Retention is arguably the most critical metric in SaaS regardless of a company’s stage. We sit down with Daniel Bakh, CEO & Co-founder at Fullview, Parker Moore, Head of Customer Success at Vitally, and Enzo Avigo, CEO & Co-founder at June to discuss recent trends in this key metric.

Sid Jain, Senior Analyst at ChartMogul, our panel moderator is loaded with retention-related insights after analyzing data from over 2,100 SaaS startups to publish the SaaS retention report.

Together, they discuss three main topics:

- Customer retention rate, and why it’s important in B2B SaaS

- Recent SaaS retention trends and what’s happening in the market

- Customer retention strategies

Customer retention rate, and why it’s important in B2B SaaS

When it comes to the value of retention Parker puts it best,

“Retention matters because revenue matters. It’s very difficult to outsell a high churn percent number. It’s like trying to scoop water out of a sinking boat faster than it’s sinking.”

– Parker Moore, Head of Customer Success at Vitally

For early-stage companies, retention is an indicator of product-market fit.

“If you’re an early-stage company your retention is a key sign of your product-market fit. It’s something you should look at as often as you can. In the early days especially.”

– Daniel Bakh, CEO & Co-founder at Fullview

There’s more to gain from tracking retention than just financial insights. It also offers insights from the customer’s perspective.

“If people come back to your product it usually means they are getting value. It’s a very healthy way to look into the value that people derivate from your product.”

– Enzo Avigo, CEO & Co-founder at June

What’s a good cadence and practices for checking SaaS retention data?

There are a lot of different ways to look at your retention data. How you look at the data can help answer specific questions or tell a certain story. Taking a closer look at churn, in cohorts, for example, can pinpoint problem areas and help you strategize next moves.

To get the most from your data it needs to be not only accurate but malleable as well. You want to manipulate data quickly to create different reports that tell different stories. There are multiple types of retention to consider: customer retention, gross revenue retention (GRR), and net revenue retention (NRR). Our panelists most commonly refer to NRR during our conversation.

“I like looking at different cohorts—YTD, last 90, current quarter—they tell different stories. Overlay things like customer segment by NRR, or health score by NRR to actually see if it’s correlated to NRR retainment. There are a lot of ways cut it up, you need to look from different perspectives and choose what’s the most impactful or actionable for your team.”

– Parker Moore, Head of Customer Success at Vitally

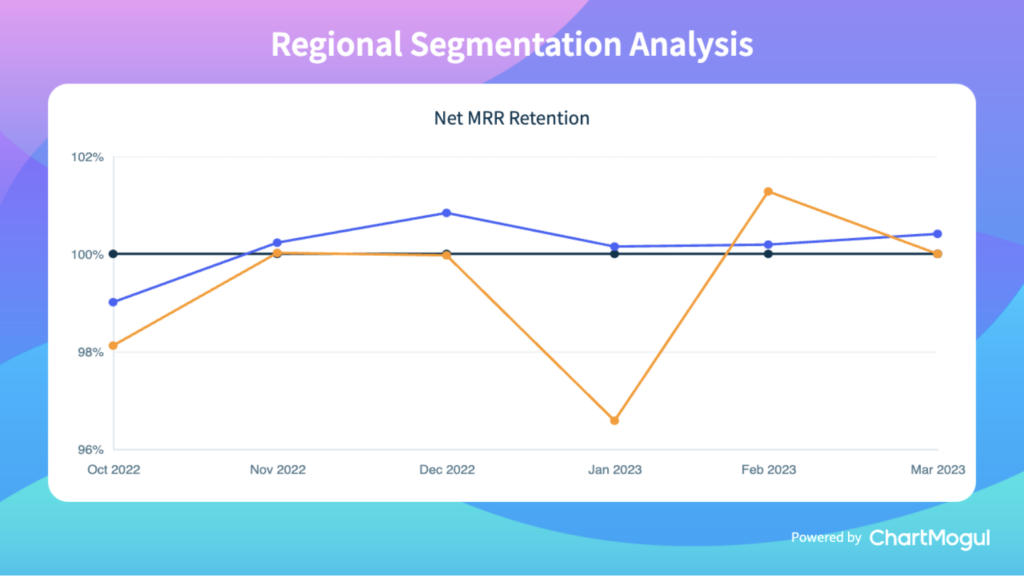

The chart below was generated with ChartMogul Subscription Analytics to show NRR by regional segments. America, Canada, and Western Europe are the selected segments displayed.

Comparing metrics by segments in ChartMogul lets you dive deeper.

Who owns retention in SaaS B2B

Ownership of retention is hard to nail down to one person or team. It’s dynamic and touches many teams and positions. Strategically it makes sense to look at it from many angles and decide which team has the most touchpoints with the angle in hand.

“I really have the feeling that it’s a metric that is owned by many people or at least many people have an impact on. I think of it as a leading metric that is really high level with a lot of metrics that impact it—NPS is one of them.”

– Enzo Avigo, CEO & Co-founder at June

Recent SaaS retention trends and what’s happening in the market

ROI is top of mind for buyers

When adding to their tech stack they care more than ever about how much value a product brings. Tools that don’t directly contribute to revenue or savings are less likely to be adopted.

“There’s a lot more scrutiny around ROI. CFOs are more involved in the buying/renewal process. You clearly need to dictate how a product has delivered business outcomes. B2B SaaS tools have not done a great job of building intuitive ways to capture ROI received from the product.”

