking at activity and retention numbers on a cohort-by-cohort basis.”

Christoph Janz, Point Nine Capital

Cohorts seem really simple on the surface, but can be surprisingly powerful. My biggest takeaway from this was to use cohorts to get a more nuanced view on retention: Instead of looking at your global retention numbers, look at them on a per-cohort basis. Then instead of the absolute, you can understand the trend.

Takeaway #6: Revenue recognition

“The new revenue standard will significantly affect the revenue recognition practices of most companies. The new standard provides a comprehensive, industry-neutral revenue recognition model intended to increase financial statement comparability across companies and industries.”

PwC

Revenue recognition is a tough nut to crack, and for some, a necessary evil. Whether you like it or not, you need to balance your books. With the introduction of ASC 606, revenue recognition for SaaS changed significantly. But it’s actually a lot more straightforward than it used to be! Start with the 6 guiding principles in the lesson.

Takeaway #7: Data literacy

“Data literacy is built upon data democratization and the user experience. If a platform is difficult, it won’t be used. If a platform doesn’t serve all teams equally well, it will not be adopted across the organization. If a platform isn’t architected to bridge the gap between regular people and the data scientists creating the algorithms, then the era of data-driven anything will fail to materialize.”

H.O. Maycotte, Forbes

After researching for a blog post on data literacy, it dawned on me how much we expect of employees when it comes to interpreting and understanding data nowadays, and how little attention we give to encouraging a good baseline of literacy with data. My takeaway here is that if you really want to be a “data driven” business, you need to start including data literacy as a core competency for every role that works with data.

Takeaway #8: Segmentation

“…is the segment measurable, addressable, stable and consistent? But the most basic is the first. Is there enough data? Segmentation is a powerful tool to be employed by startups once the customer base becomes large enough, which probably means at least a few hundred customers.”

Tomasz Tunguz, Redpoint Ventures

For me, the takeaway here was the gap between an “aspirational” segment and one that fits all of the criteria Tunguz references above — measurable, addressable, stable and consistent. There are many segments that would be incredibly valuable and actionable, but we simply can’t measure them in a reliable way.

Read the full lesson on segmentation

That’s a wrap, folks! Remember you can always go back to any of the lessons above, download the resources and go over the details.

Still haven’t run through the course yet? What are you doing?! Drop your email here and we’ll walk you through the content week by week.