– Parker Moore, Head of Customer Success at Vitally

People are consolidating their tech stacks.

Clients may want to take a step back and review their tech stacks for non-crucial products. It’s a situation with a high potential for churn. Year-end reviews are just one case where you might see this.

“The biggest lump in terms of churn was the end of the year when people started to consolidate their stack wanting to cut a lot of expenses. This is where we’ve seen the biggest drop (churn) … quite a few customers have seen the same.”

– Enzo Avigo, CEO & Co-founder at June

Buyers are more cautious

There’s more scrutiny in the market around spending but it’s not always a bad thing. Potential clients who go the extra mile to justify buying a product are usually a good fit. Daniel says there’s a silver lining to the current market conditions.

“You have less noise. You’ll be able to find a stronger product-market fit with the people who buy your product. There will be more signal and less noise versus 2021 and 2020 where people were just buying because they had so much money—which could really muddy the waters when it comes to understanding if you have product-market fit.”

– Daniel Bakh, CEO & Co-founder at Fullview

Customer retention strategies

Go the extra mile to showcase value

Proving value, high touch support, and proactive customer success are the echoing points when it comes to moving the needle on retention. Having a great product is the foundation but you need to go the extra mile and show value to the customer.

“The more that CS teams can partner with product and marketing to ideally get ROI intuitively displayed in the product or at least start to create a consistent narrative that you can equip your champions with around ROI the better.”

– Parker Moore, Head of Customer Success at Vitally

Establish and iterate on your onboarding experience

The onboarding stage is a great time to get on the same page with your customer and establish their definition of success. Once you have that you can craft their user experience so your product enables them to achieve those goals.

“We learned recently that if you can understand the goal people have with your product, their success definition, then you can help them navigate that journey. Something we see a lot of great companies doing is really trying to understand why customers are adopting their tool, what’s goal and success definition and really trying to help them get there.”

– Enzo Avigo, CEO & Co-founder at June

Prioritize product and feature adoption

At Fullview customer success includes ensuring product adoption by the user. Not only do customers get the most from all the features, but it also helps them reach their goals.

“We try to be proactive in helping our customers. They come to us, onboard, and then we’re basically monitoring to make sure everything is going well. We don’t just let them off to do their own thing. We really try to see what is going on in their day-to-day usage of the product.”

– Daniel Bakh, CEO & Co-founder at Fullview

Align on OKRs with the new customer

Parker discusses how at Vitally they align on the desired outcome and set up an OKR framework around those goals. Everything is documented in the product so there’s no ambiguity about what needs to be done. It’s also a nice feature for quickly presenting ROI within the tool.

“In the beginning, we try to align on what outcome you want to achieve. We try to follow the OKR format—what’s the objective, the key result you want to drive, and by what time? Then drive that to completion and that’s the signal to align on the next goal with that customer. When someone in the organization questions the value of the tool we have it documented.”

– Parker Moore, Head of Customer Success at Vitally

Using discounts to increase retention or delay churn in the near term

In any sales cycle the topic of discounts is bound to arise at some point. It’s a tool you can always use as leverage for the unwilling to convert. On this point there is unanimity amongst the panel: use discounts cautiously.

It can be challenging for early-stage companies to understand your product-market fit and price point if you’re giving a high number of discounts.

“You need to be a bit careful in the early stages because it can also give you a skewed view of your product-market fit. You’re also trying to validate that people want to pay at or above a certain threshold for your product.“

– Daniel Bakh, CEO & Co-founder at Fullview

In the short-term, a discount can win you that contract. But keep in mind your lifetime value (LTV) to customer acquisition cost (CAC) ratio. Enzo brings up the point that you need to be mindful when discounting and ensure you’re dealing with the right persona. It’s worth considering the short and long-term implications of a discount.

“If you discount the wrong persona or ICP, or they come for the wrong reason then you’re basically just delaying the churn. You’re gonna make a few bucks but it’s gonna hurt your NRR and other things that investors look at a lot.”

“Something we learned early on was that the people who we gave the biggest discounts churned the most.”

– Enzo Avigo, CEO & Co-founder at June

Thank you to the panelists

Parker Moore

Head of Customer Success, Vitally

Parker Moore is the Head of Customer Success at Vitally, which is a best-in-class Customer Success Platform for B2B SaaS companies. Since joining, he has grown the CS organization by 5x & been part of incredible customer growth.

Prior to Vitally, Parker worked at HubSpot and Eventbrite, where he helped build out the Customer Success function. Parker lives in Michigan with his wife and two boys.

Enzo Avigo

CEO & Co-founder, June

Enzo Avigo is the Co-Founder of June.so – the next-gen analytics for B2B SaaS.

Prior to founding June, Enzo has built 6+ years of experience in Product Management where he worked in various verticals – SaaS (Intercom), FinTech (N26) and eCommerce (Zalando) – and helped scale fast-growing companies.

Daniel Bakh

CEO & Co-founder, Fullview

Daniel Bakh is the CEO and co-founder of Fullview. With a background in product-led growth, enterprise sales, and VC.

Daniel is also an angel investor with over 40 startups in his portfolio. He started Fullview in May 2021 after experiencing first-hand the frustrations and inefficiencies of giving and receiving customer support.